Asian Futures:

- Australia's ASX 200 futures are up 31 points (0.42%), the cash market is currently estimated to open at 7,393.00

- Japan's Nikkei 225 futures are up 70 points (0.24%), the cash market is currently estimated to open at 29,138.63

- Hong Kong's Hang Seng futures are up 146 points (0.58%), the cash market is currently estimated to open at 25,476.96

UK and Europe:

- UK's FTSE 100 index rose 26.32 points (0.37%) to close at 7,234.03

- Europe's Euro STOXX 50 index rose 33.85 points (0.82%) to close at 4,182.91

- Germany's DAX index rose 124.64 points (0.81%) to close at 15,587.36

- France's CAC 40 index rose 42.31 points (0.63%) to close at 6,727.52

Friday US Close:

- The Dow Jones Industrial rose 382.2 points (1.09%) to close at 35,294.76

- The S&P 500 index rose 33.11 points (0.75%) to close at 4,471.37

- The Nasdaq 100 index rose 94.5 points (0.63%) to close at 15,146.92

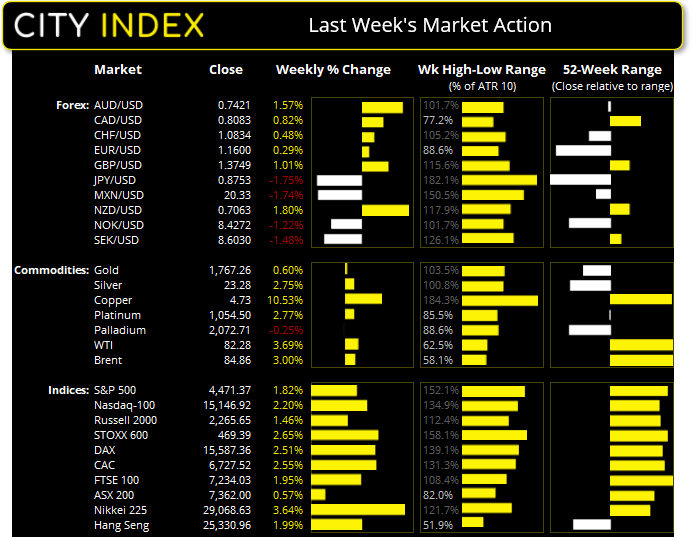

Indices:

It was a strong close for equities last week as corporate earnings on Wall Street exceeded expectations. As just one example, Goldman Sachs (GS) profits rose 66% in Q3 to see the stock rise over 3%. The S&P 500 rose 0.75% to a 1-month high, or 1.8% for the week and 3.8% for October so far. The Nasdaq 100 was the strongest large cap index last week, rising 2.2%.

The ASX 200 finally closed above 7332.2 resistance to suggest it has now changed trend. Futures markets are pointing to a firm open around 7362, and our bias remains bullish above 7250.

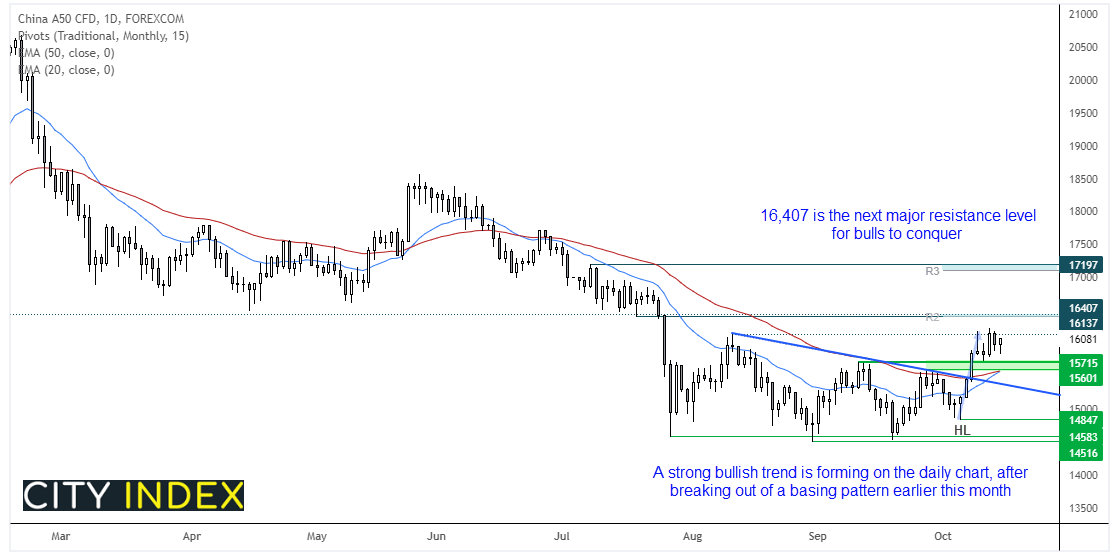

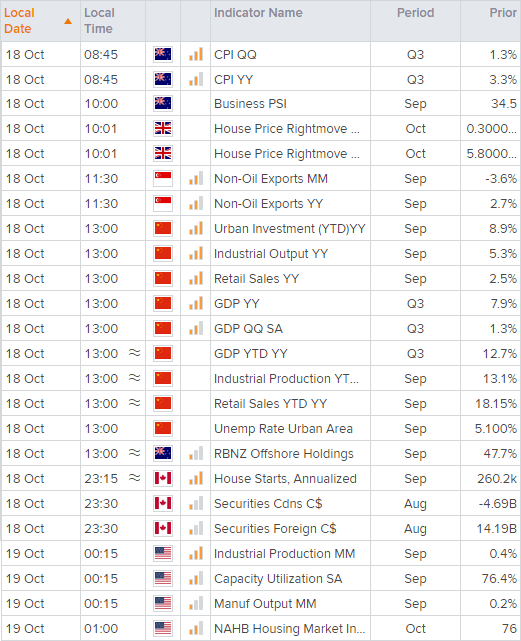

A slew of data from China is scheduled for 13:00 ADST. GDP is expected to fall to the annual rate of 5% from 7.9%. Retail sales is forecast to rise to 3.5% (2.5% prior), industrial production is expected to fall to 3.9% from 5.3%. The China A50 is an index to keep an eye on as we continue to suspect it has seen a major low in September.

A higher low formed in October ahead of a break of trend resistance, and prices are now consolidating above the 15,600 – 15,715 support zone. Given the strength of the move into this area we remain bullish above 15,600 and are anticipating an eventual break above 16,400. And a solid set of data today could at least help the index prove that key resistance level.

ASX 200 Market Internals

ASX 200: 7362 (0.69%), 16 October 2021

- Information Technology (1.41%) was the strongest sector and Utilities (-0.54%) was the weakest

- 10 out of the 11 sectors closed higher

- 3 out of the 11 sectors outperformed the index

- 136 (68.00%) stocks advanced, 51 (25.50%) stocks declined

- 66.5% of stocks closed above their 200-day average

- 52.5% of stocks closed above their 50-day average

- 60.5% of stocks closed above their 20-day average

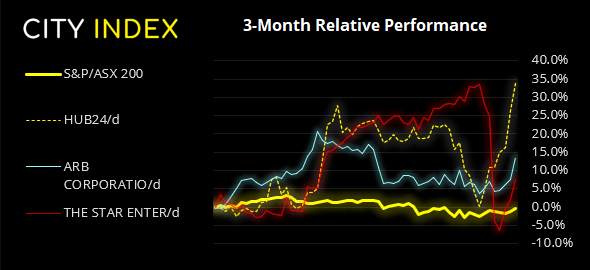

Outperformers:

- + 5.79%-Hub24 Ltd(HUB.AX)

- + 5.59%-ARB Corp Ltd(ARB.AX)

- + 5.43%-Star Entertainment Group Ltd(SGR.AX)

Underperformers:

- ·-11.51%-Pendal Group Ltd(PDL.AX)

- ·-6.85%-Platinum Asset Management Ltd(PTM.AX)

- ·-5.37%-Treasury Wine Estates Ltd(TWE.AX)

Forex:

Commodity currencies were the strongest FX majors last week, with AUD, CAD and NZD all rising around 2.5%. The Japanese yen was the weakest and fell -2.6%. AUD/JPY closed above 84 for the first time in 1.5 years, is probed a 7-year trendline.

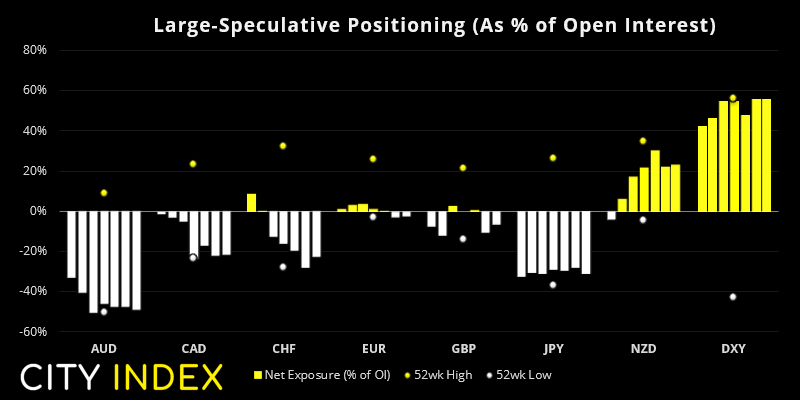

AUD and NZD are the currency pairs to monitor for today’ data dump from China at 13:00 AEDT. Rising bond yields have remained supportive of the Australian dollar, which has made it a tough ride for bears as large speculators remain just off their most bearish level of net-exposure in history. So strong data today could make it more painful and spur a short-covering rally. That said, AUD/USD has stalled at its 200-day eMA so a weak data set from China could potentially send AUD back below 0.74.

Yet the New Zealand dollar remains the favoured currency due to yield differentials and a hawkish RBNZ. AUD/NZD has touched an 8-day low in Asian trade after its rally from the September low stalled and turned at the 200-day eMA.

From the Weekly COT Report (Commitment of Traders)

From Tuesday 12th October 2021:

- AUD bears are slowly learning their lesson as they trimmed their net-short exposure to AUD futures for the first week in 16. AUD has since risen to a 5-week high since the report was compiled, which has no doubt been fuelled by extra short-covering.

- Traders were net-short EUR futures for a second consecutive week.

- Large speculators were their most bearish on JPY futures nearly 4-years.

- Traders increased net-long exposure to the E-mini S&P 500 contract to its highest level since November 2020.

- Net-long exposure to the US dollar index (DXY) rose to a 2-year high.

- Traders increased net-long exposure to platinum futures to their highest level in 3-months, as gross-shorts continued to close out.

Commodities:

Oil prices rose for a 6th consecutive week saw WTI close at its highest level in nearly 7-years. The facts that prices continue to rise on lower volumes remains a concern, but until momentum turns lower then the trend points higher. But at some point fresh buyers need to step in to support this market, and we would also expect some resistance around the 83.0 handle or 85.0 level (where a historical support level sits at 84.05).

Gold was simply tossed aside on Friday as money flowed bac into riskier assets. Down -1.6% on the day, Friday’s candle is part of a 3-bar bearish reversal pattern (Evening Star) which formed at 1800 resistance and the 200-day eMA. Momentum favours further downside with next support residing around 1750.

Up Next (Times in AEST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade