Asian Futures:

- Australia's ASX 200 futures are up 33 points (0.46%), the cash market is currently estimated to open at 7,289.70

- Japan's Nikkei 225 futures are up 240 points (0.86%), the cash market is currently estimated to open at 27,918.21

- Hong Kong's Hang Seng futures are up 189 points (0.77%), the cash market is currently estimated to open at 24,890.73

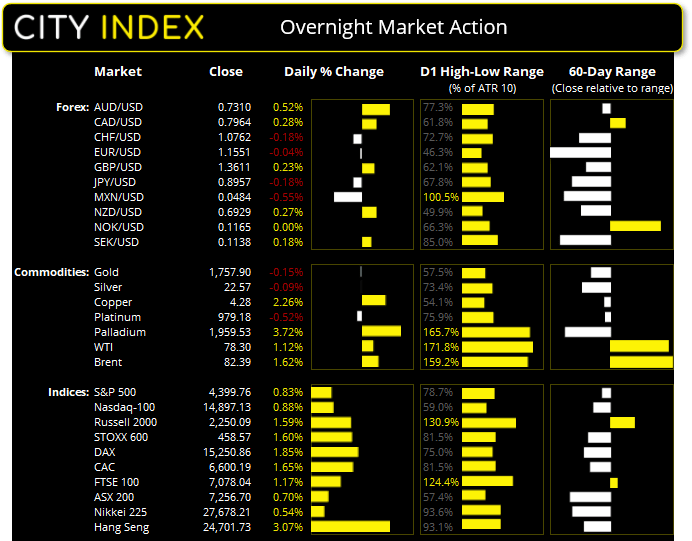

UK and Europe:

- UK's FTSE 100 index rose 82.17 points (1.17%) to close at 7,078.04

- Europe's Euro STOXX 50 index rose 85.69 points (2.14%) to close at 4,098.34

- Germany's DAX index rose 277.53 points (1.85%) to close at 15,250.86

- France's CAC 40 index rose 107.07 points (1.65%) to close at 6,600.19

Thursday US Close:

- The Dow Jones Industrial rose 337.95 points (0.98%) to close at 34,754.94

- The S&P 500 index rose 36.21 points (0.83%) to close at 4,399.76

- The Nasdaq 100 index rose 130.378 points (0.88%) to close at 14,897.13

Indices:

It was a risk-on tone to markets overall on news that Joe Biden and Xi Jinping will hold a virtual meeting by the end of the year. The VIX (volatility index) is back below twenty for the first day in 8, and the Dow Jones led Wall Street’s rebound rising 0.98%, the Nasdaq 100 rose 0.88% and the S&P 500 0.83%. All large cap indices gapped higher and rallied in the first hour, before partially handing back early gains resulting in 1-bar reversal candles. The Nasdaq 100 formed a bearish pinbar and found resistance at its 20 and 50-day eMA’s. All eyes are on NFP to see if it can continue higher above 15k or (at the least) fill yesterday’s opening gap.

The ASX 200 continues to coil up on the daily chart above a cluster of support levels. The longer it holds above the recent lows the more we remain convinced an upside breakout is on the cards.

The China A50 also shows signs of a potential base forming above the 14,516 – 14,583 area, and higher low (with 2x bullish hammer) formed at 14,847. Yesterday’s bullish close tested trend resistance, but now we’d like to see a break above 15,601 to confirm a breakout.

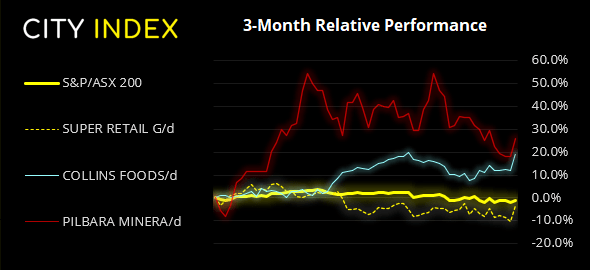

ASX 200 Market Internals:

ASX 200: 7256.7 (0.70%), 07 October 2021

- Information Technology (2.28%) was the strongest sector and Energy (-0.78%) was the weakest

- 10 out of the 11 sectors closed higher

- 4 out of the 11 sectors outperformed the index

- 144 (72.00%) stocks advanced, 47 (23.50%) stocks declined

- 63% of stocks closed above their 200-day average

- 37.5% of stocks closed above their 50-day average

- 43% of stocks closed above their 20-day average

Outperformers:

- + 7.75%-Super Retail Group Ltd(SUL.AX)

- + 6.93%-Collins Foods Ltd(CKF.AX)

- + 6.68%-Pilbara Minerals Ltd(PLS.AX)

Underperformers:

- ·-6.96%-Whitehaven Coal Ltd(WHC.AX)

- ·-4.15%-Star Entertainment Group Ltd(SGR.AX)

- ·-2.15%-Santos Ltd(STO.AX)

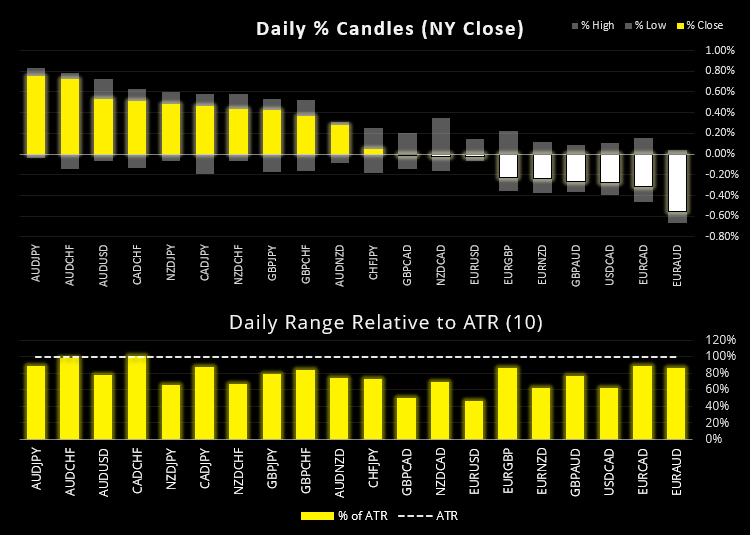

Forex:

Commodity currencies were the strongest majors (led by China-sensitive AUD) on the US-Sino development and higher oil prices.

Bank of Canada’s Governor Macklem was relatively upbeat on the economy, saying demand was led by consumer, and, whilst growth is slightly below July’s expectations the central bank expect it to bounce back. One of the more hawkish comments included “Canadians can be confident we [BOC] will control inflation”, which aimed to soothe concerns after the heated election where rising inflation was a major criticism of Trudeau.

CAD/JPY rose to a 3-month high in live with our bullish bias after finding support at 88 with a bullish hammer on Wednesday. Resistance around 89.0 appears likely (monthly R2 pivot) but our bias remains bullish above 88.00.

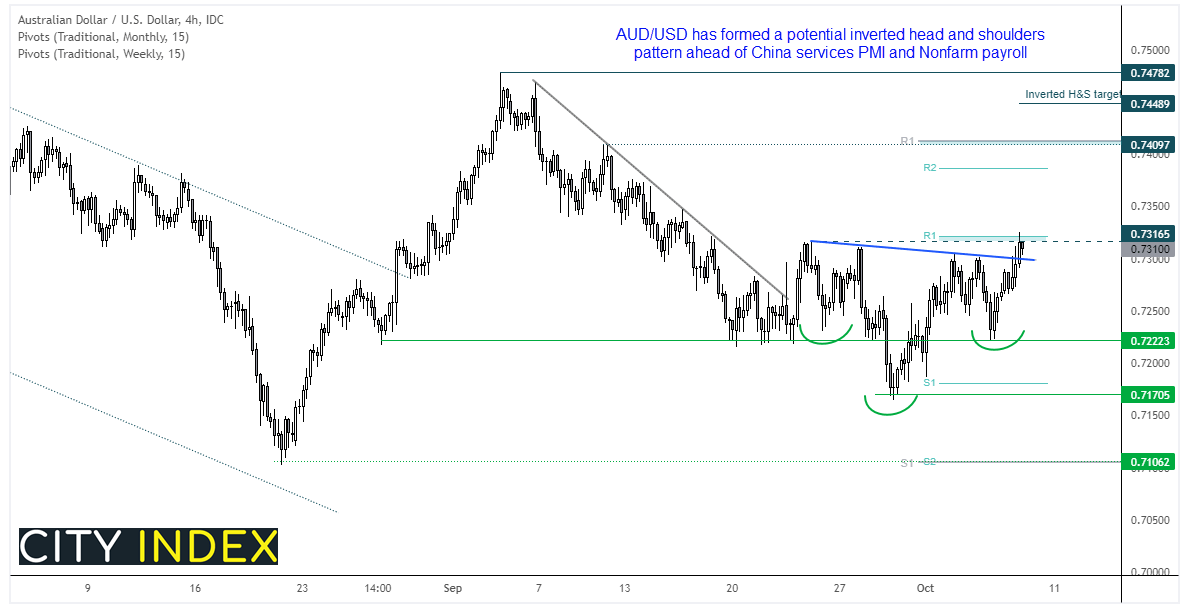

Trade is usually om the quiet side leading up to NFP, although China’s service PMI could warrant a look at 11:45 AEDT. It contracted in August, falling to 46.7 from 54.9 and missing the 52 expected. A faster rate of contraction could knock some wind out of the Aussie. That said, if it can climb back above 50 to show expansion then perhaps AUD/USD could break out.

AUD/USD is beginning to turn higher after finding support around 0.7170. The four-hour chart shows that a potential inverted head and shoulders pattern is in the making. Prices have broken above the neckline and the pattern projects a target around 0.7490. Yet prices now need to break above 0.7310 – 0.7317 zone to resume its head and shoulders breakout. The trend structure remains bullish above 0.7222, but if this is to be a successful H&S pattern then prices should not revert below the neckline. A decent print from China today would be a good start for the bull case, and a weak NFP report could hopefully see it accelerate towards weekly R2 pivot.

Commodities: WTI has $80 back in sight

Any concerns that oil prices had topped were short-lived. WTI initially fell below the October 2018 high of 76.90 then quickly recovered to firm an elongated bullish candle, and a ‘buying tail’ which accounted for around half of the day’s volatile range. We remain bullish above 76.90 and see the potential for it to tap $80 today.

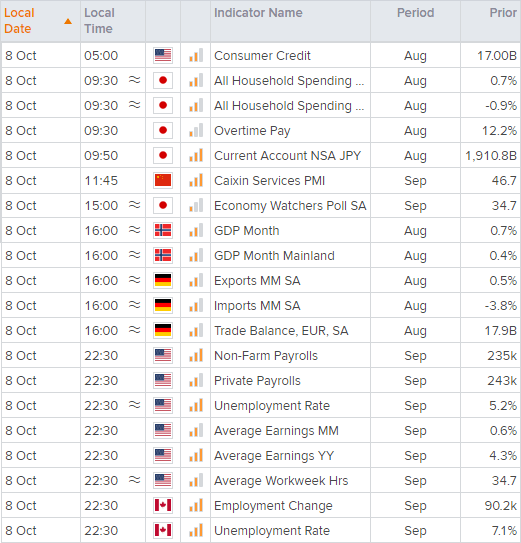

Up Next (Times in AEDT)