Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

As of Tuesday 14th December:

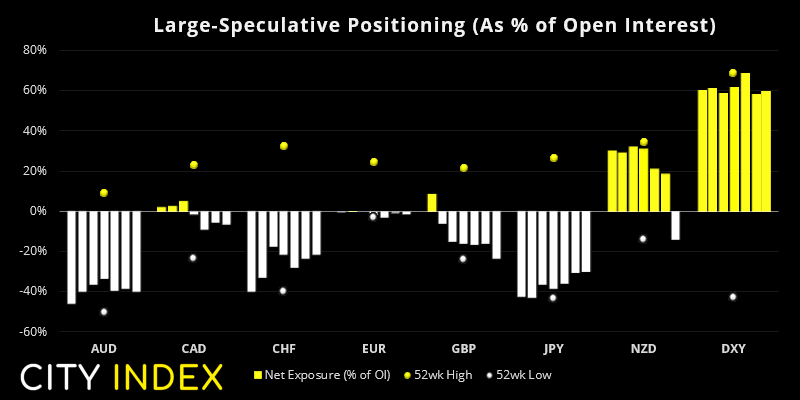

- Traders were net-long the US dollar by around $19.7 billion according to calculations from IMM. Whilst positioning remained effectively flat for the week, they reduced long exposure by around -$5 billion the week prior

- Net-long exposure to the US dollar index fell to an 11-week low

- Large speculators were their most bearish on British pound futures since October 2019

- Large speculators flipped to net-long exposure to New Zealand dollar futures

- Traders continued to offload short exposure to Japanese yen and Swiss franc futures

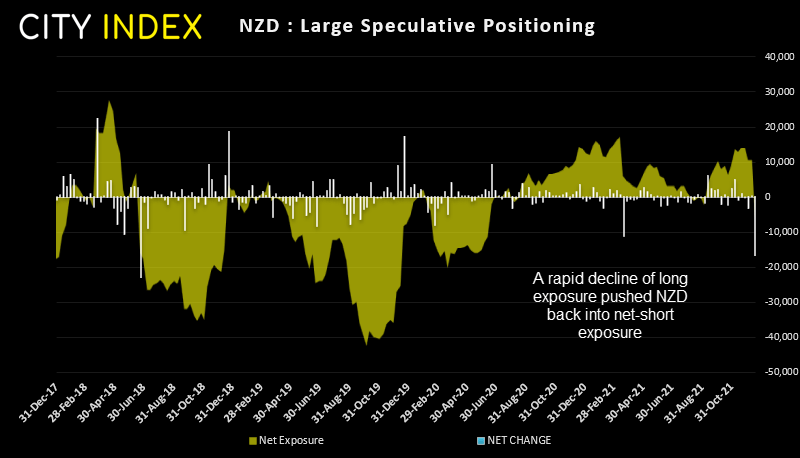

NZD traders flipped to net-short exposure (quite aggressively too)

It is the first-time large speculators have been net-short the Kiwi dollar since September, although they’re now their most bearish level since June 2020. But what makes it of interest is how aggressively long positions were closed out. At -18,4k longs closed last week it saw the net-exposure index fall at its second most aggressive weekly change on record. Looking through the calendar and notes does not reveal an obvious catalyst for the sudden shift in sentiment. But the takeaway is clear; bulls appear a lot less confident of their original position said otherwise. Ad from that we could assume traders have pushed back their expectations for an earlier hike by RBNZ, as this is purely a play of longs closing out whilst shorts also trimmed exposure by -1.7k.

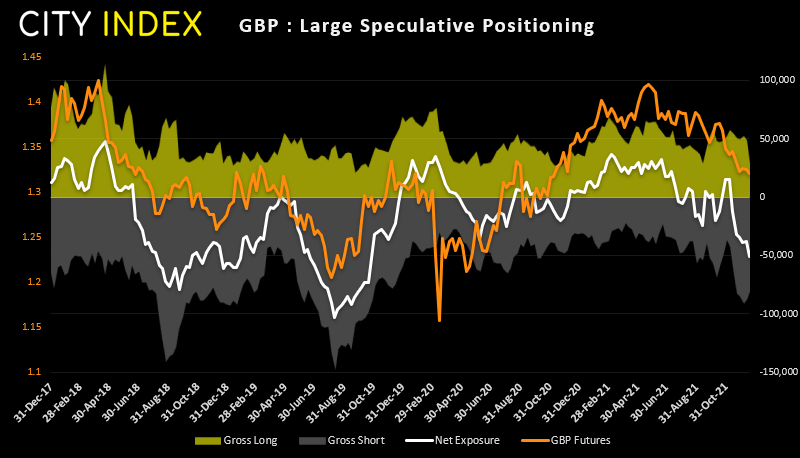

Bearish exposure to GBP futures hits 22-month high

Bears remain very much in control of the pound overall, with net-short exposure having fallen to a 22-month low. And what is not likely to help is how Omicron is sweeping though the UK with lockdowns all but confirmed for Christmas. However, the same could also be said for the US – so if we saw the UK somehow recover ahead of the US in terms of new cases and hospitalisations, it could be a bullish signal. But we have also noticed that, whilst net-exposure remains clearly bearish, both longs and shorts have trimmed exposure to the currency which basically shows a lack of confidence (or conviction) of its direction over the near-term.

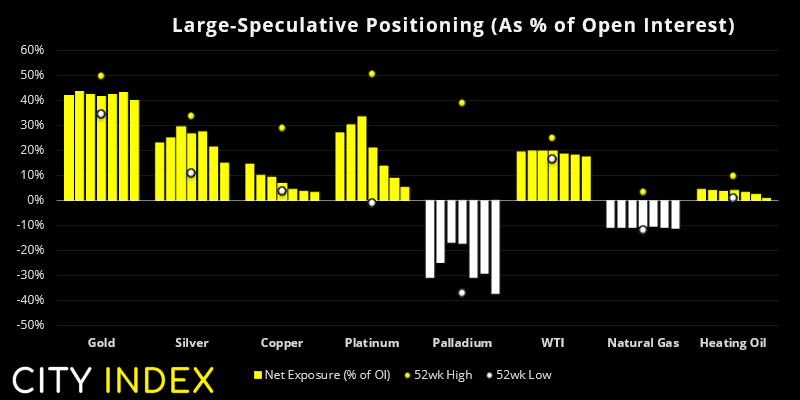

As of Tuesday 14th December:

- Large speculators were their most bearish on palladium futures on record

- Traders continued to trim long exposure to silver, copper and platinum

- However, of those three metals we saw a notable pickup of short interest on platinum and silver futures

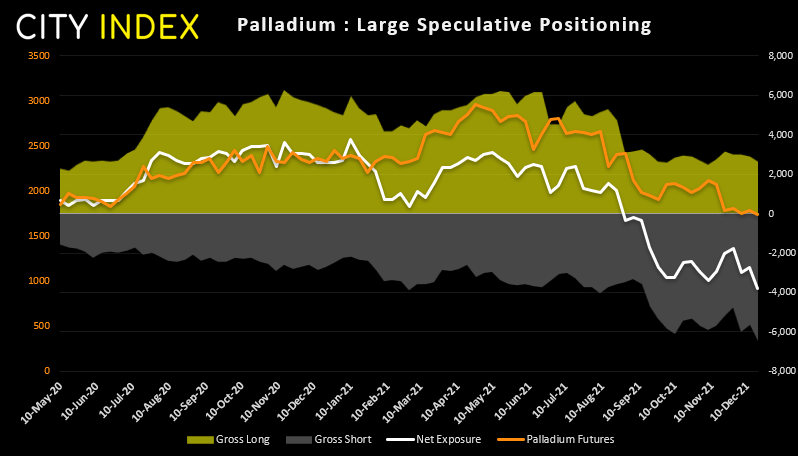

Large speculators were their most bearish on palladium futures on record

Palladium futures remain the most unloved of the precious metals, being the only one to be net-short – and at a record level of bearishness. Positioning clearly shows a strong rise in shorts whilst longs have dwindled, which are key ingredients for a strong trend. Yet with it being at a record, it raises the potential for a sentiment extreme. For now, we see no such evidence on price action so have to assume the trend will remain bearish until momentum says otherwise.

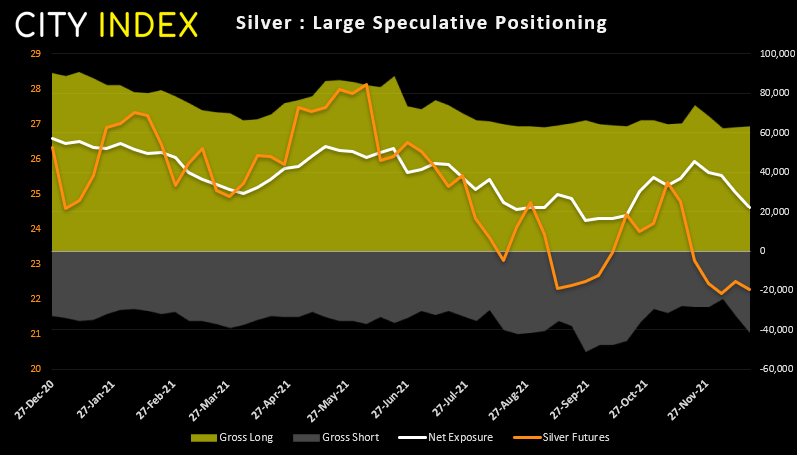

Short interest to silver has risen for 2-weeks

Perhaps this will come to nothing, but little changes can lead to big changes. Over the past two weeks bears have increased gross shorts by around 8k contracts each week, whilst gross longs have remained effectively flat. So let’s see how silver reacts around these lows as price action over the coming days should provide clues to how confident the last 16k of added shorts really are.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade