- USD/CNH comes across as a lagged version of USD/JPY, sitting in a broad ascending triangle pattern

- Policymakers from both Japan and China are either intervening or threatening to intervene to support their respective currencies against the US dollar

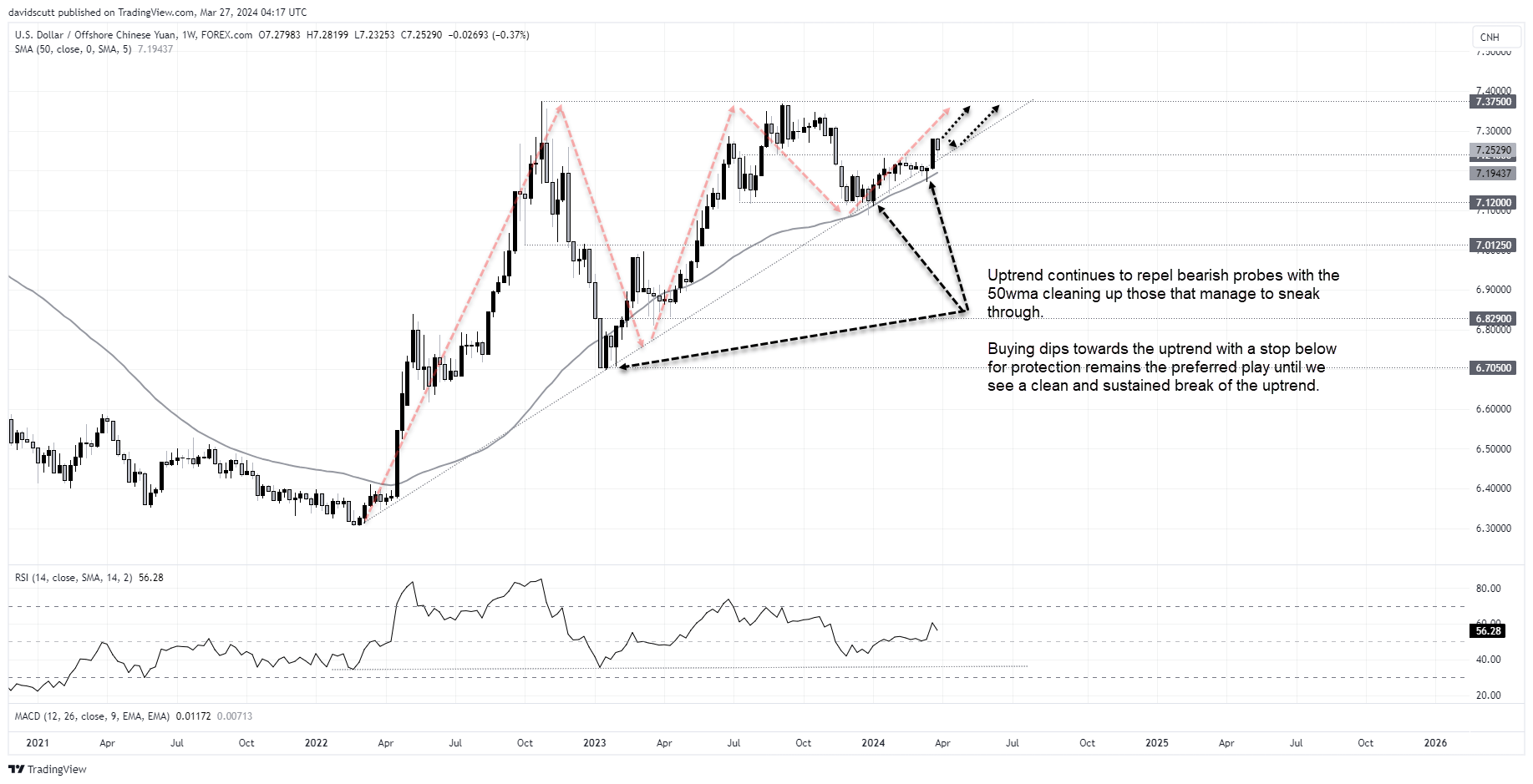

- Buying USD/CNH dips remains the preferred play until we see a clean and sustained break of uptrend support

The overview

There’s not much difference between the USD/CNH and USD/JPY on the weekly charts, other than the former appears to be lagging the latter. With the yen falling to fresh multi-year lows even with the threat of BOJ intervention, will the yuan be next?

Buying USD/CNH dips remains the preferred strategy until the uptrend breaks.

The background

Whether it’s fundamentals or technicals, the Chinese yuan looks eerily similar to the Japanese yen right now. Both are under pressure, especially against the US dollar, forcing policymakers from China and Japan to either directly or threaten to intervene to prop up their value. Other than the BOJ starting to tighten monetary policy while the PBOC continues to ease, the only other obvious difference between USD/CNH and USD/JPY is the former is lagging the latter with the yen briefly hitting fresh lows on Wednesday.

The bullish trend for USD/CNH looked like it was coming to an end earlier this month. Chinese stocks were rebounding, encouraging capital inflows for foreign investors. Economic data was also showing signs of turning around, helping to stabilise what was arguably extreme bearish sentiment. USD/CNH broke its uptrend dating back to early 2022, suggesting the bear trend for the yuan was in it’s final act. But it wasn’t.

You can see on the chart below that it was a false break, with the bullish hammer candle on the weekly providing a sign of things to come. Followed by a surprisingly weak USD/CNY fix last Friday, not only did the price surge back into the uptrend but also took out horizontal resistance at 7.2400.

Even with renewed support from the PBOC this week, the price action looks unconvincing for USD/CNY shorts, bouncing off the former resistance, bolstering the case for the path of least resistance being higher.

Just like USD/JPY, USD/CNH sits in an ascending triangle pattern, sandwiched between uptrend support and resistance at 7.3750. While it’s some distance from a potential upside break, convention suggests it may trade above 8.0000 should the full extension play out.

Wouldn’t that make for some spicy foreign policy debates at upcoming US Presidential debates!

The trade setup

While a break of the ascending triangle is a trade to put on the radar, nearer-term, the easiest option is to respect the trend until the price doesn’t. Just look how many times USD/CNH has bounced from it, with the 50-week moving average mopping up the remaining threats whenever the latter has faltered.

Buying dips remains the preferred play until we see a clean and decisive break of both.

Those contemplating the strategy could buy on moves towards the uptrend, allowing for stop losses to be placed either below the support or 50wma. Minor resistance is located around 7.28, the high hit on Friday on Monday. Beyond, sellers may be lurking above 7.33 but there’s not a lot of resistance evident until around 7.3650. If we get to those levels, traders will be on alert for a topside break of the ascending triangle.

The wildcards

China has around $3.3 trillion in FX reserves, so it can fight market forces for a considerable period via multiple mechanisms. Amplifying the risk of capital flight could see the PBOC’s recent attempts to slow the yuan’s depreciation continue. Unless we see a sustained improvement in sentiment towards China’s economic outlook, it’s hard to see yuan appreciating by any meaningful degree unless it stems from the US side of the equation.

On the latter, any further scaling back of Fed interest rate cut expectations may lead to an accelerated rally in USD/CNH. Conversely, any significant increase in easing expectations could threaten the sustainability of the uptrend. The former comes across as the more likely scenario right now.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade