NZD/USD and AUD/USD were the strongest currency majors during Wednesday’s Asian session with higher producer prices in New Zealand keeping the pressure on the RBNZ to potential hike rates further. Whilst I doubt they will hike again this cycle, markets are now sensitive to positive economic data after the domestic bank of ANZ revised their forecasts for another 2x 25bp this year.

The annual rate of inflation in Australia reached a 15-year high of 4.2% y/y, which means it is the first time the pace of wages has outstripped the official inflation figures since Q1 2021. Yet with the quarterly figure softening to 0.9% q/q – 0.4 points lower than Q3’s 1.3%, it eases some concerns that the RBA may want to act on their tightening bias buried with their recent statement. Still, this helped AUD/USD rise for a fifth day during the Asian session, as the 0.9% q/q was not softer than expected whilst the 4.2% y/y was above the 4.1% consensus.

China’s equity markets continued to rally after the PBOC unexpectedly cut their loan prime rates yesterday. The Hang Seng rose over 2.5% during its best day in nearly two weeks.

Events in focus (GMT):

There’s no major economic news scheduled in today’s European session, although we do have a few central bankers speaking ahead of the FOMC minutes being released. I doubt we'll glean too much form the FOMC minutes since Fed members have been highly vocal on their stance, and the meeting was ahead of last week's inflation data. But traders will likely pounce on any minor clue of any easing, which could further weigh on the US dollar and support Wall Street indices. Take note that BOC’s deputy governor speaks, so I’m keeping an ear out for any potentially dovish comments given the soft inflation figures released for Canada yesterday.

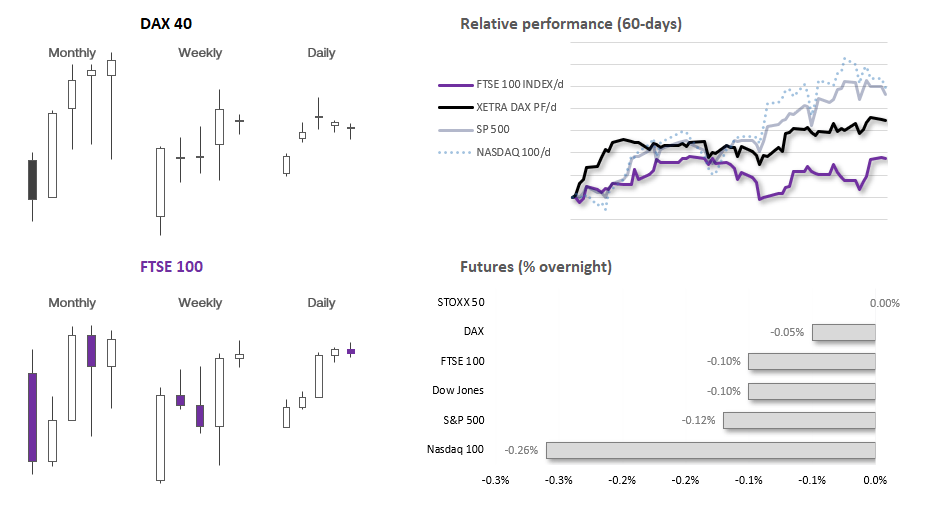

However, take note that AI poster child Nvidia release their earnings report after the NY market close, and it could prompt some extreme levels of volatility. Options market imply a +/- 11% move for the stock, futures markets such as the Nasdaq 100, Dow Jones and S&P 500 are likely to follow its lead.

- 10:25 – ECB Supervisory Board Member Fernandez-Bollo Speaks

- 13:00 – BoC Deputy Governor Gravelle Speaks

- 14:00 – BoE MPC Member Dhingra Speaks

- 15:10 – ECB Supervisory Board Member Tuominen Speaks

- 18:00 – FOMC Bowman speaks

- 19:00 – FOMC Meeting Minutes

- Nvidia earnings (after market close) – volatility expected after NY close

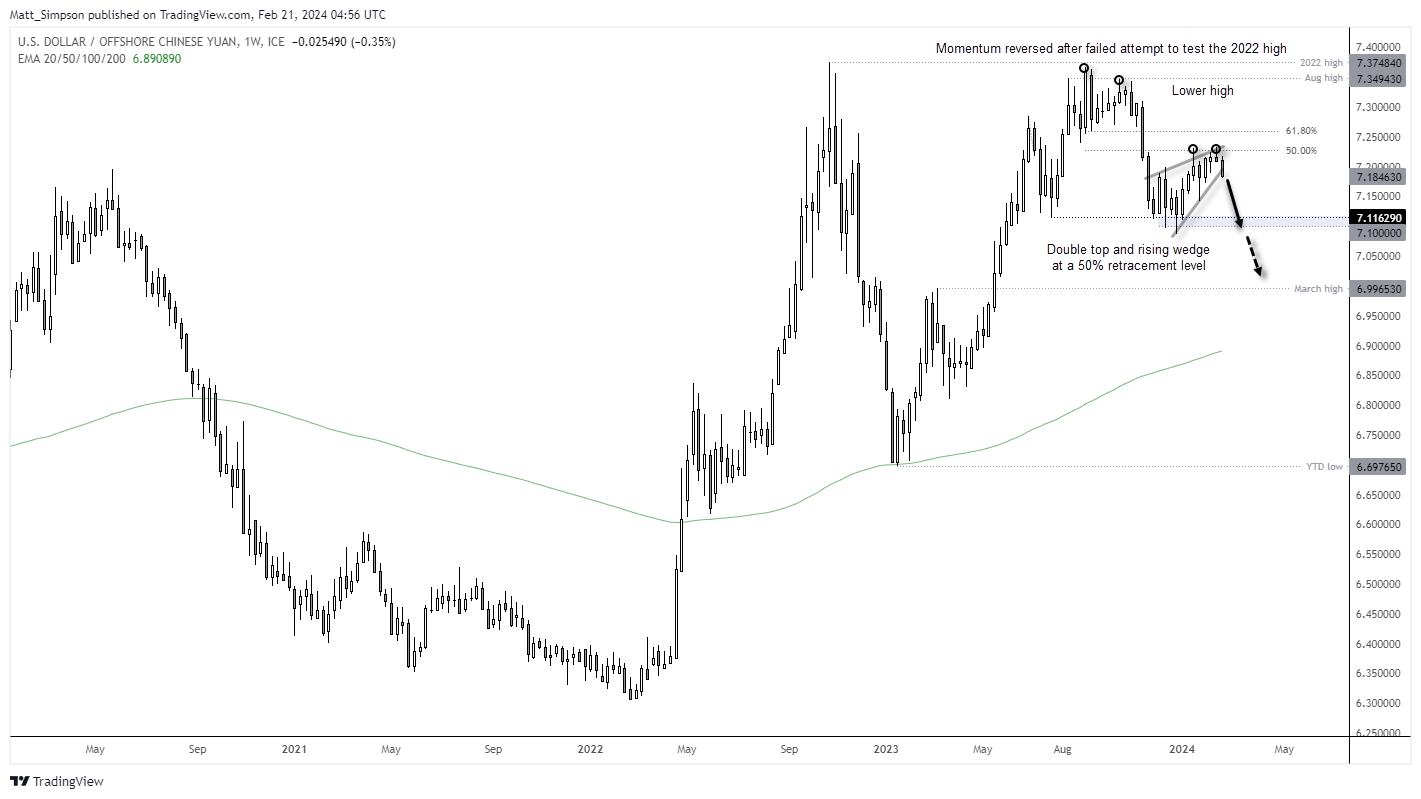

USD/CNH technical analysis

I have outlined a bearish case for the US dollar index on the weekly charts, which could allow the likes of AUD/USD, EUR/USD etc to recoup some of their losses sustained in previous weeks. Yet one of the more compelling to short the US dollar appears to be against the Chinese yuan.

The daily chart shows a decent bearish trend is developing on USD/CNH after a momentum shift following a failed attempt to retest the 2022 high, back in September. A lower high then formed ahead of a strong fall to the 7.1 handle, and prices have since retraced higher in what appears to be a rising wedge (bearish reversal pattern in a bear trend. And that pattern indicates a target around 7.1 near the cycle lows.

Bears could enter short at market with a stop above the double-top high, or seek to fade into minor rallies towards it. Whilst the pattern projects a 7.1 target, if his is the beginning of a bearish trend then it should break to new cycle lows. For that, we may need to wait for the Fed to begin teasing traders with potential cuts.

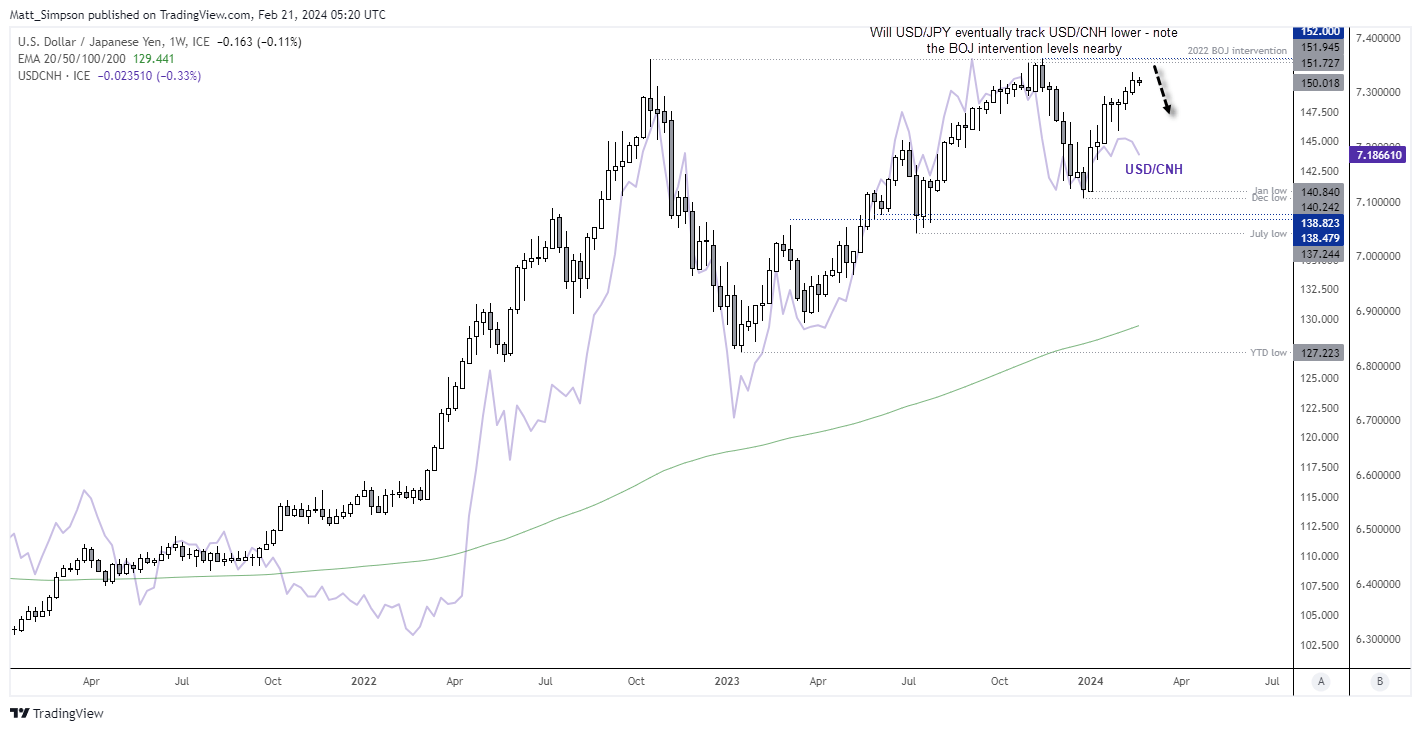

USD/JPY technical analysis

If the yuan continues to strength, other Asian currencies are likely to also want a higher currency to remain competitive with trade. It is therefore interesting to note that the usually-tight correlation between USD/CNH and USD/JPY has broken down in recent days, with USD/CNH turning lower yet USD/JPY heading higher.

With the US dollar index shows signs of a retracement on the weekly timeframe, and excessive short exposure to yen futures on the CME exchange, perhaps USD/JPY nearing an inflection point. I am now more convinced than ever that USD/JPY will struggle to break above 152.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade