- China’s inflationary pressures remained weak in December

- Expectations are mounting that policymakers could deliver further stimulus measures in the coming days

- The offshore Chinese yuan and China A50 have strengthen following the inflation report

Chinese inflationary pressures remain weak, whether it be upstream or for consumers. But with expectations for further stimulus from the Chinese government and People’s Bank of China baked in the cake, whether it has meaningful implications for China’s equity market or currency remains debatable.

According to China’s National Bureau of Statistics (NBS), consumer price inflation (CPI) declined 0.3% in the 12 months to December, slightly ahead of the 0.4% decrease forecast by economists. Food prices skidded 3.7% over the year with non-food prices edging higher by 0.25%.

For 2023, inflation rose just 0.2%, far below the PBOC’s loose target of around 3%.

Upstream deflationary pressures were even more acute with producer price inflation tumbling 2.7% from a year earlier, leaving prices over the year down 3% overall. The year-on-year decline was slightly larger than what markets were expecting.

This inflation measure is often referred to as factory-gate inflation, or the price charged to other businesses. Given China’s role as a manufacturing superpower, there are linkages between what happens with producer prices with import and consumer price inflation in developed nations.

Price weakness at the producer and consumer level continues to point to an economy operating well below its potential level, explaining why markets continue to speculate there’ll be further stimulus measures rolled out by policymakers in the near-term, including the potential for further reductions in medium-term lending facility, reverse repo and loan prime rates, along with the amount of cash required to be held by banks through the required reserve ratio.

But that’s arguably largely in the price already. And one look at China’s economic performance last year suggests measures already implemented have yet to deliver a meaningful improvement in activity.

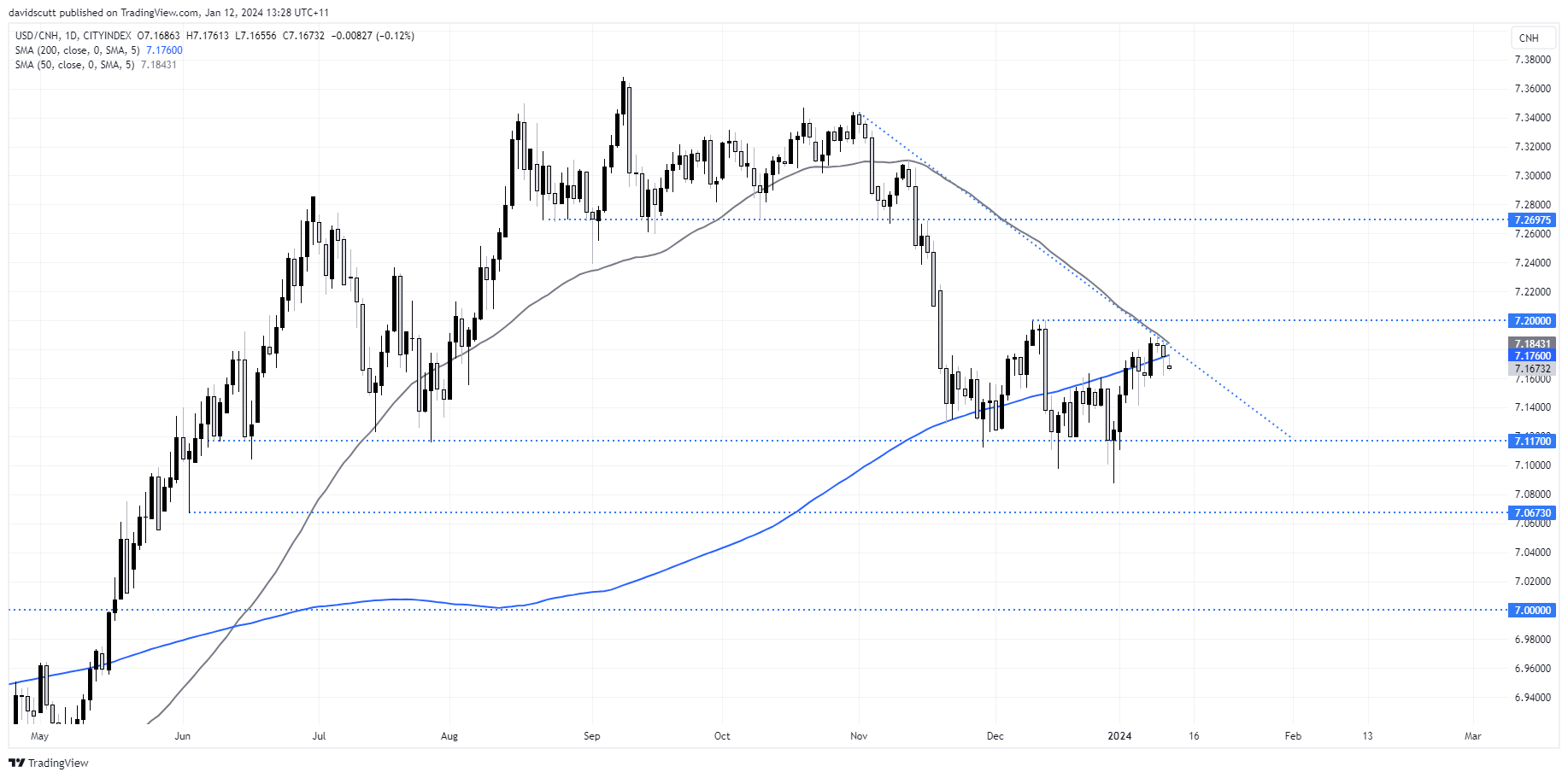

USD/CNH tangoing with the 50 and 200DMA

Despite the latest soft inflation report, the Chinese yuan has strengthened against the US dollar on Friday, leaving USD/CNH below its 200-day moving average, a level the pair has been hanging around for much of the past two months. While a probe below on Thursday failed, it’s obvious USD/CNH is paying close attention to the 50-day moving average right now, as has been the case for much of the past year.

The proximity of the 50DMA, helping to form a descending triangle pattern, points the potential for downside in the near-term. For those considering shorts, a stop above the 50DMA, targeting a move towards 7.1170 which it has tagged on multiple occasions since June without ever closing below it, is one potential option.

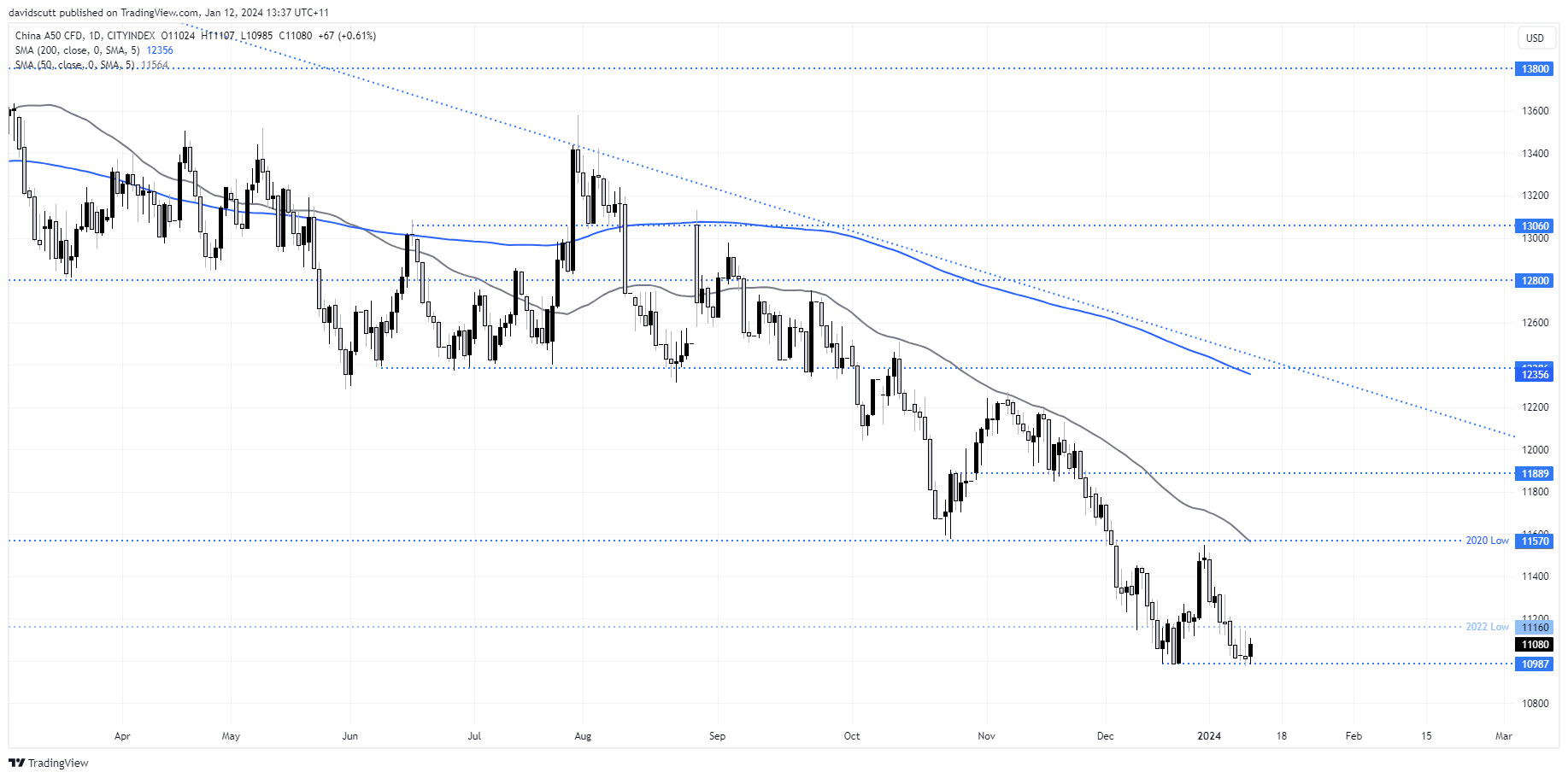

A50 trying to form a base having tumbled to multi-year lows

For equities, the China A50 is one of the ugliest charts going around right now. But for all the pessimism that exists, especially from offshore investors, it has tried and failed to break below the lows set late last year on three occasions this week and failed. For those feeling brave, potential longs could leave a tight stop under the lows targeting a push back above 11500, where the index stalled in December. The proximity of the 50DMA which was respected late last year suggests upside beyond may be difficult to achieve in the near-term.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade