- Chinese policymakers are reportedly rolling out numerous measures to stabilise the nation’s stock markets

- China A50, Hang Seng and Chinese yuan have been unable to sustain strength beyond the short-term recently

- A sustained rally may help to turn the bearish narrative towards Chinese markets

Chinese policymakers are quickly moving towards throwing everything, including the kitchen sink, to support the nation’s beleaguered stock market. State-backed funds have been reportedly stepping in prop up mainland indices through purchases of several ETFs. And if the mail on Tuesday proves to be true, the bids may be about to get a whole lot larger with plans to deploy a ¥2 trillion fund. Short selling bans are being rolled out and there are are even reports Jack Ma has been buying up Alibaba stock after its recent shellacking. Voluntarily, of course.

Intervention does not guarantee sustained market gains

It has all the hallmarks of what was seen in 2015 when China’s stock market was last in an ugly bear market. But now, like then, heavy government doesn’t guarantee it’ll lead to a dramatic turnaround in fortune. It addresses the symptom rather than the cause. Investors are not fearful in general – just look at other markets around the world surging to record highs – but they are towards Chinese assets. Going off the rush to buy ETFs linked to offshore markets within China, resulting in huge price premiums being paid relative to the value of their underlying assets, it hints that some investors are willing to invest anywhere but China.

Price leads narrative

There is a real confidence problem right now. And while the underlying reasons are complex, covering a number of internal and external risks, the easiest way to change the bearish narrative towards Chinese markets is for the price action to turnaround. Price leads narrative.

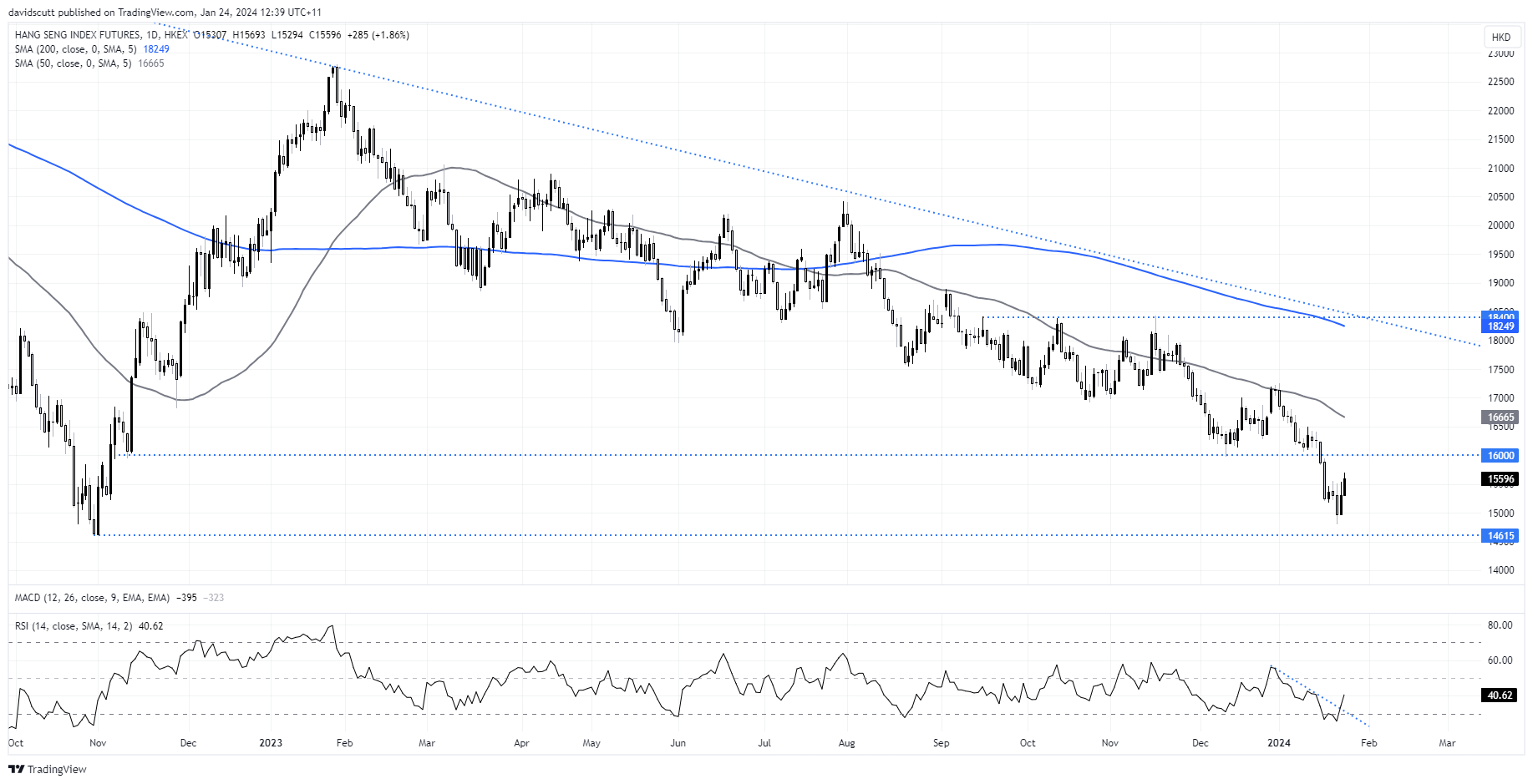

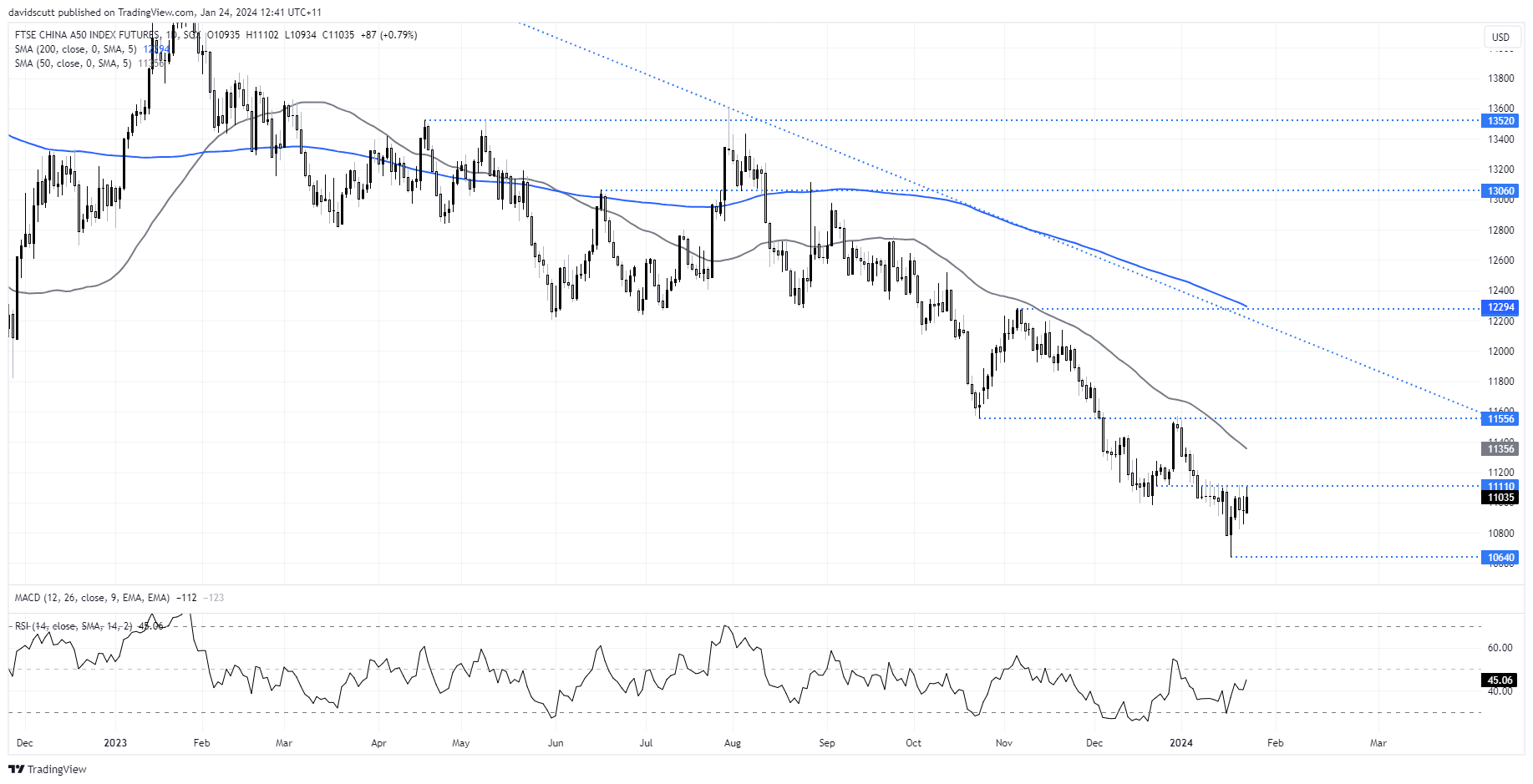

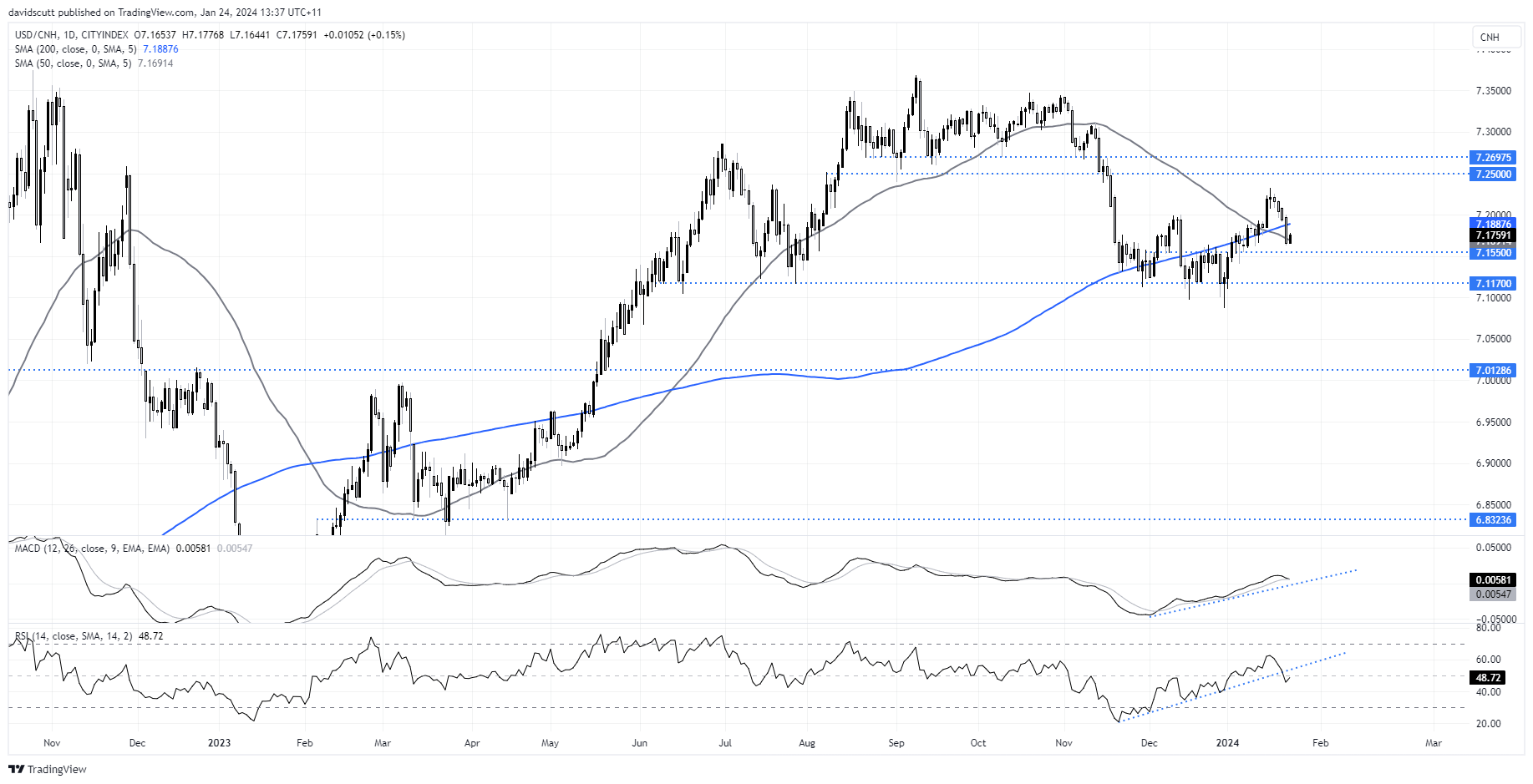

When it comes to the Hong Kong’s Hang Seng, China’s A50 and USD/CNH, investors are desperately seeking evidence that the measures being rolled out are delivering results. If they receive that, cheap valuations combined with dire sentiment will provide fertile ground for some form or meaningful rally.

Levels to keep an eye on

Hang Seng futures came within a whisker of taking out the post-pandemic lows earlier this week, only managing to rebound on the back of the speculated ¥2 trillion fund flagged by Bloomberg. Some may be willing to buy the underlying index or futures on the report, but with scepticism so high about whether it will work, it may take a break and hold of 16000 or even the 50-day moving average to trigger more true believers to buy back in.

It’s a similar setup for China A50 futures which have seen rallies faulter on nine separate occasions at 11110 over the past two weeks. Should that selling abate and the 50-day moving average be broken cleanly, that would help assist a price-led improvement in sentiment.

USD/CNH is another barometer of broader China sentiment, although it carries the disclaimer that policymakers at the PBOC continue to push back against attempts to weaken the yuan further by continuously setting the daily fix for the onshore yuan stronger than market-implied levels, along with draining yuan liquidity in Hong Kong, making it costly for speculators to short the currency. Yes, there’s heavy intervention, but that may not be necessary if the trajectory for USD/CNH continues to be lower.

Right now, USD/CNH is trading around its 50-day moving average, a level it has respected on numerous occasions over recent years, arguably more so than the 200-day equivalent which it sliced through earlier this week. Below, horizontal support is located around 7.1150 and again from 7.1170. Should the pair manage to break and hold below the latter, taking out the low hit earlier this year, it’s the type of move that will get others pondering whether the downside momentum has legs given there’s little visible support located until just above 7.0100.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade