US futures

Dow futures -1.20% at 32779

S&P futures -1.3% at 3950

Nasdaq futures -1.77% at 11960

In Europe

FTSE -0.17% at 7920

Dax -1.65% at 15304

Learn more about trading indices

Core PCE rises to 4.7%

US stocks are pointing to a weak start reversing gains from the previous session as investors digest the latest inflation data and look ahead to the University of Michigan consumer sentiment index as well as comments from several Fed speakers.

US core PCE, the Federal Reserve’s preferred gauge for inflation, unexpectedly rose in January to 4.7% YoY, up from an upwardly revised 4.6% in December. Expectations had been for a decline to 4.3%.

The hotter-than-forecast inflation data comes after a series of strong-than-expected data Prince from the US testing that the economy is more resilient and stronger than initially expected, despite rising interest rate levels.

The data mounts pressure on US central bank to continue hiking interest rates, even after they slowed the pace of rate hikes at the February meeting. The data suggests that the US economy is heading for a no landing outcome right now, with inflation and growth still strong.

According to the CME Fed watch tool, the market is now pricing in a higher probability of the terminal rate reaching 5.75%, a move that wasn’t even considered a possibility just one month ago.

In line with more hawkish Fed bets, stocks are falling, with high growth tech stocks leading the charge lower, gold falling to a 2023 low and USD rising.

Corporate news

Boeing falls pre-market after the FAA announced that the airplane maker has paused deliveries of its 787 Dreamliner jets temporarily due to an issue over a technical issue.

Beyond Meat has jumped over 12% after posting a smaller-than-expected loss in the fourth quarter and while also beating revenue expectations.

Adobe is falling over 3% premarket on reports that EU S Justice Department is preparing an antitrust lawsuit in order to block Adobe’s bid for Figma, the cloud based designer platform.

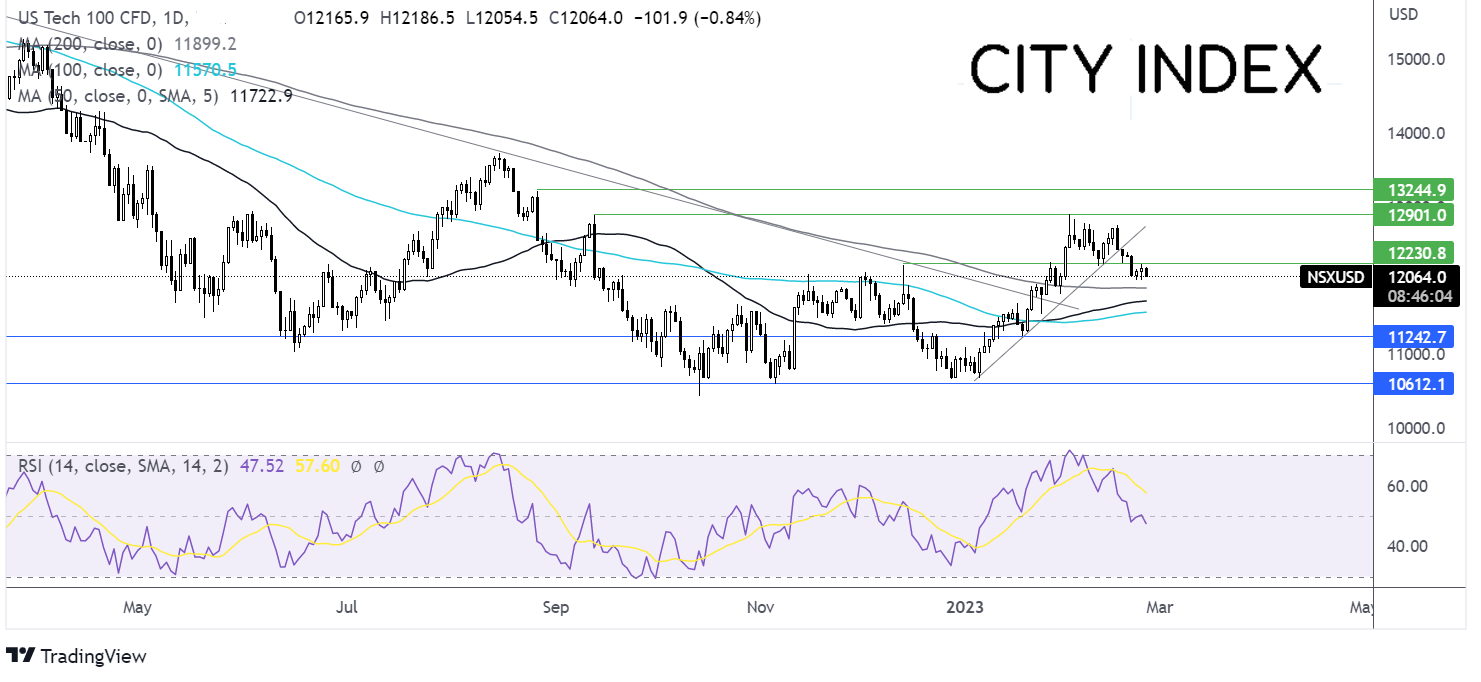

Where next for the Nasdaq?

After running into resistance at 12750, the Nasdaq has fallen, taking out the 7-week rising trendline support and breaking below 12215, the December high. The price is consolidating fining support around 12000 the psychological level. A break below here is needed to expose the 200 sma at 11900 and the 50 sma at 11735. On the flip side, buyers could look for a rise over 12215, to bring 12650 the rising trendline support and 12750 back into target.

FX markets – USD rises, GBP, EUR fall

The USD is rising for the fourth day and is expected to rise around 1% across the month, marking the fourth straight week of gains as strong data across the month boosts expectations of a more hawkish Federal Reserve.

EUR/USD is edging lower as investors digest mixed data. German Q4 GDP contracted by more than expected at -0.4%, down from the preliminary reading of -0.2%, and down from 0.5% growth in Q3. Meanwhile, German consumer confidence improved to -30.5, up from -33.5 amid hopes that the eurozone’s largest economy will avoid a deep recession as energy prices & inflation fall.

GBP/USD is heading lower despite UK consumer confidence improving again in February. The GFK consumer confidence index increased to -38 up from -45 in February. However, this is still low by historical standards and morale has a long way to go before it's back to pre-Covid levels. GBP/USD is set to book its first monthly loss since September, owing to a stronger USD.

EUR/USD -0.48% at 1.0607

GBP/USD -0.58% at 1.1950

Oil rises but is set to fall across the week

Oil prices are all rising, extending gains from the previous session but are still set to book a loss of just below 1% across the week.

Investors have been weighing up the prospect of higher US interest rates dampening growth and hurting the oil demand outlook and higher oil inventories against the prospect of reduced oil supply from Russia.

US oil inventories are at the highest level in over 18 months, which raises questions of demand levels, which is putting pressure on oil prices; this is being offset by

Russia said that it plans to cut oil exports from the Western port by as much as 25% next month, which is ahead of the 500,000 barrels per day production cut previously announced.

WTI crude trades +09% at $76.10

Brent trades at +1.1% at $82.70

Learn more about trading oil here.

Looking ahead

15:00 Michigan consumer confidence