US futures

Dow futures +0.25% at 34690

S&P futures +0.2% at 4470

Nasdaq futures +0.01% at 14379

In Europe

FTSE +0.3% at 7472

Dax +0.3% at 14400

Euro Stoxx +0.56% at 3900

Learn more about trading indices

Stocks pare yesterday’s losses

US stocks are pointing higher on Tuesday, rebounding from the softer close on Monday after Fed Powell signaled that the central bank was prepared to adopt a more aggressive approach to rein in runaway inflation.

The Fed said it is prepared to hike rates by 50 basis points as surging commodity prices since the Russian invasion has added pressure on the central bank to tighten monetary policy. The steep hiking cycle required to tame inflation does raise concerns of slowing growth, which could keep the upside in equities limited.

Fed Powell has also done a complete 180 turn from last year when he was not at all concerned by “transitory” inflation, to warnings now that the labour market is too tight and inflation much too high.

Steady oil prices are helping to market mood. With no high impacting economic data due to be released today, attention will remain on Fed speakers.

In corporate news:

Nikes trades over 5% higher pre-market after impressing with quarterly results, while soothing fears by saying that the manufacturing issues which hurt sales over the past six months were behind it.

Tesla was also trading mildly higher after starting manufacturing in its European hub in Germany.

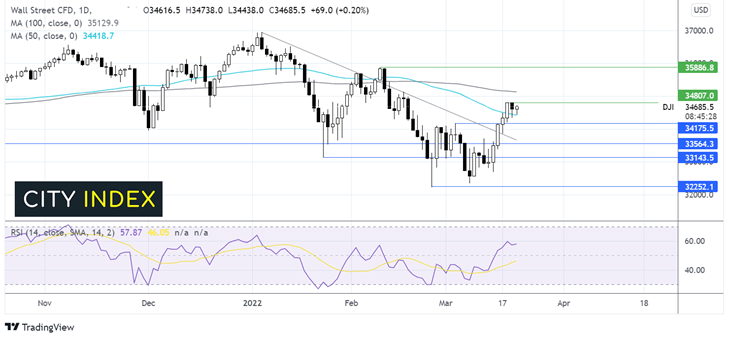

Where next for the Dow Jones?

The Dow Jones extended its run higher from 32250 in late February, running into resistance at 34800 at the end of last week. The price has eased off this recent high, finding support on the 50 sma at 34400. The long lower wick and the bullish RSI suggest that there is more upside to be had. Buyers would need to break above 34800 to expose the 100 sma a 35100 and then look towards 35900 the February 9 high. To negate the near-term uptrend, sellers could look for a break below support at 34100.

FX markets USD rises, GBP gains.

USD is heading higher, building on gains from the previous session after the more hawkish comments from Fed Powell. Powel said that the central bank could well hike rates by 50 basis points if that is what is needed.

GBPUSD rises amid the upbeat market mood and after data from the ONS showed that the Government borrowed more than forecast in February at £13.1B, versus £8.5B forecast. This was down from a year earlier. The data comes ahead of the Chancellor’s Spring Statement tomorrow, where he is expected to take a measured approach to supporting households and businesses amid the surging cost of living.

GBP/USD +0.4% at 1.3221

EUR/USD -0.16% at 1.0999

Oil cools as EU still split on a Russian oil embargo

Oil prices rallied 7% yesterday on fears that the EU could join the US by banning Russian oil imports. Today oil prices started the day higher but fell as it became clear that European Union ministers are still divided over whether to impose an embargo on Russian oil. Germany, for example, is too dependent on Russia’s oil to vote in favour of such a move.

Following Fed Powell’s speech yesterday, the stronger USD also weighs on oil prices. Oil is denominated in USD, so a stronger USD makes oil more expensive for foreign buyers, hurting demand.

Later today, API inventory data will be in focus and are not expected to show a change in crude stockpiles.

WTI crude trades -0.25% at $109.60

Brent trades +0.02% at $112.64

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.