US futures

Dow futures -0.50% at 33740

S&P futures -0.75% at 4104

Nasdaq futures -1% at 12447

In Europe

FTSE -0.71% at 7838

Dax -0.95% at 15369

Learn more about trading indices

Jobs data supports a more hawkish Fed

US stocks are set for a weaker start on Monday, extending losses from the end of last week as investors continue digesting the stronger-than-expected U.S. jobs report, which has prompted investors to rein in optimism surrounding a dovish pivot and as US-China tensions rise.

There are a number of Federal Reserve policymakers who are due to speak across this week and could shed some light on how hawkish the Fed may need to be in order to rein in inflation. Federal Reserve chair Jerome Powell will be the main focus and is due to speak tomorrow.

Separately news of a suspected China spy balloon shot down in US waters is unnerving investors. Investors are weary that this could ramp up pressure on Biden to apply further restrictions on China. Chinese ADR’s such as Alibaba and JD.com trade lower pre-market.

Attention will also be on earnings as earnings season continues and is over halfway through. Companies due to report this week include Disney, PepsiCo. Meanwhile,Tyson Food and Activation Blizzard report today. So far, 69.9% of companies have reported results above expectations. Overall quarterly earnings are set to decline 2.7%.

Corporate news

Tyson food has fallen sharply premarket after reporting a 70% full in EPS to $0.85c as margins are squeezed by rising operating costs.

Dell rises pre-market despite the firm announcing that it will cut 6.5% of the workforce as demand for personal computers falls.

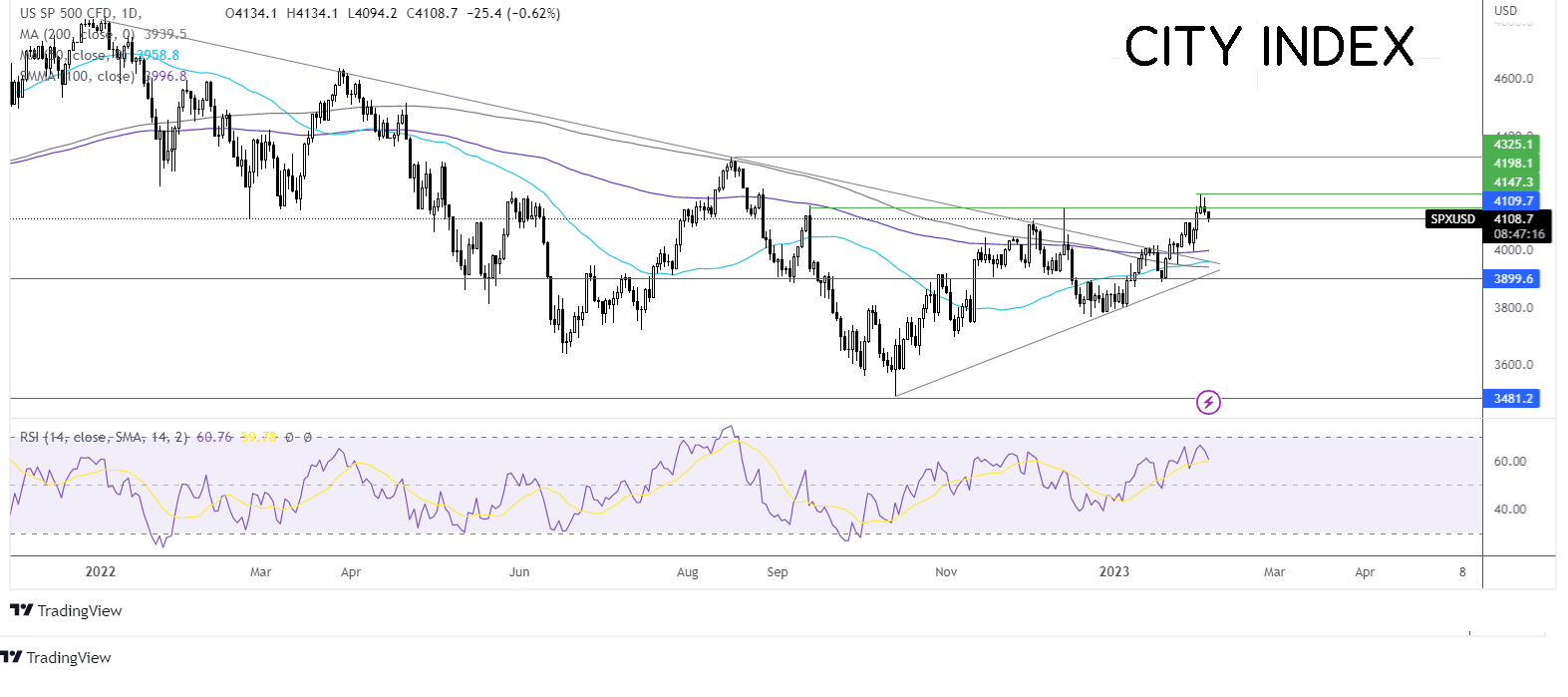

Where next for the S&P500?

After running into resistance at 4195, the S&P500 has eased lower, taking out support at 4150 and is testing 4100 the December high. The RSI remains above 50, and the 50 sma has crossed above the 200 sma keeping buyers hopeful of further upside. Buyers would look for a rise over 4150 and 4195 to extend the bullish uptrend towards 4325. However, sellers could be encourage d by the long wicks on the previous two candles, which suggest that there isn’t much demand at the higher prices. Sellers could look for a fall below 4000/3995 the psychological level, 100 sma and last week’s low to extend the downside to test the 200 sma at 3940.

FX markets – USD rises, EUR falls

The USD is rising, adding to 1% gains last week, as investors re-assess the likelihood of a less hawkish Fed in light of Friday’s strong jobs report. The risk-off mood from geopolitical tensions is also supporting the greenback,

GBP/USD is rising after steep losses last week and as investors digest comments from BoE policymaker Catherine Mann who said that more rate hikes are likely, than not. Huge strike action across the UK highlights the struggles that workers face amid the ongoing cost of living crisis.

EUR/USD remains below 1.08 after a mixed bag of data. While German factory orders rebounded firmly up 3.2% MoM in December, up from -4.4% in Nov and well ahead of the 2% forecast. Eurozone investor sentiment also improved considerably as recession fears eased. However, retail sales were weaker than forecast, dropping -2.8% MoM, below the 2.7% decline forecast.

GBP/USD +0.1% at 1.2070

EUR/USD -0.12% at 1.0770

Oil rises after steep losses last week

Oil prices are edging higher at the start of the week after booking losses of almost 8% last week. Concerns that the Fed may not be able to slow the pace of rate as much as initially expected, after the strong jobs report unnerved the oil market, fueling bets of slowing global growth.

Today those recession fears are being met with optimism surrounding the demand outlook amid the China reopening. The EIA expects half of global oil demand growth this year for come from China and the reopening bodes well for demand if jet fuel demand is anything to go by.

Still, higher interest rates and a stronger USD are keeping oil price gains in check.

WTI crude trades +0.3% at $74.00

Brent trades at +0.7% at $80.45

Learn more about trading oil here.

Looking ahead

N/A