US Dollar Outlook: EUR/USD

EUR/USD bounces back from a fresh monthly low (1.0755) to halt a six-day selloff, but data prints coming out of the US may curb the recent rebound in the exchange rate as the US Non-Farm Payrolls (NFP) report is expected to show another rise in employment.

US Dollar Forecast: EUR/USD Halts Six-Day Selloff Ahead of US NFP

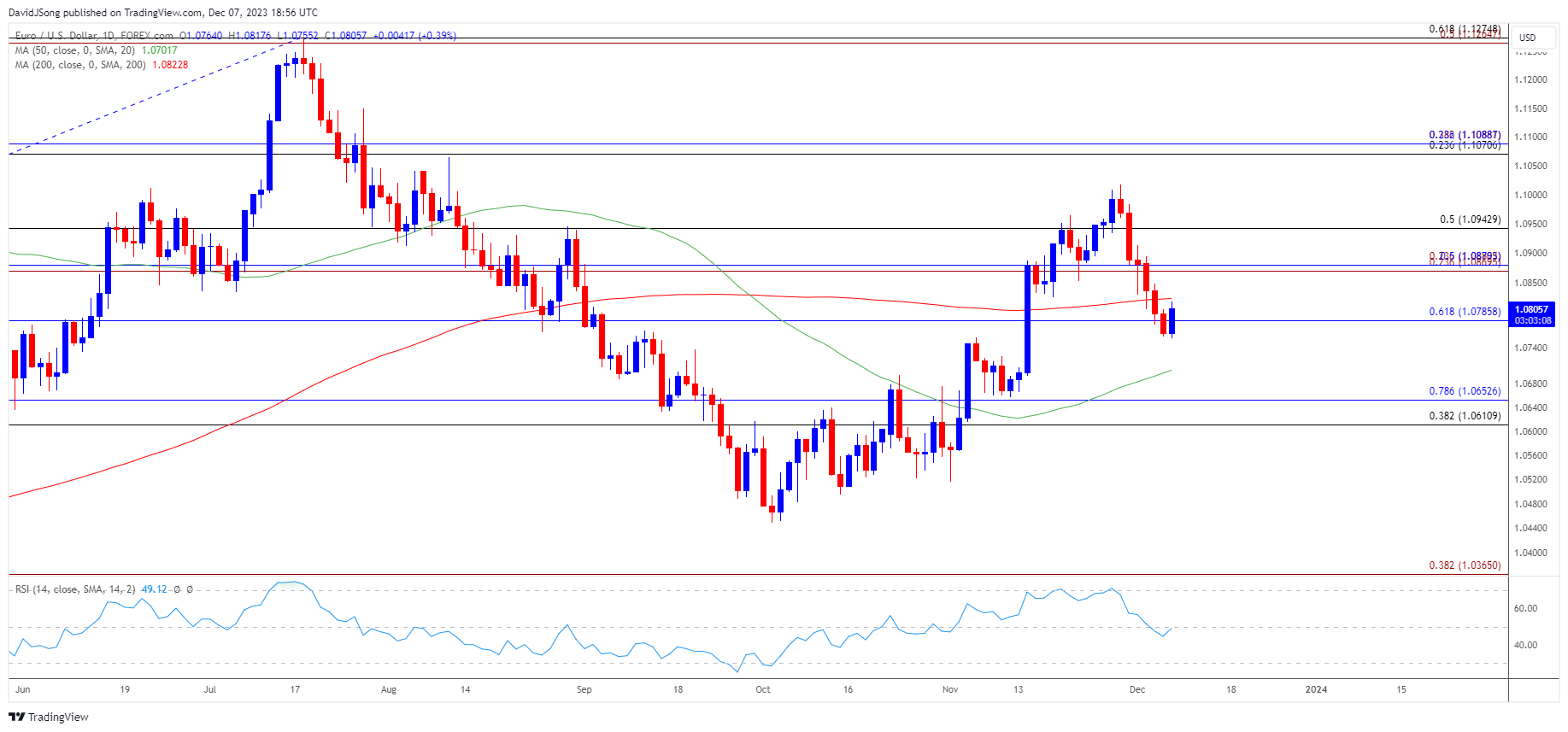

EUR/USD seems to have reversed course ahead of the August high (1.1065) as the recent selloff pulls the Relative Strength Index (RSI) from overbought territory to indicate a textbook sell-signal, and the exchange rate may struggle to retain the advance from the November low (1.0517) as European Central Bank (ECB) board member Isabel Schnabel warns that ‘the most recent inflation number has made a further rate increase rather unlikely’ during an interview with Reuters.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

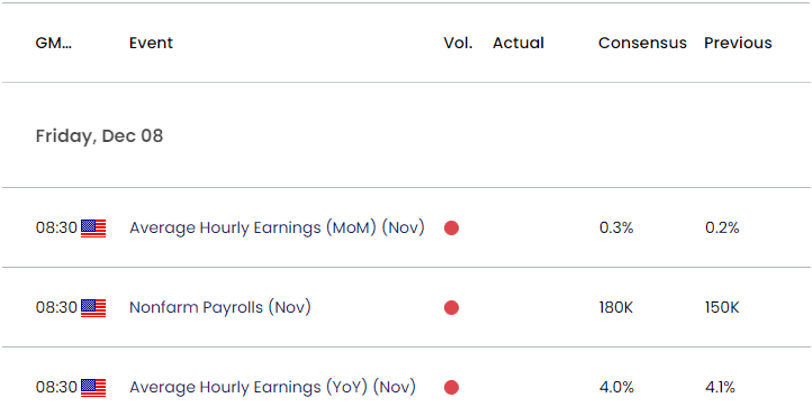

US Economic Calendar

In contrast, the Federal Reserve may further combat inflation as the NFP report is anticipated to show the economy adding 180K jobs in November following the 150K expansion the month.

In turn, a positive development may lead to a bullish reaction in the US Dollar as it puts pressure on the Federal Open Market Committee (FOMC) to implement at its last meeting for 2023, but a below-forecast NFP print may drag on the Greenback as it raises the central bank’s scope to retain the current policy.

With that said, EUR/USD may attempt to retrace the decline from the November high (1.1017) as it snaps the recent string of lower highs and lows, but recent rebound in the exchange rate may end up being short-lived as the Relative Strength Index (RSI) falls back from overbought territory to indicate that the bullish momentum abating.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD seems to be carving a bullish outside-day (engulfing) candle as it bounces back from a fresh monthly low (1.0755), and the exchange rate may further retrace the decline from the start of December as it snaps the recent string of lower highs and lows.

- A break/close above the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region may push EUR/USD back towards the monthly high (1.0913), with a breach above 1.0940 (50% Fibonacci retracement) bringing the November high (1.1017) on the radar.

- However, EUR/USD appears to have reversed course following the failed attempt to test the August high (1.1065), and the recent rebound in the exchange rate may end up short-lived as the Relative Strength Index (RSI) falls back from overbought territory.

- Failure to defend the monthly low (1.0755) may push EUR/USD towards the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) area, with the next region of interest coming in around the November low (1.0517).

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong