US dollar and NFP takeaways

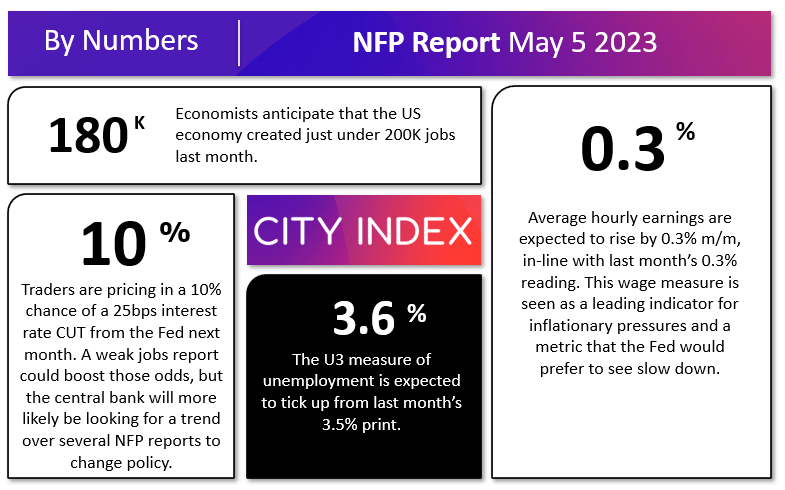

- The NFP report is expected to show 180K net new jobs and wages rising 0.3% m/m.

- With the Fed now likely pausing, traders will be more sensitive to unexpected weakness in the labor market than strength.

- The risks to the US dollar are finely-balanced, with EUR/USD looking relatively bearish and GBP/USD relatively bullish.

NFP overview

With the Fed shifting toward a likely pause in interest rates, the monthly jobs report takes on a different significance. Now, instead of looking for a reading that’s “good enough to keep the Fed raising interest rates,” traders will shifting their focus to watching out for data that is “bad enough to prompt rate cuts.”

As the graphic below shows, economists are not expecting anything of the sort yet:

Source: StoneX

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

By now most regular readers know that we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Services PMI Employment component printed at 50.8, down only slightly last month’s 51.3 reading.

- The ISM Manufacturing PMI Employment component printed at 50.2, up sharply from 46.9 last month.

- The ADP Employment report came in at 296K net new jobs, above expectations and last month’s 142K reading.

- Finally, the 4-week moving average of initial unemployment claims were up notably to 239K from 198K last month.

Weighing the data and our internal models, the leading indicators point to a slightly above expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 175K-225K range.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.3% m/m last month, will likely be just as important as the headline figure itself.

US dollar impact from NFP

|

|

Wages < 0.2% m/m |

Wages 02-04.% m/m |

Wages > 0.4% m/m |

|

< 125K jobs |

Bearish USD |

Slightly Bearish USD |

Neutral USD |

|

125K – 225K jobs |

Slightly Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

> 225K jobs |

Neutral USD |

Slightly Bullish USD |

Bullish USD |

The US dollar index has spent most of the last month consolidating near 1-year lows in the 101.00 area, leaving the world’s reserve currency ripe for a breakout if we see a surprising NFP reading.

If we see a strong reading on the US labor market, readers may want to consider bearish positions on EUR/USD, which is testing resistance just below the 1.1100 area after a less-hawkish-than-expected decision from the ECB earlier.

Meanwhile, a soft jobs report could present buying opportunities in GBP/USD. Cable is on the verge of breaking out to an 11-month high above 1.2580, with room to rally toward at least the mid-1.2600s before encountering previous resistance if the fundamental outlook for the greenback worsens.

-- Written by Matt Weller, Global Head of Research

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade