Oil rises ahead of the OPEC+ meeting

Oil prices are edging higher on Wednesday ahead of the OPEC+ meeting later, where the oil cartel is expected to slash oil output by 1 million or more barrels per day.

Oil prices have already risen by 8% so far this week in anticipation of the largest output cut since the depths of the pandemic.

In reality, the real impact of a large cut would be smaller, given that some of the members are failing to reach their output quotas.

However, an agreement on a large cut would send a strong message that the group is more than determined to support oil prices, even if this means strong criticism from other countries such as the US.

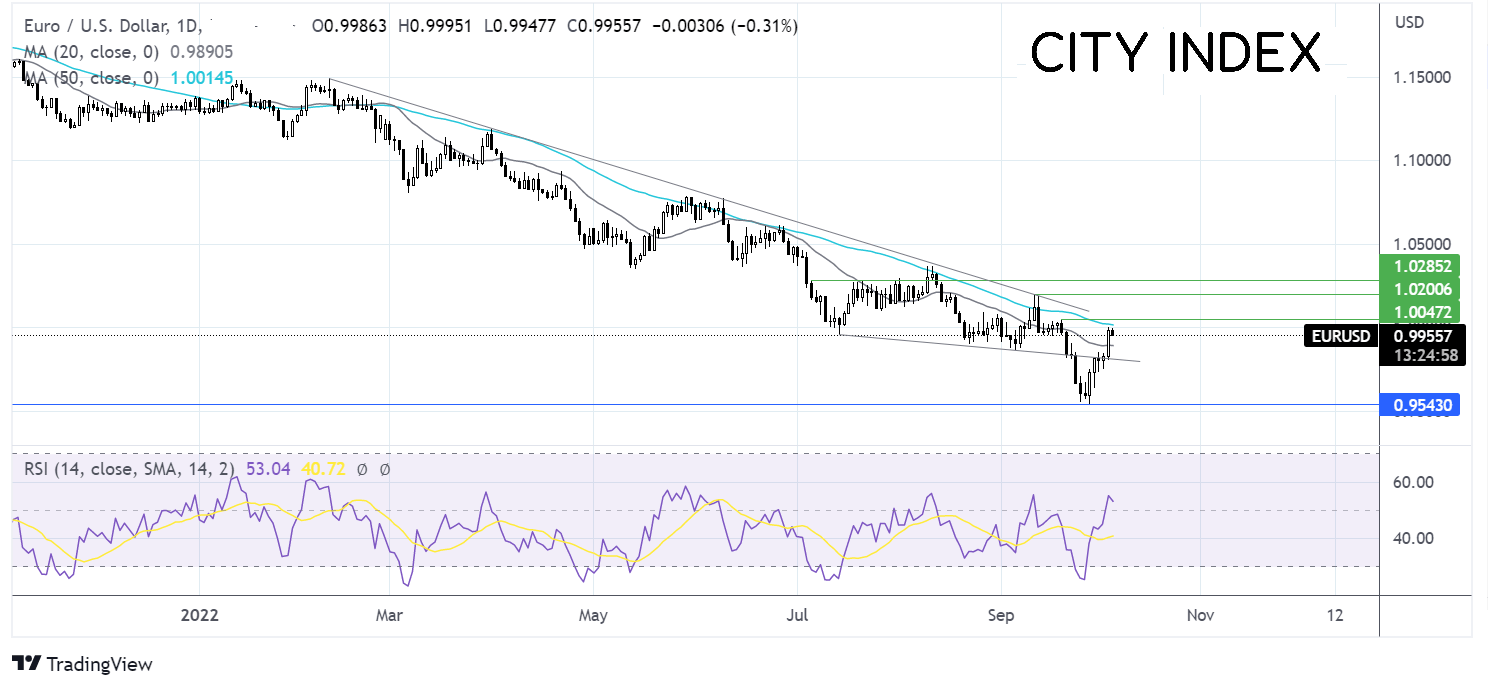

Where next for oil prices?

Oil prices have been forming a series of lower lows and lower highs since mid-June. The price trades within a descending channel. After finding support at 76.75 the price has rebounded higher and is attempting to rise out above the upper ban of the channel, which is also the 50 sma resistance at 87.70. A rise above here could open the door to 90.00, the September high, ahead of 97.20, the late August high.

Failure to meaningfully rise out above the falling channel could see the price fall back towards support at the 20 sma at 83.60. A break below here could open the door to 80.00 round number and 76.75, the September low.

EUR/USD stalls near parity ahead of PMI data

EUR/USD rose 1.6%, back to within a whisker of parity in the previous session after weaker than expected JOLTS job openings data fueled optimism that the Federal Reserve could adopt a less aggressive stance to hiking interest rates.

However, comments from Federal officials following the close reinforced the Fed’s hawkish message, lifting the USD after days of declines.

Today the pair is edging lower with eurozone composite PMI data in focus. Expectations are for business activity to contract further in September, falling to 48.2, down from 49.8 in August.

Concerns over the energy crisis in Europe keep investors jittery despite the EU energy chief saying there is enough gas storage to get through the winter.

Meanwhile, the USD will be looking toward the release of US ISM services PMI which is expected to stay strong at 56. ADP private payrolls are expected to rise to 200k, up from 132k. Strong data could lift the USD.

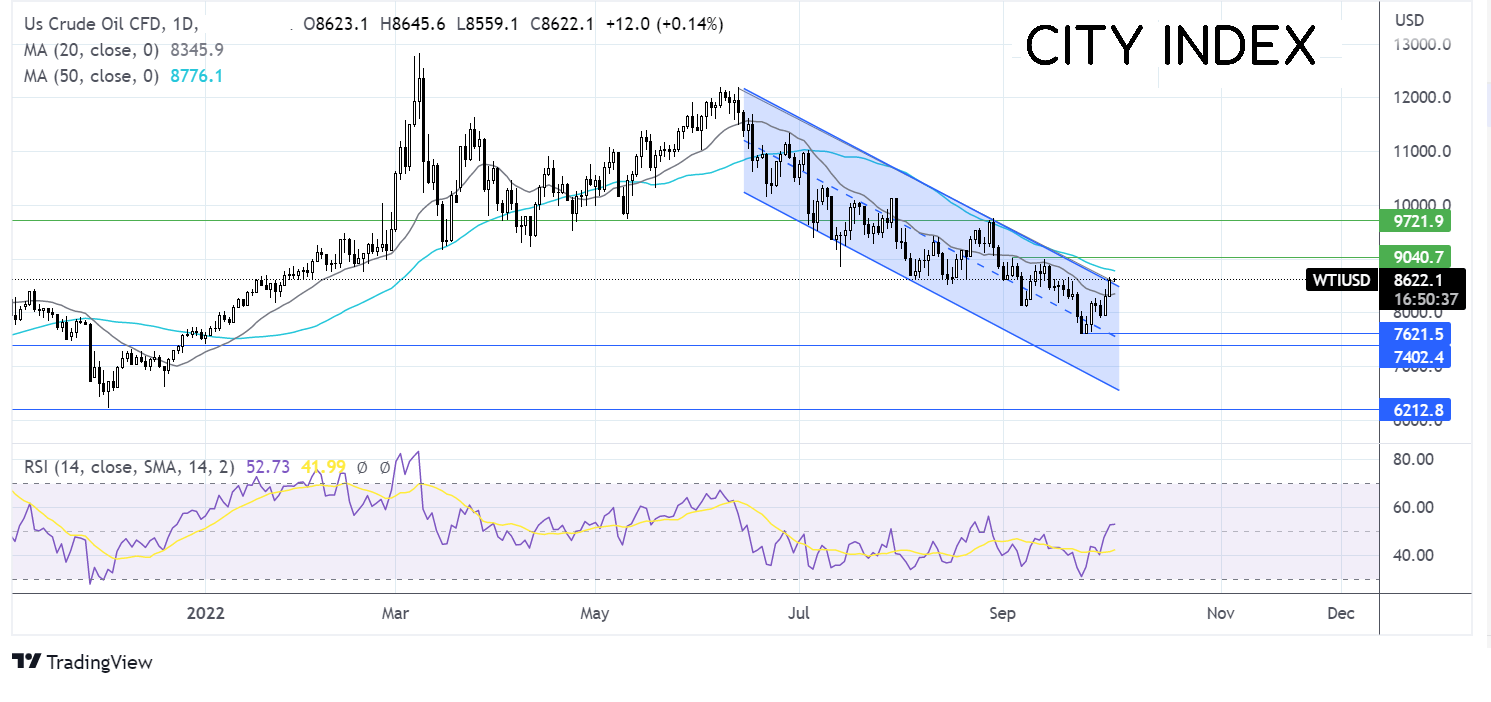

Where next for EUR/USD?

The EURUSD rebound from 0.9535 has run into resistance at parity, also the 50 sma. A rise above this level is needed to extend the bullish run and bring 1.0050, the September 20 high, into focus ahead of 1.0190, the September high.

On the flip side, sellers will look for a move below the 20 sma at 0.9895 to open the door to more downside and 0.9810, the falling trendline support.