- RBA keeps cash rate unchanged at 4.35% in May, as expected

- Bank provides unchanged long-term underlying inflation forecast, disappointing hawks

- AUD down, ASX, Australia bond futures up

The Reserve Bank of Australia (RBA) kept Australia’s cash rate unchanged at 4.35% in May but refrained from increasing its longer-term underlying inflation forecasts, limiting the risk of a near-term interest rate hike.

Not ruling anything in or out, which is neutral for rate risks

Repeating the guidance provided in March, the Board said it’s “not ruling anything in or out” when it comes to the outlook for interest rates. On inflation, it acknowledged slow progress in achieving its mandate, noting inflation was “declining more slowly than expected” with services inflation remaining “high and…moderating only gradually”. It declared “the persistence of services inflation is a key uncertainty.”

“It is expected to ease more slowly than previously forecast, reflecting stronger labour market conditions including a more gradual increase in the unemployment rate and the broader underutilisation rate,” the RBA said.

“Growth in unit labour costs also remains very high. It has begun to moderate slightly as measured productivity growth picked up in the second half of last year. This trend needs to be sustained over time if inflation is to continue to decline.”

In short, to achieve its inflation mandate, the RBA believes productivity needs to improve on a sustainable basis. Given the trend since the GFC, such an assumption should be regarded as high-risk. As such, it wisely added it remains "vigilant to upside risks."

Labour market upgraded despite "particularly weak" consumer

Fueling inflationary pressures in the low productivity environment, the RBA said that while labour market conditions had eased over the past year, they remained “tighter than is consistent with sustained full employment and inflation at target.”

Counteracting strength in the labor market, it acknowledged household consumption growth has been “particularly weak” with households “curbing discretionary spending and maintaining their saving.”

“Real incomes have now stabilised and are expected to grow later in the year, supporting growth in consumption,” it said. “But there is a risk that household consumption picks up more slowly than expected, resulting in continued subdued output growth and a noticeable deterioration in the labour market.”

RBA puts faith in productivity growth, steady rates to finish inflation fight

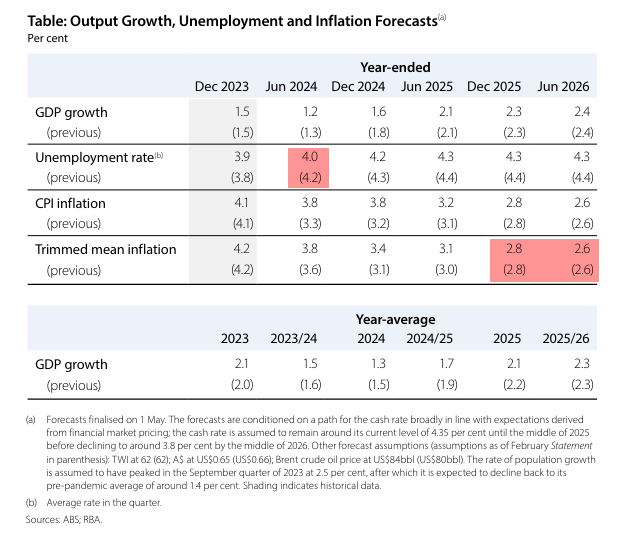

While the unchanged rates decision was expected by most economists and traders, where there was some dispersion in opinion was what the RBA would signal on the longer-term trajectory for inflation. On that front, its forecasts disappointed hawks who were looking for material upgrades with the bank continuing to signal trimmed mean inflation will return to target by the middle of 2025 with a return to the midpoint 12-months later.

Source: RBA

The assumption was underpinned by a significantly higher forecast track for the cash rate than that used three months ago, reflecting market repricing, allowing it to continue pointing to progress in returning inflation towards target despite lowering its unemployment forecasts.

The unchanged longer-dated underlying inflation forecast took the wind out of the Australia’s sails while simultaneously putting a bid in ASX 200 and Australian bond futures. The statement was on the hawkish edge of the neutral rates spectrum but not hawkish enough for markets that had priced in a 40% probability of a 25 basis point rate hike in August.

Attention now turns to RBA Governor Michele Bullock’s press conference scheduled to begin at 3.30pm AEST.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade