Commodities were under heavy selling pressure at the beginning of the week due to demand concerns stemming from lockdowns in China. It has also weighed on global equity markets as investors are pricing in slower global growth.

Iron ore didn’t escape the volatility and it fell as much as -11% on Monday as it tracked Chinese stainless steel futures lower. However, on Tuesday the government vowed to support the economy which allowed iron ore to recoup much of Monday’s losses.

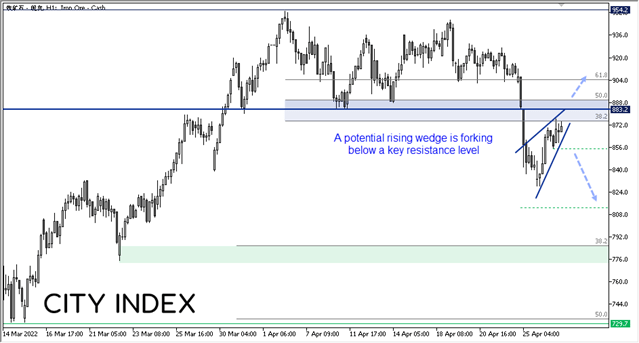

With prices hovering below a key level of resistance it could be make or break for iron ore. The market now needs to decide whether it can continue its uptrend or retrace further from its 10-month high, set earlier this month.

Iron ore is within an uptrend on the daily chart, although it is currently retracing against that trend. If it reverts to the bullish trendline form the November low it could be headed towards 760 – 780 (depending on how quickly it tries to get there).

On Monday prices broke beneath 883.2 support and confirmed a double top pattern. If successful, the double top projects a target around 813. However, 883.2 remains an important level to monitor as prices tried to retest it yesterday.

A break above 883.2 resistance invalidates the double top pattern. Traders could then wait to see if it is then respected as support before considering long opportunities.

On the hourly chart we can see yesterday’s high respected a 38.2% Fibonacci level, just below 883.2 resistance. Bullish momentum of yesterday’s rally is also softer which shows momentum is weakening, and prices are coiling up within a potential rising wedge pattern.

We are now looking for evidence of a bearish reversal pattern around (or below) nearby resistance levels. A break beneath 856 could assume bearish continuation and brings the doble top target around 813 back into focus, with support levels around 780 and 800 also making potential targets for bears.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade