Market Summary:

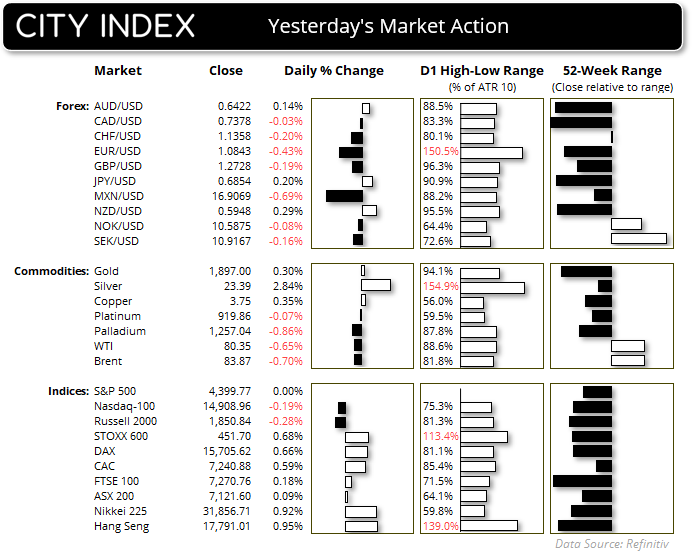

- The Japanese yen (JPY) was the weakest forex major currency last week, the US dollar was the strongest

- The S&P 500 and Nasdaq 100 snapped their 2-day winning streak ahead of a key earnings report from Nvidia (NVDA), thanks to a mix of negative headlines

- US banks were lower as S&P Global ratings joined Moody’s by downgraded ratings and their outlooks for several mid-sized US banks, due to a “tough” climate and “squeezed liquidity” and falling security values

- FOMC member Thomas Barkin said the US should be prepared for the economy to reaccelerate, helping to further support the US dollar and help DXY close with a bullish engulfing day

- US department store Macy’s shares fell -14% after reporting a 14% rise in credit-card delinquencies. It was the stock’s worst day since June 2020.

- WTI crude oil retraced lower for a second day and closed back below $80 due to the risk-off tone and stronger US dollar

- AUD/USD rose to the May high in line with our near-term bias, yet handed back gains later in the session to close the day with a bearish hammer candle.

Events in focus (AEDT):

- 08:45 – New Zealand retail sales

- 09:00 – Australian flash PMIs (manufacturing, services, composite)

- 09:30 – Japan’s flash PMIs

- 17:30 – German flash PMIs

- 18:00 – Eurozone flash PMIs

- 18:30 – UK flash PMIs

- 22:30 – CA retail sales

- 23:45 – US flash PMIs

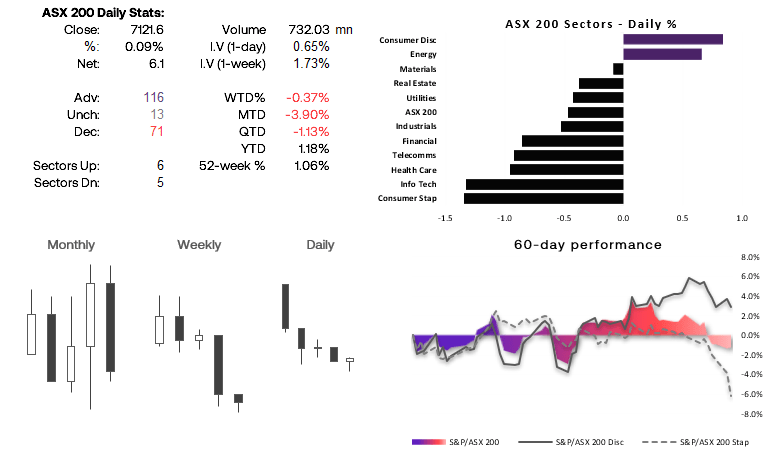

ASX 200 at a glance:

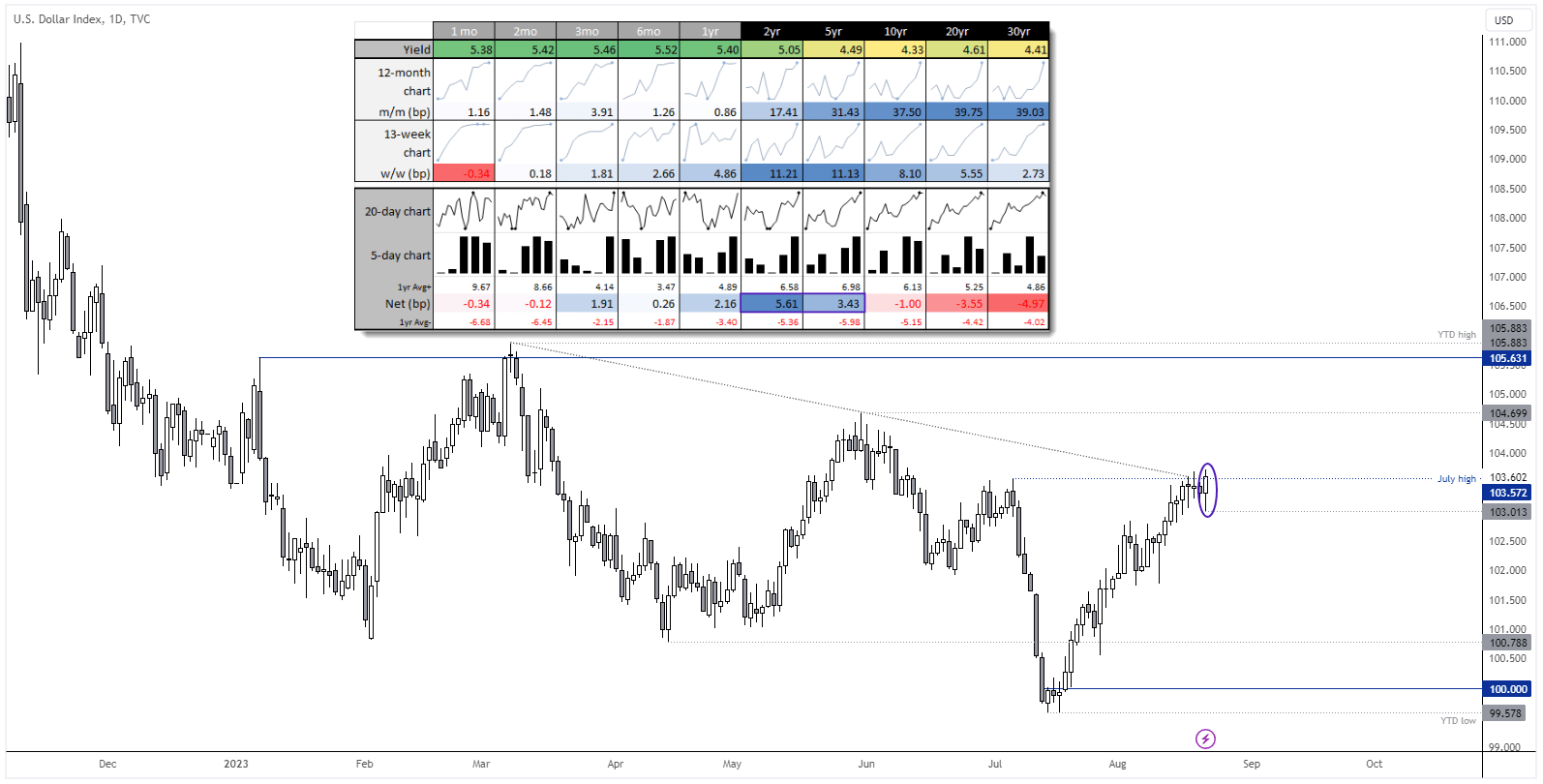

US dollar index technical analysis (daily chart):

The US dollar tracked bond yields higher at the short end of the curve, resulting in a bullish engulfing candle on the US dollar index daily chart. I had expected there to be some chop around the highs and perhaps even a pullback, but I’m now left wondering if the US dollar will be bid heading in the Jackson Hole symposium. With expectations that Powell will stick with the ‘higher for longer’ narrative, there seems little room for any dovish surprise but more room for a hawkish surprise. And that could potentially mean the US dollar gets a tailwind from ‘buy the rumour, sell the fact’.

Gold technical analysis (gold futures left, gold spot right):

In all fairness, gold has held up well over the past couple of days given the rise in yields. With that said, Wall Street indices retreated overnight along with the 10-year yield and above, so perhaps gold attracted some safe-haven flows during the mild risk-off session.

The question at the back of my mind is whether spot gold prices are due another leg lower. We can see they fell through 1900 last week – a big round number that ‘should’ have held as support. Yet if we compare this to the front-month futures contract, ‘real' support could actually be lower. The daily trend structure is also bearish, and the current rise from the lows looks cautious at best.

RSI (2) is not yet overbought and gold futures have gaped up at the open, so perhaps there is still some upside potential for gold over the near-term and it may generate some noise around 1900. But if I see evidence of a swing high below 1917 / monthly 1 pivot, then a break to new lows seems favourable.

And if 1900 is to provide support on gold futures like it did in late June, this suggests support for spot golf could sit around 1970 / monthly S2 pivot.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade