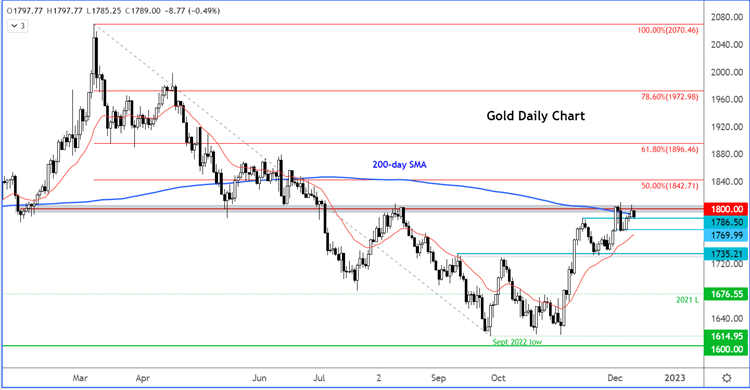

Gold has turned lower, hit by profit-taking ahead of the major central bank events taking place this week, with traders continuing to pay respect to the key $1800 resistance level.

Whether or not we will break and hold above this level depends pretty much on how hawkish or otherwise the Fed is going to be on Wednesday. If the US central bank indicates that the terminal interest rate is going to be 5% or higher, then this will keep bond yields underpinned, which in turn should undermine the zero-yielding gold.

Ahead of the Fed decision, we will also have the latest US consumer inflation data on Tuesday. November CPI is expected to have eased further to a still-very-high 7.3% annual rate from 7.7% the month before. A bit of a deviation in the expected figure shouldn’t matter too much, since the Fed officials are unlikely to alter their views on the back of that. However, a big miss or beat could send the dollar in the direction of the surprise, pushing gold in the other direction.

Last week’s hotter-than-expected PPI print called into question the “peak inflation” narrative, although UoM's survey showed inflation expectations fell. If CPI continues its recent downtrend then this should help provide gold some short-term support, before the focus shifts to the Fed. Otherwise, and especially with bond yields bouncing back in the last couple of trading days, gold could remain under pressure. Rising yields tend to increase the opportunity cost for hold onto an assets that doesn’t pay any interest, unlike bonds.

Anyway, there is no need to rush into any trades as this week’s events have the potential to set the directional bias for the greenback – and gold – until at least the end of the year. We will have the likes of SNB, BoE and ECB all to look forward to Thursday of this week, too.

If, by Thursday, the precious metal finds itself above $1800 then that should give the bulls the green light to power ahead as we approach year-end. But if, by Thursday, gold has formed a key bearish reversal signal and there's been some downside follow-thru, then it is back to square one for the precious metal.

Let's wait for gold to show us the direction then trade accordingly. Patience is key here.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade