UK inflation & the BoE

Today’s data confirmed that the squeeze on UK households has risen again. Inflation has surged to its highest level in 3 decades. It’s unsurprising to see fuel prices, which jumped 10% in the month, as the main driver of inflation as oil prices surged amid the fallout from the Russian war. But this certainly wasn’t the only driver, with price rises evident across many categories including furniture and hospitality as supply chain disruptions and rising wages also lift inflation.

The BoE expects inflation to rise to 8% in April but given the ahead of forecast print today, that could well be 8.5%. Inflation could then rise again in the autumn as the energy cap is lifted.

Hot inflation in the UK comes as the UK jobs market continues improving but economic growth shows signs of stalling putting the BoE between a rock and a hard place. Policymakers will need to decide whether to rein in inflation or support growth.

We expect the BoE to attempt to rise once more, maybe twice at a push. But fears that a hawkish BoE could tip the UK into recession are dragging on GBP.

US inflation & the Fed

Meanwhile, US CPI rose ahead of forecasts to 8.5% YoY in March, up from 7.9% in February. Interestingly core CPI was slightly short of forecasts at 6.5%, rather than the 6.6% forecast, which some, including Brainard, considered a sign that inflation could be peaking.

Even so the hot inflation boosted the market’s expectations of a 50-basis point rate hike. According to the CME Fed Funds, the market is now pricing in an 87% chance of a 50 bp rate hike in May, up from 81% pre-release yesterday.

The more hawkish expectations boosted the US dollar index, which rallied 0.4% yesterday, marking its 10th straight day of gains.

Whilst US inflation is high, the US jobs market strong and economic growth, whilst slowing comes from a much stronger base. The US bond yields inverted sounding alarm bells over a possible recession, but the markets seem less concerned.

Learn more about the Federal ReserveGBP/USD

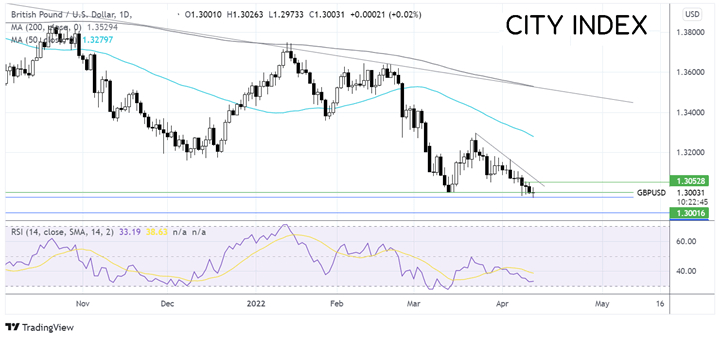

The expected divergence in the outlook for monetary policy is weighing on the pound against the USD.

GBP/USD has been trending lower since March 23, forming a series of lower highs and lower lows. The pair has broken below 1.30 the key psychological support and 1.2980 the 2022 low, opening the door to 1.29 round number.

On the flip side, the first point of resistance above 1.30 psychological level is 1.3050 and then 1.3080 the 50 sma.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.