Today’s Bank of England (BOE) meeting will garner a lot of attention, to see if they signal the June cut markets so desperately want to hear. I’m not fully convinced they will. But that may not prevent the British pound from weakening as we approach the meeting in anticipation of such an announcement.

The big question for today is if the BOE will satisfy bearish market positioning with enough dovish talk to prevent shorts from covering, and inadvertently sending GBP/USD higher. Asset managers remained near the record level of net-short exposure to GBP futures, set two weeks ago according to the COT report. And large speculators were net-short for a second consecutive week, and at their most bearish level since January 2023.

Markets are pricing in 41bp of easing this year, which roughly equates to an 82% chance of two 25bp cuts by December. Yet ING have four cuts pencilled in, with easing to begin in August or potentially June.

Even if the BOE do not effectively confirm an incoming cut to arrive as soon as June or July, we may be able to indicate pressure is building to move if we see a change in MPC votes. Last month only one member of voted to cut, eight to hold and none to hike. Part of my finds it difficult to believe we’ll see a material difference to chance policy today, given their last meeting was the first since late 2021 to not have votes for a hike. But if pressure is building to cut, it should at least see votes to cut be 2 or greater (which would mean hold would become 7 or less).

Ultimately, traders will want a clear script from the BOE to justify continued weakness of the British pound, as failure to do so could send GBP pairs higher.

Economic events (times in AEST)

- 11:00 – BOE interest rate decision, MPC votes, minutes

- 12:15 – ECB De Guindos speaks

- 12:30 – US jobless claims

- 13:15 – BOE Bailey speaks

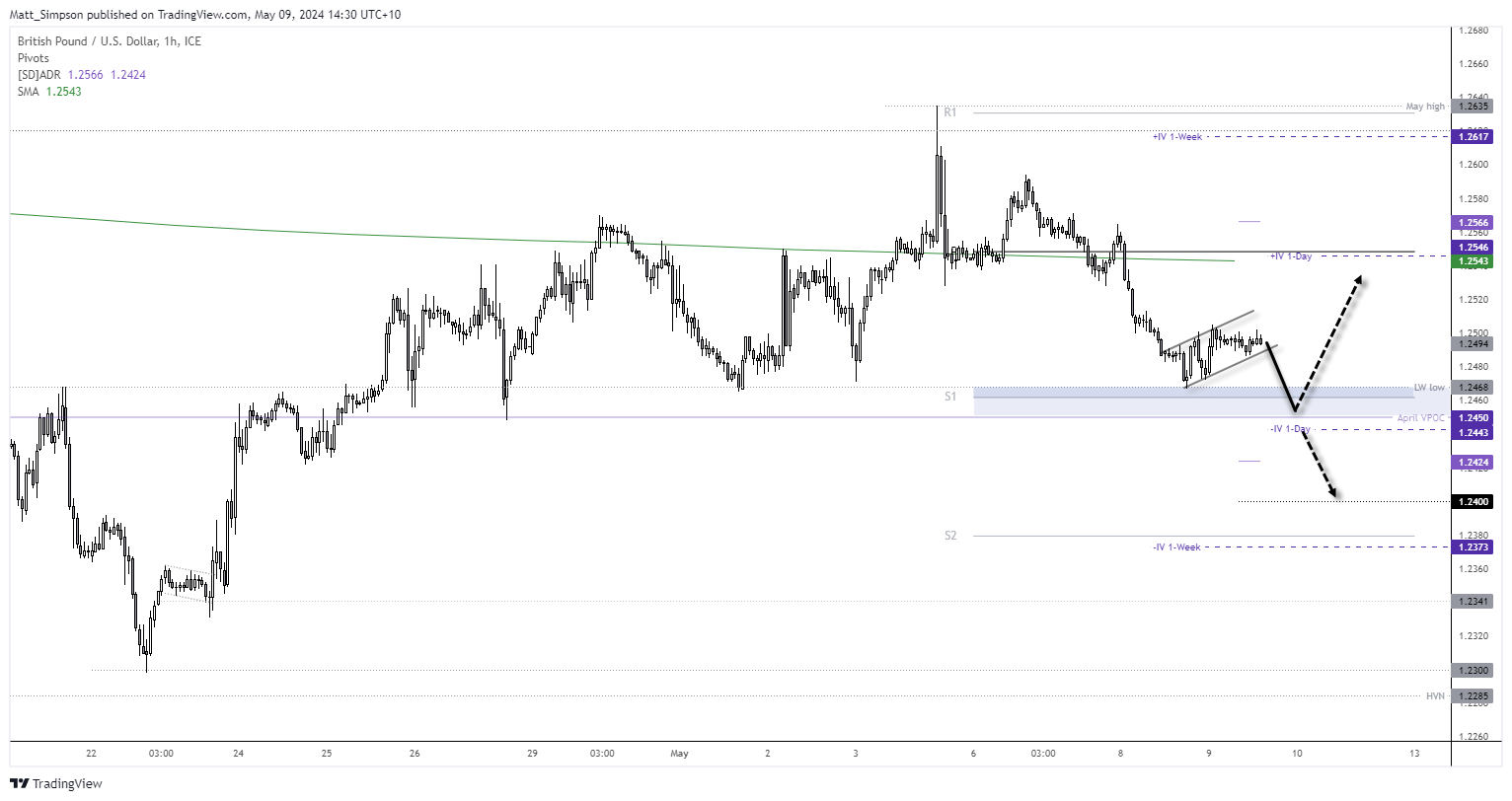

GBP/USD technical analysis:

The 1-hour chart shows a downtrend on GBP/USD, although it is within a period of consolidation after finding support at last week’s low. Whatever happens, I suspect we’ll at least see an initial move lower – with a clear dovish BOE likely required to send it beneath last week’s low. Notice that the weekly S1 pivot sits between the April VPOC (volume point of control) and last week’s ow, making it a likely support zone.

But if the BOE fail to deliver the dovish message traders seek, then GBP/USD could rally on the back of short covering. Note that the upper 1-day implied volatility band suits near the weekly pivot point and 200-day average, making it a likely area of resistance.

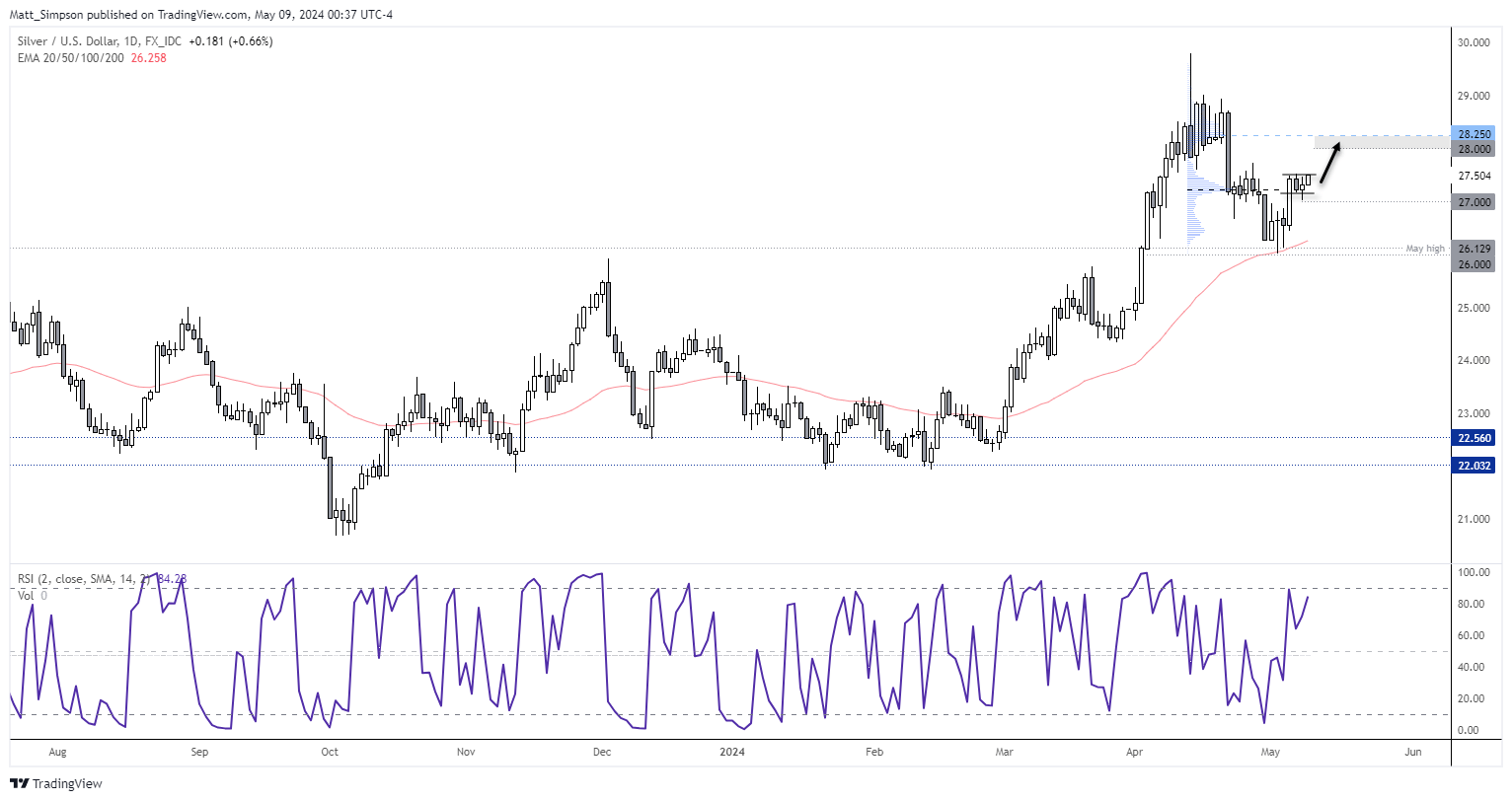

Silver technical analysis:

Regular readers will know that I have been awaiting for gold prices to pop higher over the past week. Whilst there’s no cigar, the bias remains bullish until bearish momentum returns to the daily timeframe. However, silver may have the more compelling setup.

Silver prices formed a strong rally in March through the first half of April, before a 3-wave retracement found at the May high near the $26 handle. Momentum has pushed higher ahead of a small consolidation, with prices now holding above $27. Given this consolidation has formed around the VPOC from the 3-wave decline, it appears comfortable in its current consolidation. But if prices can break above last week’s high ~27.50 then I suspect bulls will want to gun for the $28 handle at a minimum, or the high-volume node around $28.25.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade