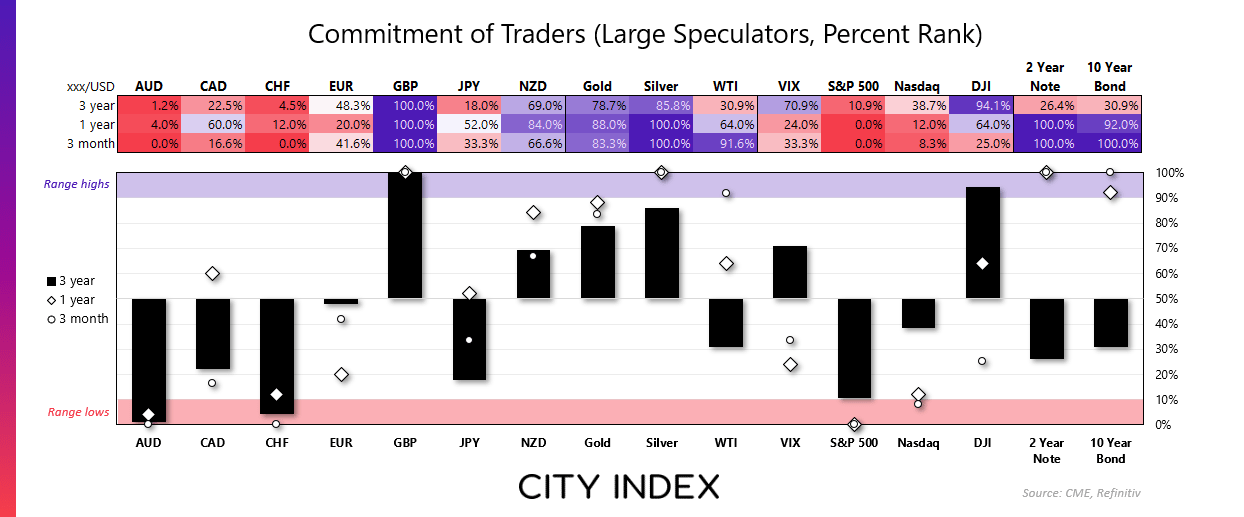

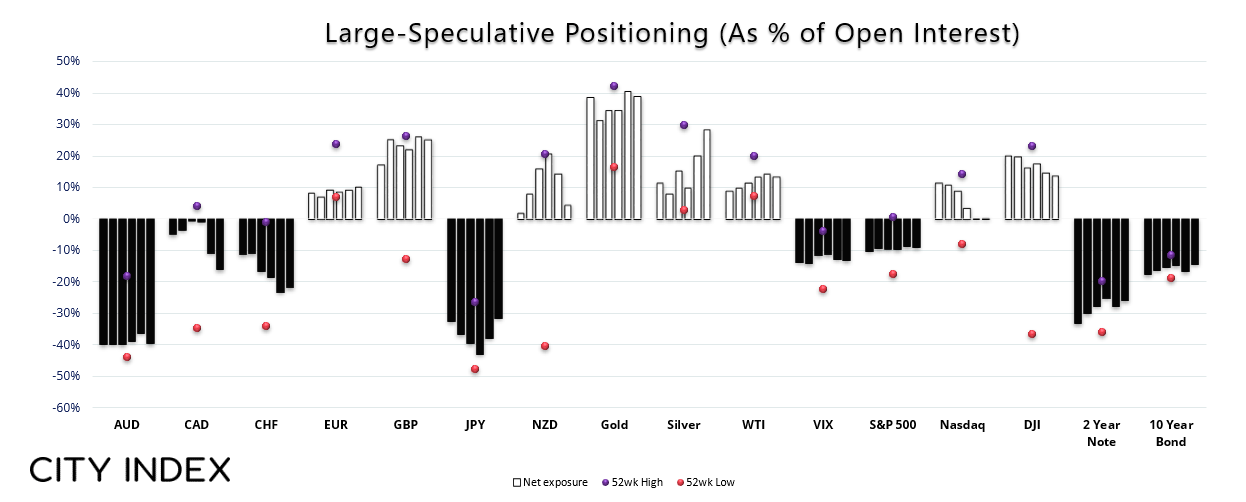

Market positioning from the COT report - as of Tuesday March 12, 2024:

- The 3-year, 1-year and 3-month percent rank for GBP/USD futures hit 100% to suggest a sentiment extreme could be on the horizon

- Large speculators reduced net-short exposure to Japanese yen futures for a second week after it reached a 16-year high

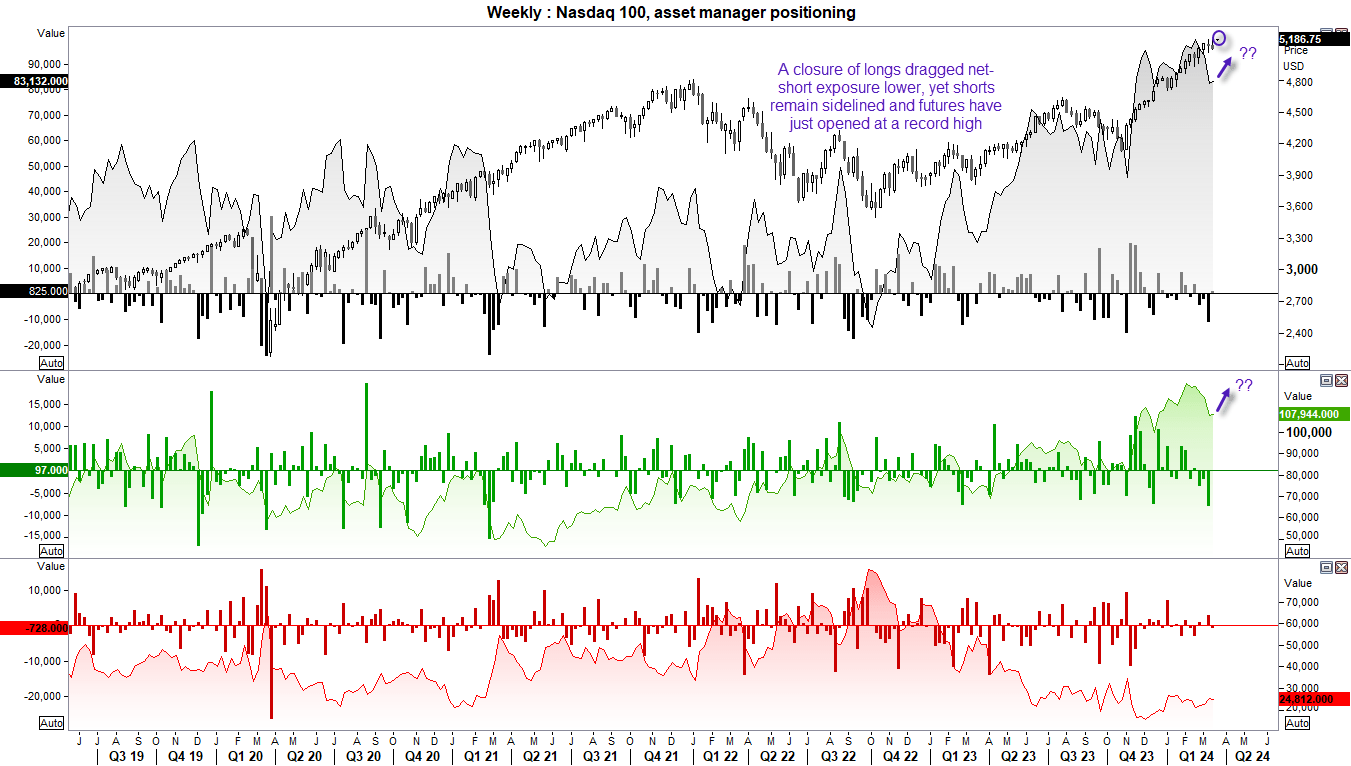

- A divergence has formed between net-long exposure and Nasdaq 100 futures among large speculators, yet a lack of short interest and the fact prices opened at a record high suggests bulls could be set to return

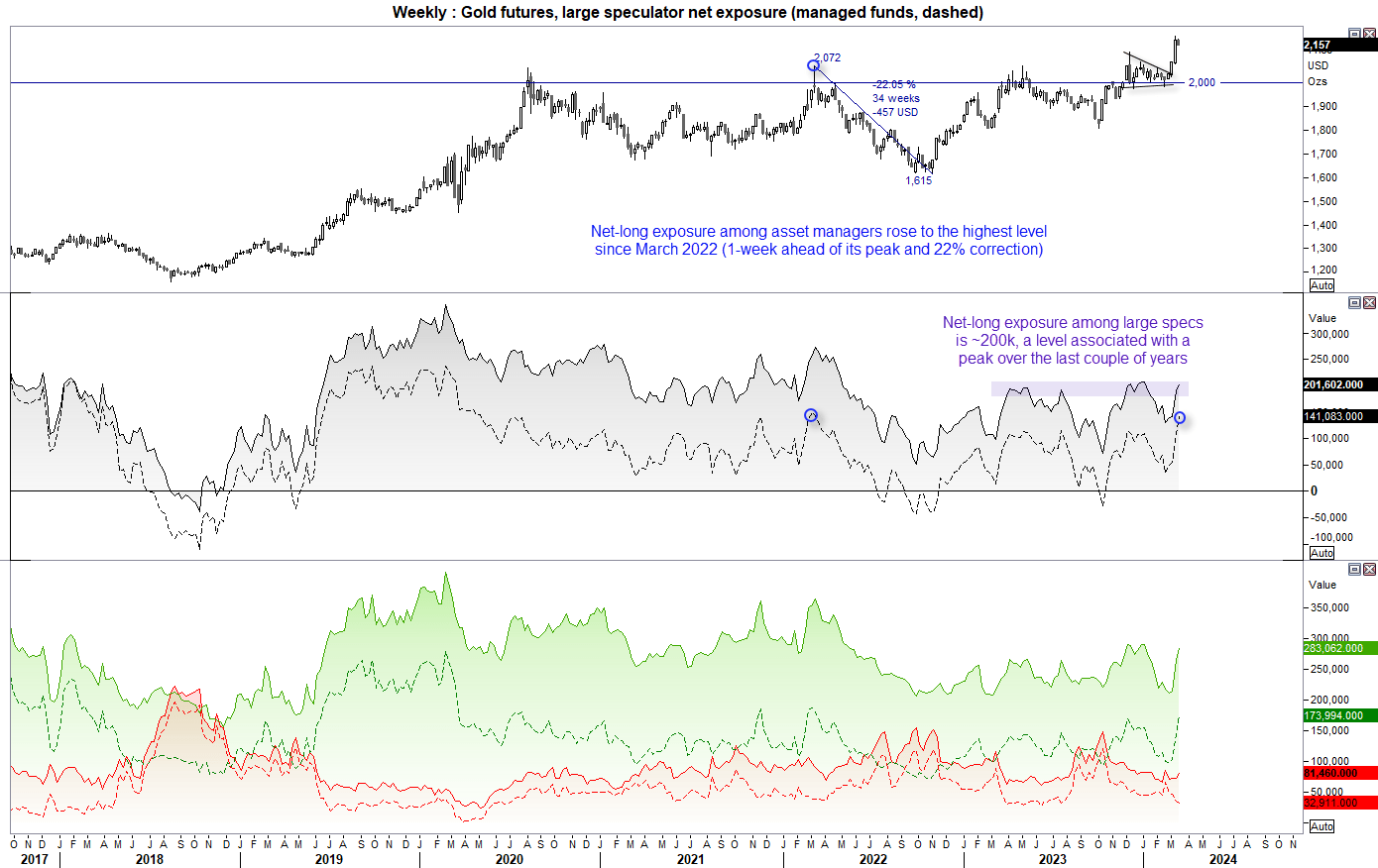

- Dare we suggest gold could be reaching a mini sentiment-extreme, with net-long exposure among asset managers reaching its highest level since the March 2022 top

- Large speculators and managed funds trimmed gross-long exposure to WTI crude oil futures for a second week, and funds increased short bets to bring into question WTI’s break above $80 last week

- Large speculators flipped to net-long exposure to copper and platinum futures last week, ahead of China’s smelters announcement that they would limit coper production

- Large specs trimmed long bets to CAD futures by -15.6% (-6.4k contracts) and increased shorts by 7.1% (4.4k contracts)

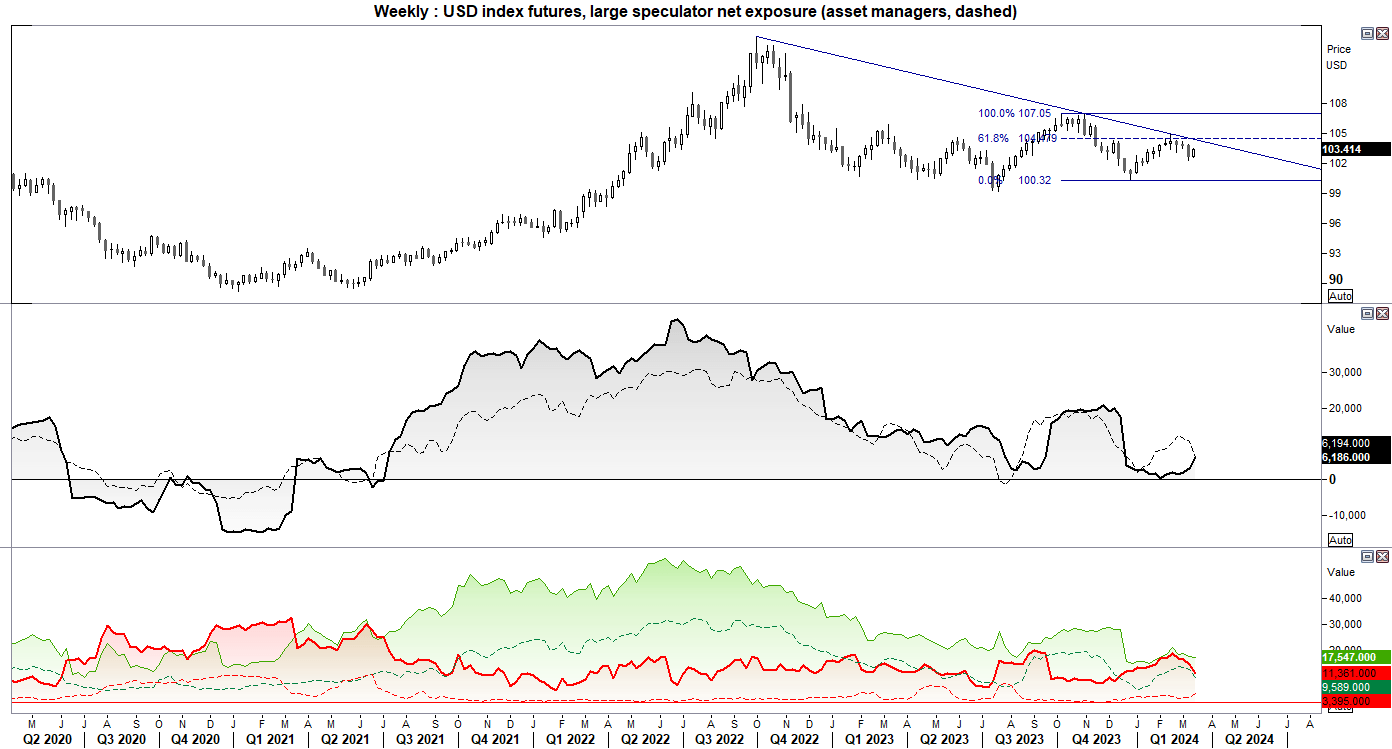

US dollar index (DX) positioning – COT report:

Scaled-back bets of Fed cuts heled the US dollar index recoup some of the prior week’s losses, to form a small bullish inside day. Yet the rally is not exactly on fire, and Friday’s miniscule ‘bullish’ range shows that bulls are already losing steam ahead of this week’s FOMC meeting. Whether this is a retracement ahead of its next leg lower, or simply part of a bull flag on the weekly chart, remain to be seen. And adding to the confusion I note that large speculators are increasing their net-long exposure yet asset managers are reducing theirs. Moreover, both groups are trimming longs, large specs are reducing shorts yet asset managers are increasing theirs.

Ultimately, it is difficult to get behind either direction for the US dollar index with such contrasting views and ultimately lower volumes on the US dollar index, especially when the upcoming the Fed meeting and incoming data can have a binary effect on the US dollar and therefore markets in general. In all likelihood, we’ll see some choppy trade and fickly price action in the first half of the week which may be better suited for intraday traders, mean reversion or simply sitting on ones’ hands.

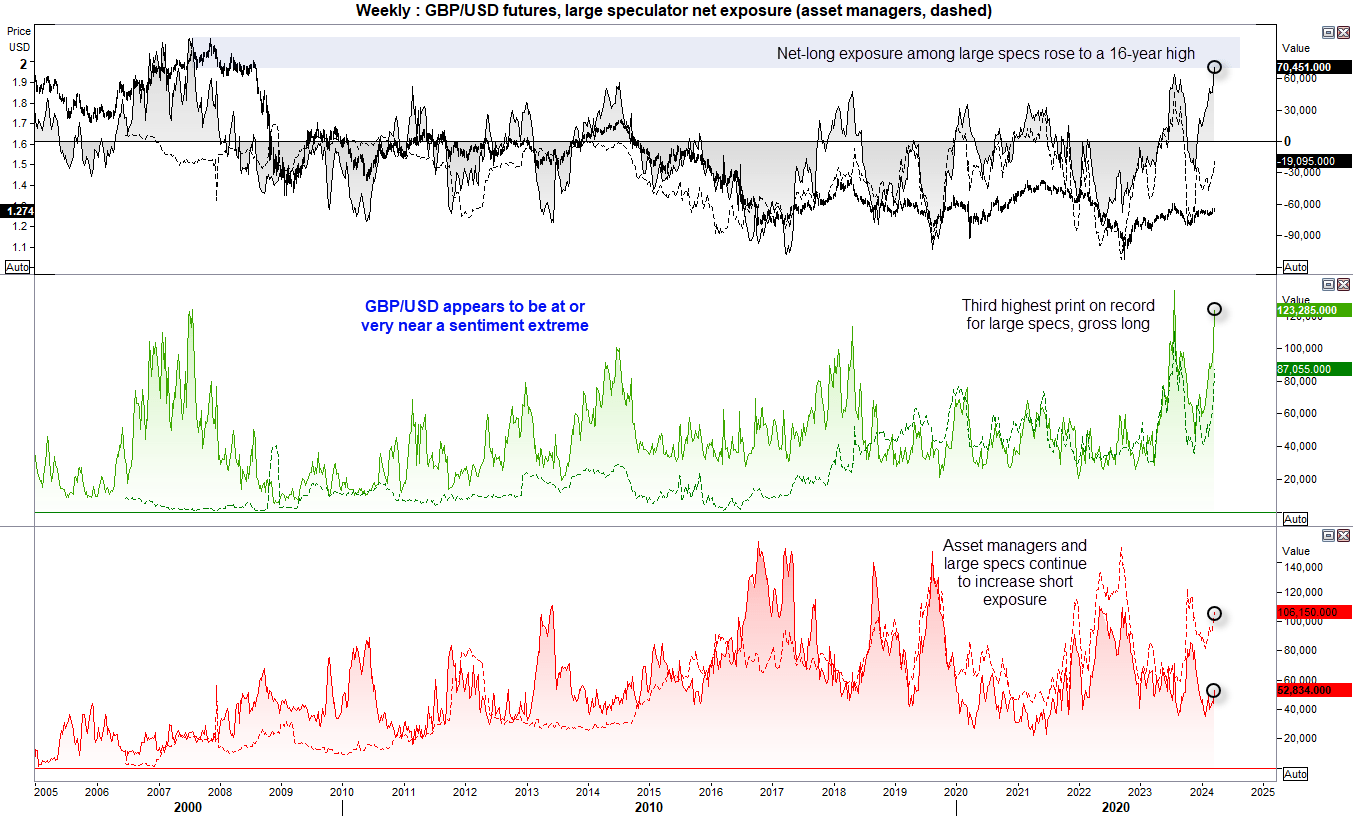

GBP/USD (British pound futures) positioning – COT report:

Net-long exposure to GBP/USD futures rose to a 16-year high, and gross-long exposure rose to its third highest level on record. These stats alone are enough to warn of a sentiment extreme, although worth noting that gross shorts are also beginning to rise among this set of traders. As mentioned last week, there remains a clear divergence between them and asset managers who remain net short, although their bearish level of exposure is diminishing.

Yet with wages slowing, unemployment rising to a 2-year high and job growth contracting, the rally on the British pound is losing steam. In GBP/USD formed a bearish inside week, and the pound had only reached an 8-month high to show it failed to live up to bullish positioning of large speculators.

It is a big week for GBP traders given inflation data on Tuesday, the BOE meeting on Wednesday, FOMC on Thursday and UIK retail sales on Thursday. And if inflation comes in softer and the FOMC meeting is not as dovish as expected (which is my bias), then GBP/USD could be looking at further downside.

Gold futures (GC) positioning – COT report:

Large speculators and managed funds continued to increase their net-long exposure to gold futures last week, although nowhere near the pace of the week prior (which was its fastest in 3.5 years among large specs).

If there is any reason to warrant caution, it is that net-long exposure for large specs is around 200k – a level which has been around interim tops over the past two years and that net-long exposure for asset managers rose to its highest level since March 2022 (which incidentally occurred just ahead of a 22% correction).

That is to say gold could enter a bear market at these levels, but it is not hard to image this rally could be in need of at least a pause, if not a pullback.

Nasdaq 100 futures (NQ) positioning – COT report:

A divergence has formed between Nasdaq 100 prices and net-long exposure of asset managers. The decline of net-long exposure has been driven lower by a closure of longs, and although shorts has risen in prior weeks they remain relatively low. Therefore it is difficult to construct a bullish case on the Nasdaq 100 with this information alone, as really we’d want to see shorts rise whilst longs decline to better assess any potential turning point. Besides, futures markets have just opened at a record high, which if anything suggests longs are returning.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade