- GBP/USD analysis: Risk assets tumble on Middle East tensions

- What is driving the US dollar and risk sentiment?

- GBP/USD technical analysis point lower after breaking 1.25 key support

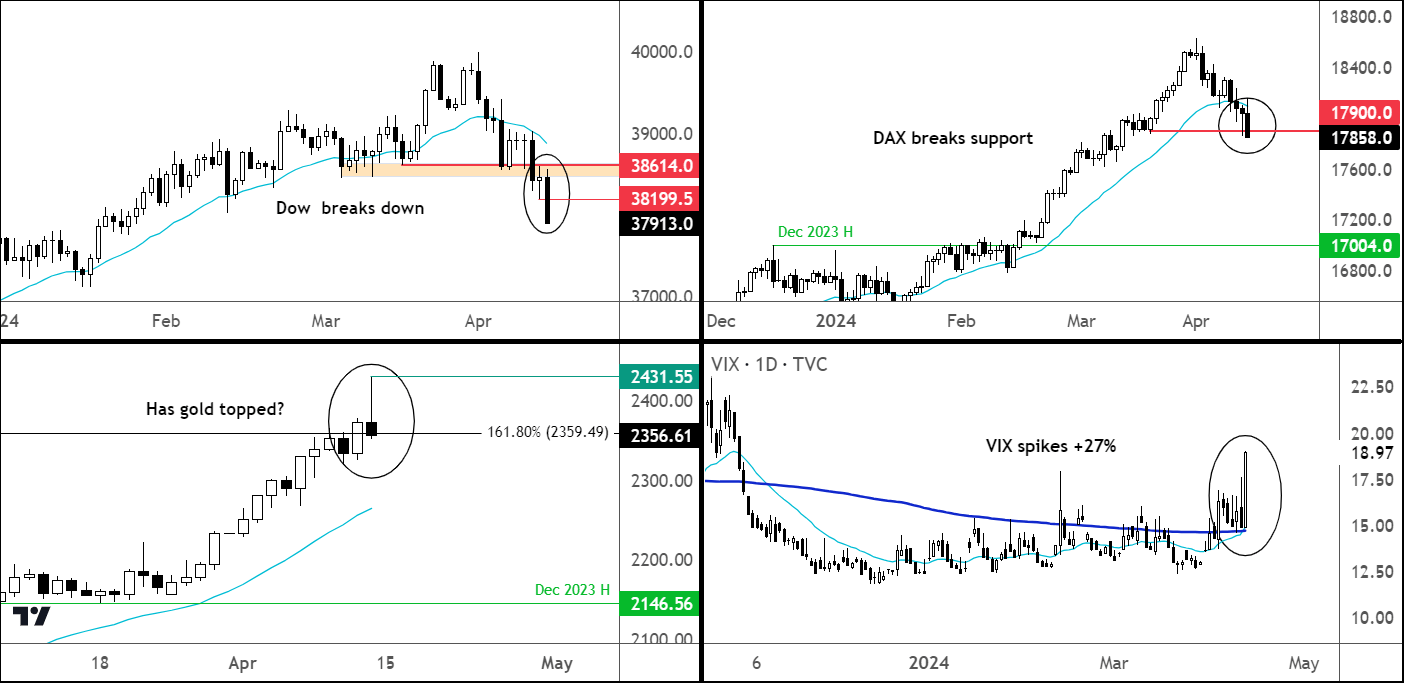

Friday saw a downturn in market sentiment, though if one were solely observing the FTSE, they might have been unaware. The UK index reached a new pinnacle as mining and energy shares surged, mirroring the rise in metal and oil prices. Meanwhile, the major US indices were down by over 1% at the time of this writing late in the day on Friday, with the Dow performing particularly poorly. Initially, gold surpassed $2430, only to relinquish all gains of 2.5% by late afternoon in London, as the US dollar strengthened against all major currencies except for the traditionally safe Japanese yen. The VIX staged a sharp rally. Primarily due to the US dollar's strength, the GBP/USD suffered a major setback, breaching the 1.25 mark to reach its lowest level since mid-November. Investors will be looking forward to significant UK data releases scheduled for the upcoming week.

Source: TradingVIew.com

GBP/USD analysis: What is driving risk sentiment and US dollar?

Friday witnessed a shift away from risk appetite following reports suggesting that Israel faced the imminent threat of a direct attack from Iran on governmental targets. Bloomberg indicated this could occur as early as Saturday. Consequently, investors were scaling back their exposure to risk in anticipation of the weekend, fearing potential downward gaps in risk assets should any incident arise.

In addition to the increased geopolitical risks and elevated oil prices, the US dollar has gained support following robust inflation data and unexpected resilience in economic data, which have pushed back expectations of Federal Reserve rate cuts. March's Consumer Prices rose to their highest annual rate since October, registering at 3.5% in mid last week. This marks the fourth consecutive month in which CPI has exceeded market forecasts, driven by sharp increases in the prices of essential goods.

Several FOMC officials, including Bank of Boston President Susan Collins, have reiterated since the CPI report that there is currently no immediate need to implement interest rate cuts. This stance is grounded in the persistently high inflation rate and the robustness of the labour market. Bond market investors are now pricing in two rate cuts by year-end, a significant shift from the expectation of approximately six cuts at the beginning of the year.

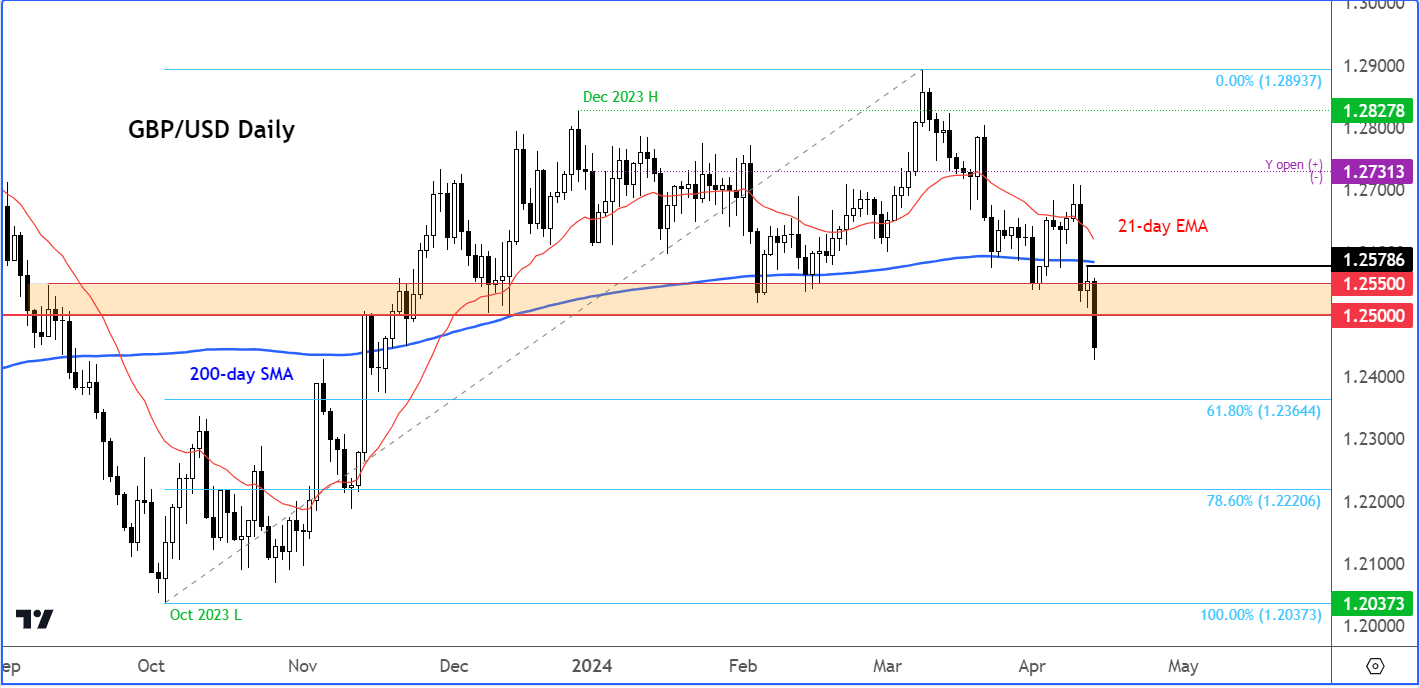

GBP/USD breaks 1.25 handle as US rate cut expectations push out

On Friday, the GBP/USD plunged below the 1.25 handle, giving back all of the modest gains made since mid-November. The US dollar was also finding good support against the euro and several other major currencies. This is all because the gap between expected rate cuts from the Fed versus the rest of the world, including the BoE, has widened. As the likes of the ECB and BoE are moving closer to cutting interest rates, possibly in June, the Fed’s timeline has lengthened. This is the main reason behind the cable’s decline.

GBP/USD analysis: Key events to watch out for in the week ahead

In the week ahead, the biggest risk facing the GBP/USD and markets in general stem from geopolitics, concerning Iran and Israel, and their supporters. From a macro point of view, the GBP/USD traders will also have to consider key UK data including wages (Tuesday), CPI (Wednesday) and retail sales (Friday). From the US, we have retail sales and Empire State Manufacturing Index (Monday), industrial production (Tuesday) and Philly Fed Index and Existing Home Sale (Thursday).

Among the data highlights is UK CPI, due for release on Wednesday, April 17 at 07:00 BST. There's been much speculation regarding the possibility of multiple rate cuts by the BOE, prompting the central bank to counter by suggesting that market expectations had turned overly dovish. Despite core CPI standing at more than double the BOE's 2% target and experiencing a 0.6% increase last month, the annual inflation rates for both CPI and core CPI are showing signs of slowing, which is positive news. However, it might still be premature to anticipate the BOE initiating easing measures in June. The forthcoming CPI data would need to show a weakening trend to sustain those expectations.

While we have a few US macro data in the week ahead, as mentioned, the next big US data is not due until late in the month when the Fed’s favourite measure of inflation is released on 26th April. Until then we may well see the dollar remain supported on any short-term dips, given that both the US and rest of the world's rates story – for example, ECB and BOC – have turned more positive for the greenback.

GBP/USD technical analysis: key levels to watch

Source: TradingVIew.com

On the GBP/USD chart, the key area of resistance is now the former support area around 1.2500 to 1.2550. This area was previously support back in December, a couple of times in February and again in early April, before it gave way on Friday. Should rates go back above this area then this may complicate the short-term directional bias as that could signal a possible false break scenario. If the selling continues, then watch out for potential bounces around key round handles like 1.24 and 1.23 etc. An additional level to watch is the 61.8% Fibonacci extension level at 1.2365 as derived from the rally that started in October and ended and March.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade