So, the FOMC day finally arrives and ahead of the event investors have taken their feet off the gas slightly – possibly because of ECB announcing it will hold an ad-hoc meeting to “discuss current market conditions” – AKA fragmentation. We have seen global stocks and US futures rebound, while the dollar has fallen across the board, lifting the EUR/USD exchange rate. Ahead of the FOMC decision later on at 19:00 BST, watch out for ECB-related headlines about any anti-fragmentation measures. ECB President Christine Lagarde is also due to speak at 17:20 BST today.

Dollar should remain supported on dips

But whether the recovery in the EUR/USD and risk assets in general will hold remains questionable, especially as the Fed is likely to bow to pressure and match market expectations with a hike of 75 basis points today. If it doesn’t, and it is “only” a 50 bp hike, then I would expect to see a sharp relief rally for risk assets and a drop in the dollar. That being said, any weakness for the greenback is likely to be short-lived. The Fed remains head and shoulders above other major central banks in terms of hawkishness. The FOMC’s updated dot plots should reflect that. Yields should also remain underpinned, keeping the pressure on bond prices on any short-term rallies.

What do we expect from the FOMC?

For what it is worth, I also think a 75bp hike tonight is very likely following those strong inflation numbers last week. In any case, another 75bp increase in July is going to follow, I reckon. By the end of the year, we are probably looking somewhere around 3.25 to 3.50 percent for the Federal Funds Rate. Obviously, a lot will depend on the trajectory of inflation going forward, but as things stand it is difficult to see why the Fed will deviate from its hawkish trajectory.

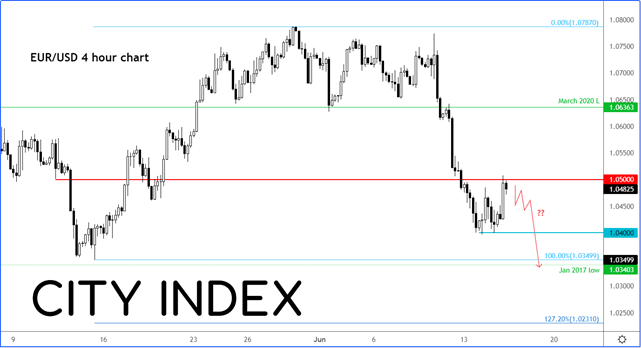

EUR/USD testing key resistance around 1.05 handle

Ahead of the above macro events, the EUR/USD is testing a key resistance area here.

The area around 1.0500 had acted as both support and resistance in the past. But as the ECB was less hawkish last week than expected and given expectations over further sharp rate hikes from the Fed, the EUR/USD has fallen along with everything else in the past few days. It moved below the abovementioned area on Monday, and it is now re-testing it from underneath.

If resistance hold here as I suspect that it might, then I would expect to see a continuation lower to a new multi-year low. Next up on bears’ target is the 2017 low at 1.0340.

One reason why it might not get there is if the ECB announces some anti-fragmentation measure. The other reason could be if the FOMC defies market expectations.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade