EUR/USD Key Points

- US Consumer Inflation Expectations continue to fall, boosting the market-implied odds of a Fed rate cut in March.

- EUR/USD has established a key short-term support level at 1.0875.

- Given the quiet economic calendar, EUR/USD may consolidate with a slight bullish bias over the next couple of days ahead US CPI and PPI.

EUR/USD Fundamental Analysis

After Friday’s NFP- and ISM-induced volatility, forex traders are catching their breath to start the new trading week. The economic calendar is essentially barren, though we did see the latest Survey of Consumer Expectations from the New York Fed this morning.

Mirroring other recent readings on price pressures, consumer expectations for inflation continue to fall, with median 1-year inflation expectations falling to just 3.0%, the lowest level for this reading since January 2021. Meanwhile, 3- and 5-year inflation expectations also dropped to 2.6% and 2.5% respectively.

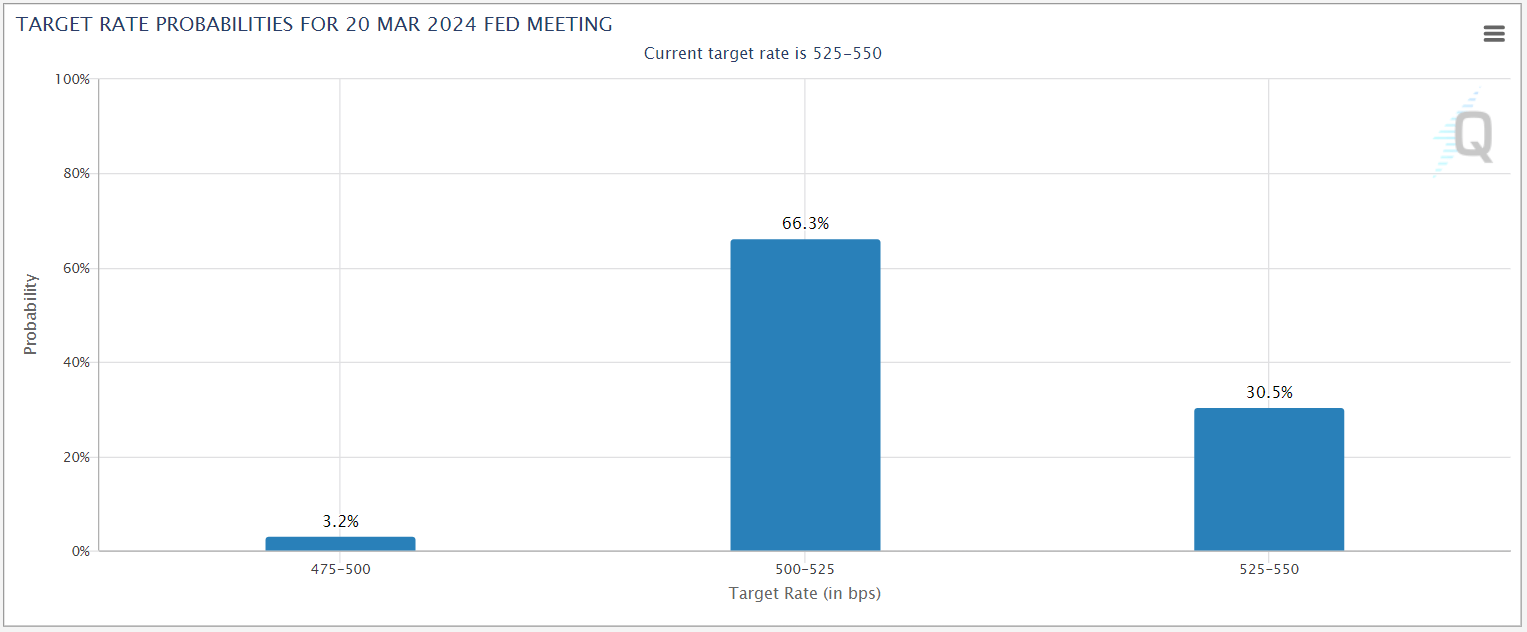

While far from a top-tier release, especially with both the headline CPI and PPI reports scheduled for later this week, this report increases the odds that the Fed will cut interest rates in March at the margin. Not surprisingly, we’ve seen the market-implied odds of a such a move tick up toward 70% in the wake of the release per the CME’s FedWatch tool, though traders still have much to play for heading through the latter half of the week and beyond:

Source: CME FedWatch

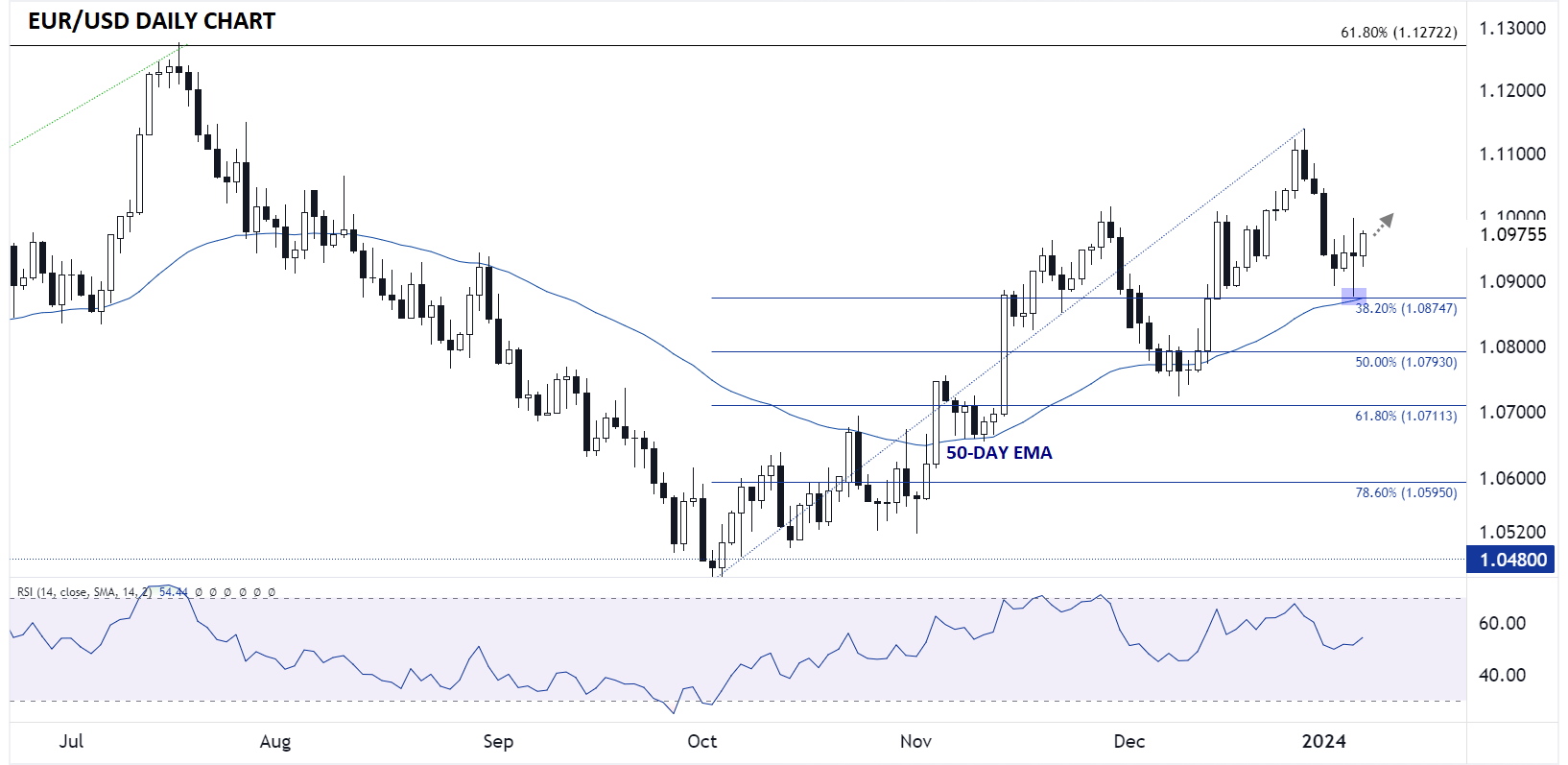

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Keying in on the world’s most widely-traded currency pair, EUR/USD dropped as low as 1.0875 in the aftermath of Friday’s NFP report before recovering to finish the day flat. That low, along with the confluence of the rising 50-day EMA and 38.2% Fibonacci retracement, means 1.0875 will be a key support level to watch this week.

So far this week, EUR/USD is in rally mode, approaching the psychologically-significant 1.1000 level as we got to press. With little in the way of major economic data until the second half of the week, I wouldn’t be surprised to see EUR/USD generally consolidate with a slight bullish bias over the next couple of days before volatility potentially picks up around the release of the US CPI and PPI reports on Thursday and Friday.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX