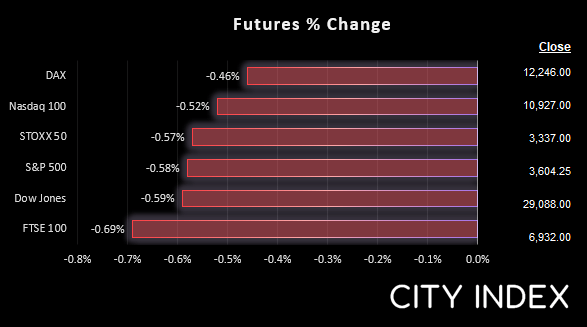

Asian Indices:

- Australia's ASX 200 index fell by -15.2 points (-0.23%) and currently trades at 6,652.60

- Japan's Nikkei 225 index has fallen by -112.5 points (-1.02%) and currently trades at 10,926.97

- Hong Kong's Hang Seng index has fallen by -268.15 points (-1.56%) and currently trades at 16,948.51

- China's A50 Index has risen by 70.81 points (0.56%) and currently trades at 12,658.47

UK and Europe:

- UK's FTSE 100 futures are currently down -49 points (-0.7%), the cash market is currently estimated to open at 6,910.31

- Euro STOXX 50 futures are currently down -20 points (-0.6%), the cash market is currently estimated to open at 3,336.88

- Germany's DAX futures are currently down -60 points (-0.49%), the cash market is currently estimated to open at 12,212.94

US Futures:

- DJI futures are currently down -167 points (-0.57%)

- S&P 500 futures are currently down -55.5 points (-0.51%)

- Nasdaq 100 futures are currently down -20.75 points (-0.57%)

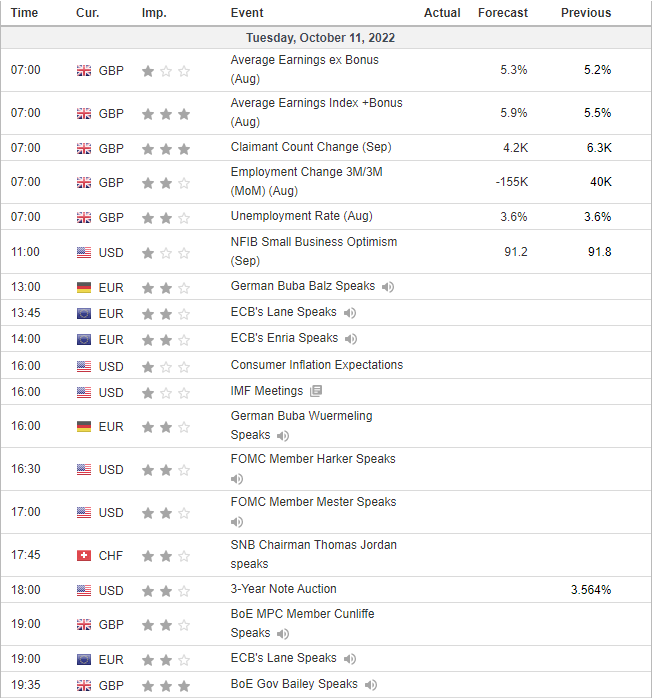

We have a busier calendar today which begins with UK employment and wage data at 07:00 BST. Whilst unemployment is expected to remain at a 48-year low of 3.6%, employment is forecast to fall by -155k. If last month’s +40k print was an early sign that the jobs boom is fading (~120k was expected), then a negative miss today surely confirms the top is in.

There are also several central bank members speaking form the ECB, Fed, BOE and SNB. We all know the Fed is hawkish and markets continue to favour a 4.5% Fed rate by the end of December, but traders are really fishing for whether the Fed will pause or at least scale back their current trajectory. Comments from BOE’s Cunliffe and Bailey at 19:00 and 19:35 warrant a closer look, given the BOE doubled their asset purchase cap to £10 billion and the UK government still lacks credibility given gilt’s (plummeting) prices. SNB Chairman Jordan speaks beforehand at 17:45, but first, ECB’s Lane is up at 13:45 and against at 19:00.

IMF meetings in Washington continue this week, with some members already warning about a global recession. Leading up to the meeting, the IMF openly asked the Fed to scale back their aggressive rate of tightening before something breaks.

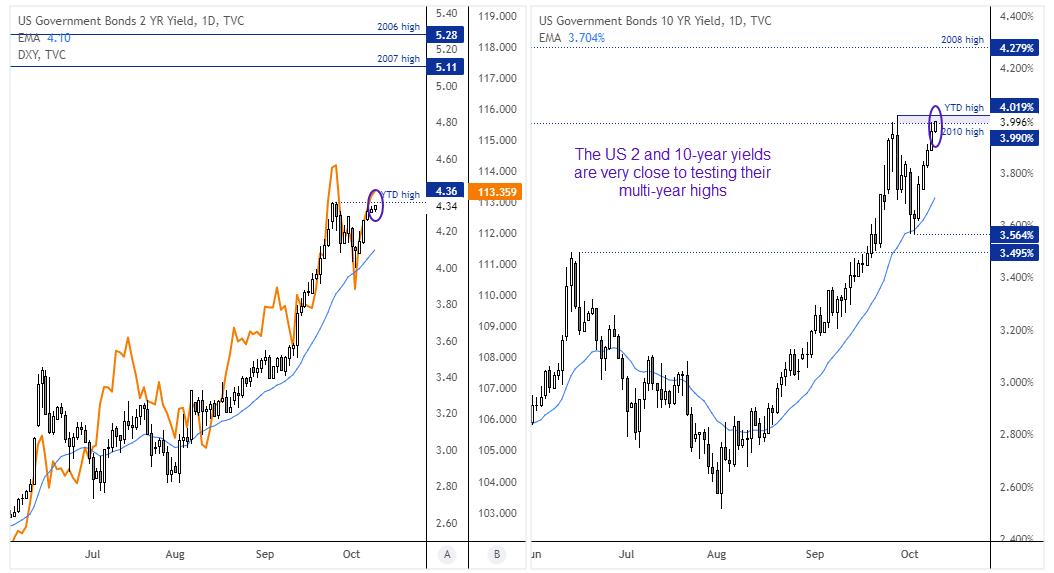

US yields are on the verge of a breakout

We’re keeping a very close eye on US yields as the 2 and 10-year are precariously close to breaking to multi-year highs. It is worth noting that the 20-year yield broke above its YTD high yesterday, and it appears the lower end of the curve may follow suit. And given the US dollar is moving in lockstep with yields, a breakout on yields likely points to further pain for equity and commodity markets, and of course commodity FX.

This means 4% on the US 10-year (or 4.36% on the US 2-year) are pivotal level for markets, and could be the difference between dollar strength and weakness depending on which way momentum moves from current levels.

The US dollar remains firm whilst yields remain high

- AUD/USD has continued lower overnight to a post-pandemic low, having closed below 63c yesterday.

- USD/CNH has risen to a 9-day high and appears set to break above 7.2000 – a daily close above this level would be a post-GFC high.

- USD/CHF has broken back above parity overnight, and trades ~50 pips below its YTD high.

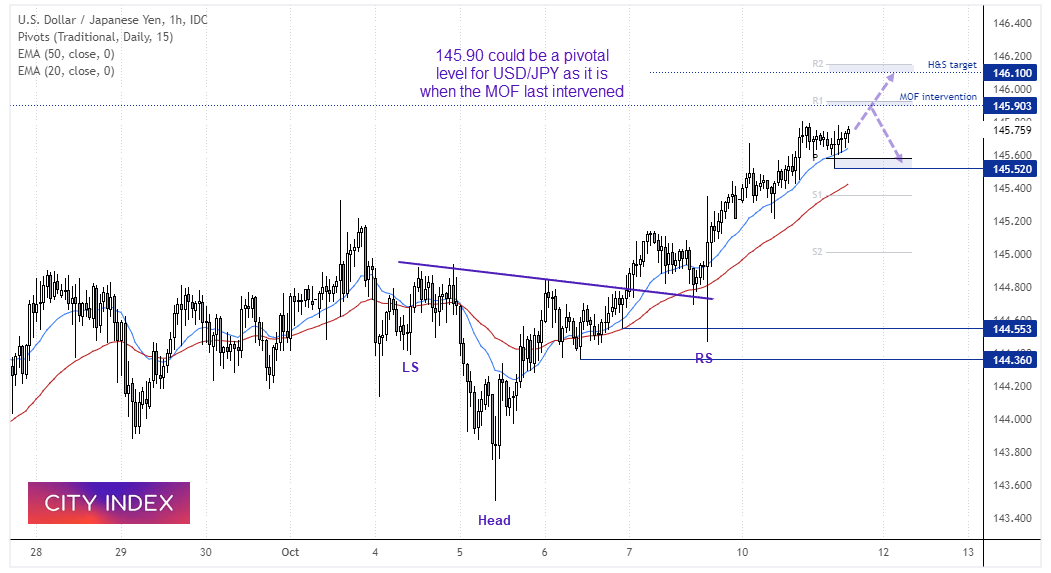

- USD/JPY is trading around 145.73 – just 20 pips beneath the level that the MOF last intervened.

145.90 a key level for USD/JPY

USD/JPY is drifting higher towards our inverted H&S target around 146.10 – and the fact it continues to rise despite an intervention shows how seriously traders took the action from the MOF (Ministry of Finance). However, traders should take note that Japan’s Financial Minister Suzuki has said that they are “watching forex moves with a strong sense of urgency”. Whether they intervene or not remains to be seen, but they last intervened at 145.90 and we’re trading right near that level now, so volatility might be expected at or around that key level.

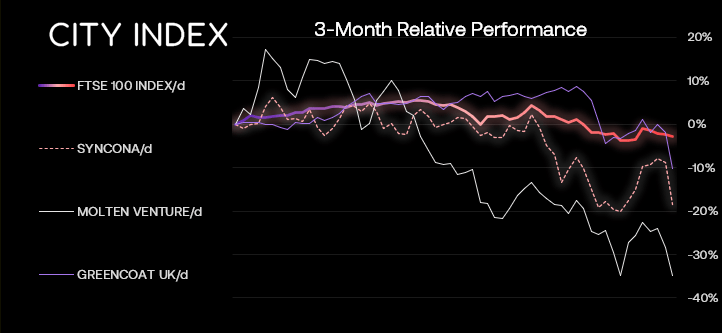

FTSE 350 – Market Internals:

FTSE 350: 3826.63 (-0.45%) 10 October 2022

- 88 (25.14%) stocks advanced and 255 (72.86%) declined

- 3 stocks rose to a new 52-week high, 36 fell to new lows

- 14% of stocks closed above their 200-day average

- 16.86% of stocks closed above their 50-day average

- 2.29% of stocks closed above their 20-day average

Outperformers:

- +12.1% - DS Smith PLC (SMDS.L)

- +7.45% - Moneysupermarket.Com Group PLC (MONY.L)

- +6.72% - Smurfit Kappa Group PLC (SKG.L)

Underperformers:

- -10.46% - Syncona Ltd (SYNCS.L)

- -8.91% - Molten Ventures PLC (GROW.L)

- -8.41% - Greencoat UK Wind PLC (UKWG.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade