Asian Indices:

- Australia's ASX 200 index rose by 24.8 points (0.33%) and currently trades at 7,528.90

- Japan's Nikkei 225 index has fallen by -118.12 points (-0.43%) and currently trades at 27,567.67

- Hong Kong's Hang Seng index has risen by 57.94 points (0.27%) and currently trades at 21,356.64

- China's A50 Index has fallen by -8.66 points (-0.06%) and currently trades at 13,552.74

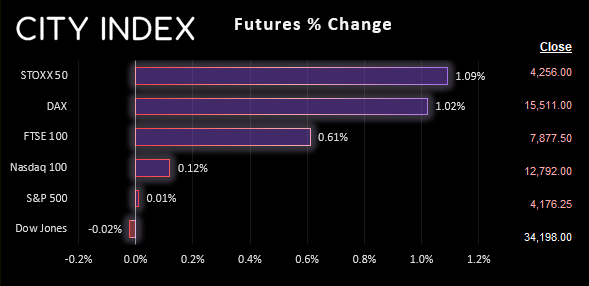

UK and Europe:

- UK's FTSE 100 futures are currently up 47.5 points (0.61%), the cash market is currently estimated to open at 7,912.21

- Euro STOXX 50 futures are currently up 46 points (1.09%), the cash market is currently estimated to open at 4,255.31

- Germany's DAX futures are currently up 156 points (1.02%), the cash market is currently estimated to open at 15,476.88

US Futures:

- DJI futures are currently down -12 points (-0.04%)

- S&P 500 futures are currently up 11.75 points (0.09%)

- Nasdaq 100 futures are currently down 0 points (0%)

Earnings of interest:

US earnings: AMC – Disney (DIS)

* BMO = Before market open, DMH = During market hours, AMC = After market close, TNS = Time not specified

- US-Sino tensions remain strained, with the Pentagon claiming China refused to receive a phone call regarding the alleged spy balloon (after the US shot it down…)

- Without a fresh catalyst to drive risk-appetite, I suspect we’re now in a phase of consolidations and retracements as we head towards US inflation data next week

- This could help the US dollar continue to pullback against its recent rally, but we’re not looking for oversized moves

- It’s not a huge data day either, so traders may want to refer to lower timeframes to seek opportunities and not expect any home runs

- Currency ranges were razor thin overnight, let’s hope that is not the case today in the European or US sessions

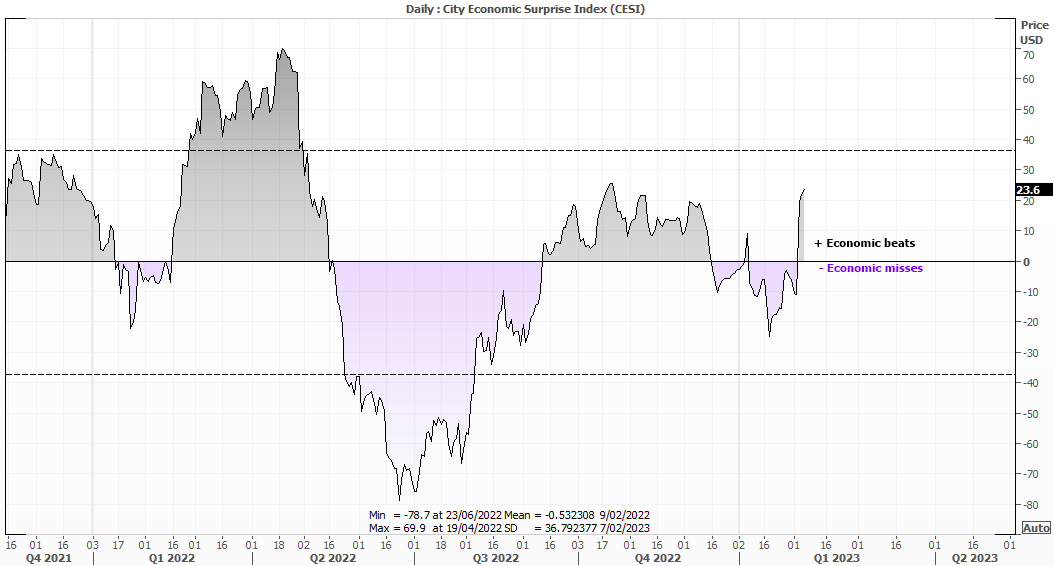

US Economic Surprise Index (CESI) hits a 5-month high

The US CESI has risen notably higher in recent days as economic data outperforms the (relatively grim) consensus. This points towards a soft landing, and likely something equity traders continue to hold onto. But stronger economic data also points towards a more-hawkish Fed as long as employment data continues to outperform. This is not a tradable indicator as such, but something to keep at the back of our minds whilst we get ‘fed’ lots of Fed noise on a daily basis.

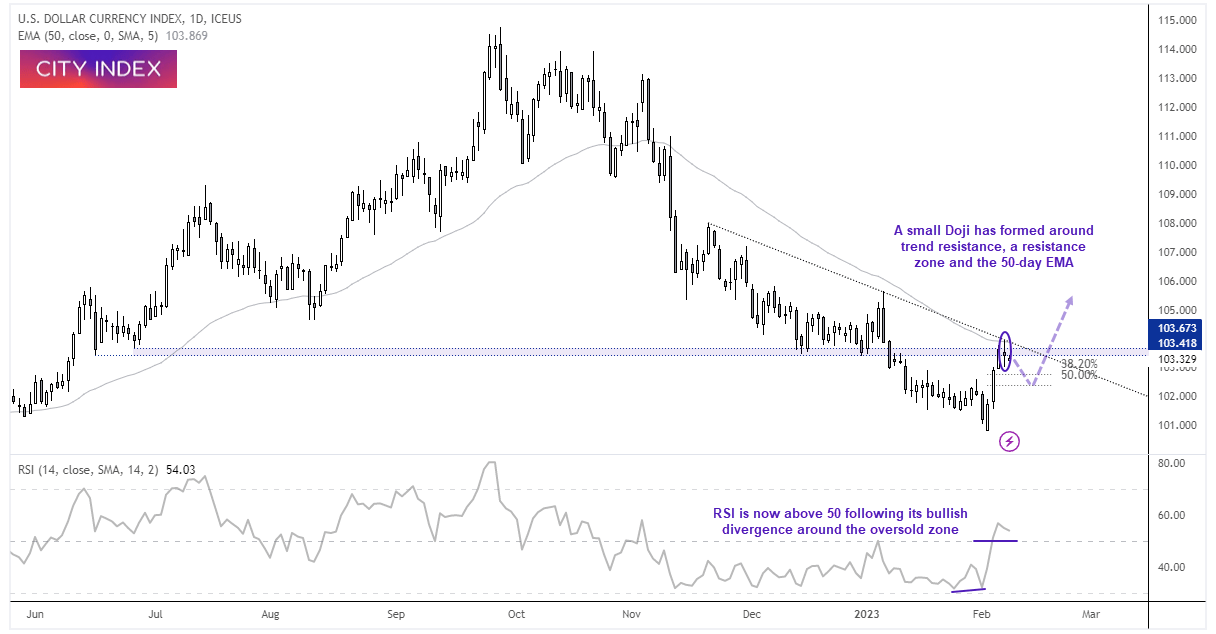

US dollar index daily chart (DXY)

The US dollar index (DXY) posted three solid days of gains between Thursday and Monday. I cannot say I am overly surprised to see A Doji formed yesterday given the resistance cluster around 103.50 which includes a previous support zone, trend resistance and the 50-day EMA. But we also had a change in sentiment for markets yesterday that were eager for a decisively hawkish message from Jerome Powell, which was not delivered. Therefore I suspect the US dollar needs a pullback or period of consolidation before its next leg higher. And I maintain my view that the US dollar remains oversold, and there is more upside on the horizon after its initial pullback is complete.

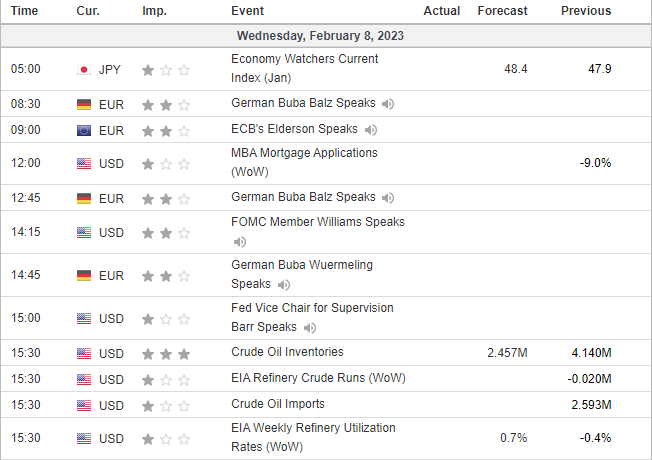

Economic events up next (Times in GMT)