There’s been an interesting reaction in the markets in the aftermath of today’s most stronger US data releases. We saw US government bond yields surged higher in reaction to data showing the US economy continuing to defy expectations, rising 2% on an annualised basis. This sent gold plunging below $1900 support, and the Nasdaq fell, while the Dow outlook improved as banks pushed higher after passing their annual stress tests. Later, as yields pulled back a bit, gold reversed and turned positive on the session and the Nasdaq came off its earlier lows. This kept the overall US stock market rally intact, with investors showing preference to economic growth than worrying about further rate increases.

Today’s data releases were mostly positive, bolstering speculation the Federal Reserve will have room to raise interest rates at least one more time – possibly twice – this year.

- First-quarter GDP was revised sharply higher to 2.0% on annualized basis in the first quarter, up from 1.3% reported initially.

- Jobless claims dropped to a four-week low of 239,000, falling by the most since 2021. Employment indicators still show no sign of a recession. Although jobless claims have risen this year, they remain low on a historical basis.

- But there were some worrying signs about the housing market. After the big upsurge in sales of new homes earlier this week, the same could not be said about pending sales. They fell by a large 2.7% in May, more than 0.5% expected.

The weaker housing data took some shine off an otherwise strong day – and week, even – for US data. Earlier in the week, we saw above-forecast readings on new home sales, consumer confidence, durable goods orders and Richmond Manufacturing Index.

Overall, this week’s data releases point to an economy that is continuing to defy expectations, remaining more resilient than feared. This should keep the doves at the FOMC quiet for another couple of months at least. But the potential for interest rates to remain higher for longer is something that could ultimately haunt investors. But for now, at least, there are no signs of panic.

If anything, the bulls were out in number buying up banks. Shares in Goldman Sachs rose 3% while JPMorgan added 2.8%. Other lenders also gained ground. Technology stocks were a bit lacklustre, but they were coming off their earlier lows at the time of writing.

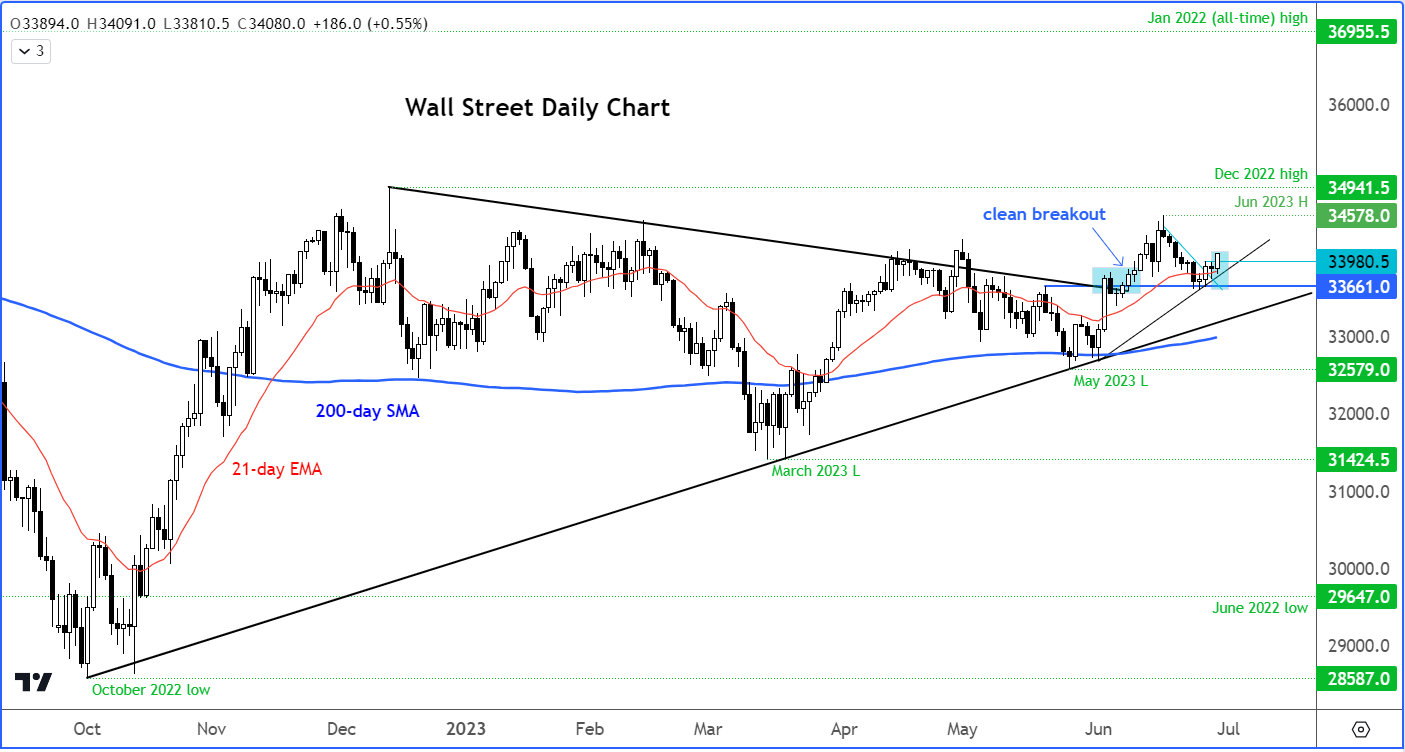

Dow outlook: Technical analysis

There are not many bearish technical indicators on the chart of the Dow to appease the bears. In fact, the index looks quite strong from a technical point of view. The technical outlook on the Dow turned positive earlier this month when it broke above its bearish trend line that had been in place since December. Following that breakout, we saw some upside follow-through until last week’s sell-off. But key support around 33660 held firm earlier this week, and the index has not looked back since. Today, it has broken its short-term bearish trend line and risen back above the 21-day exponential moving average. The bullish trend is therefore re-established. We will thus remain bullish on the Dow until the charts tell us otherwise – for example, if we see an unexpected sell-off later on in today’s session to create a fakeout. The key level that needs to hold now is Wednesday’s high at 33980.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade