- Dollar Analysis: Can Dollar extend rally to 8 weeks?

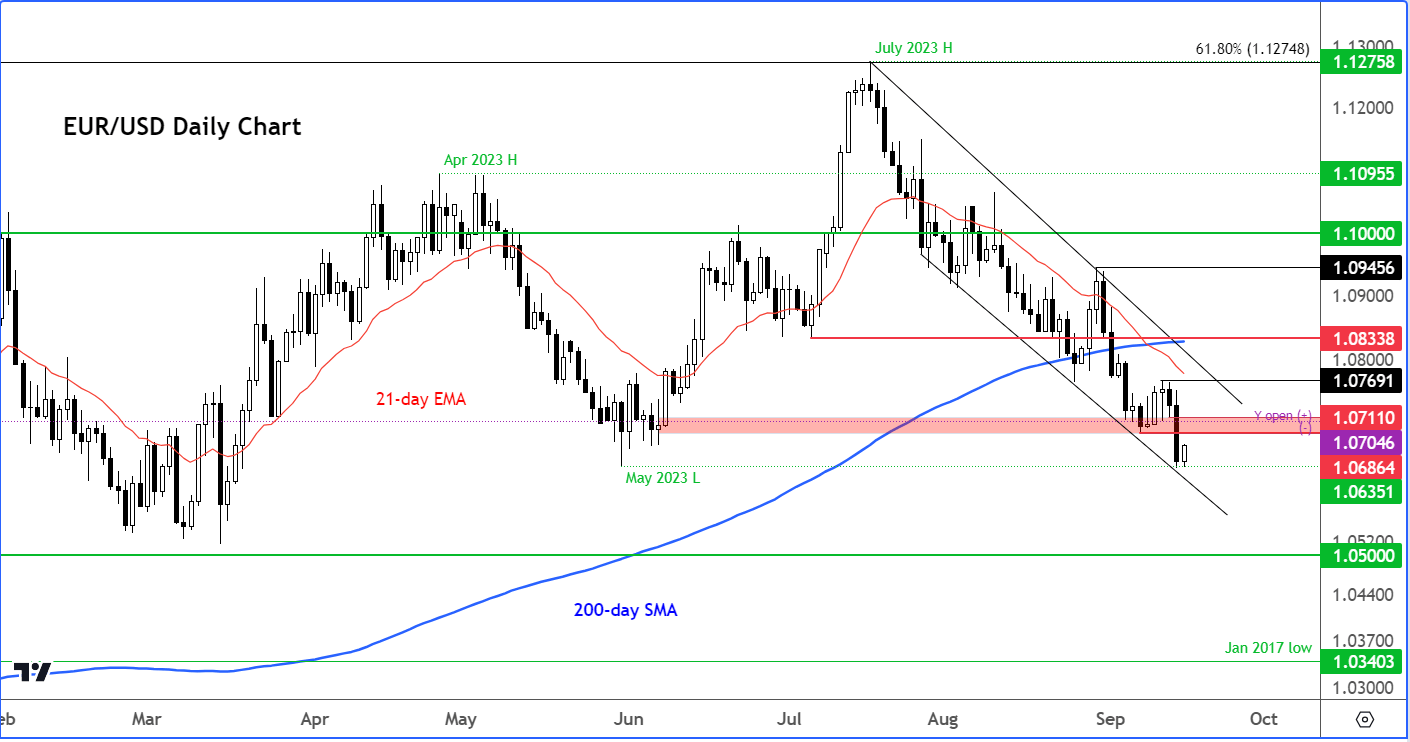

- EUR/USD rebounds after dovish ECB hike but more losses could follow

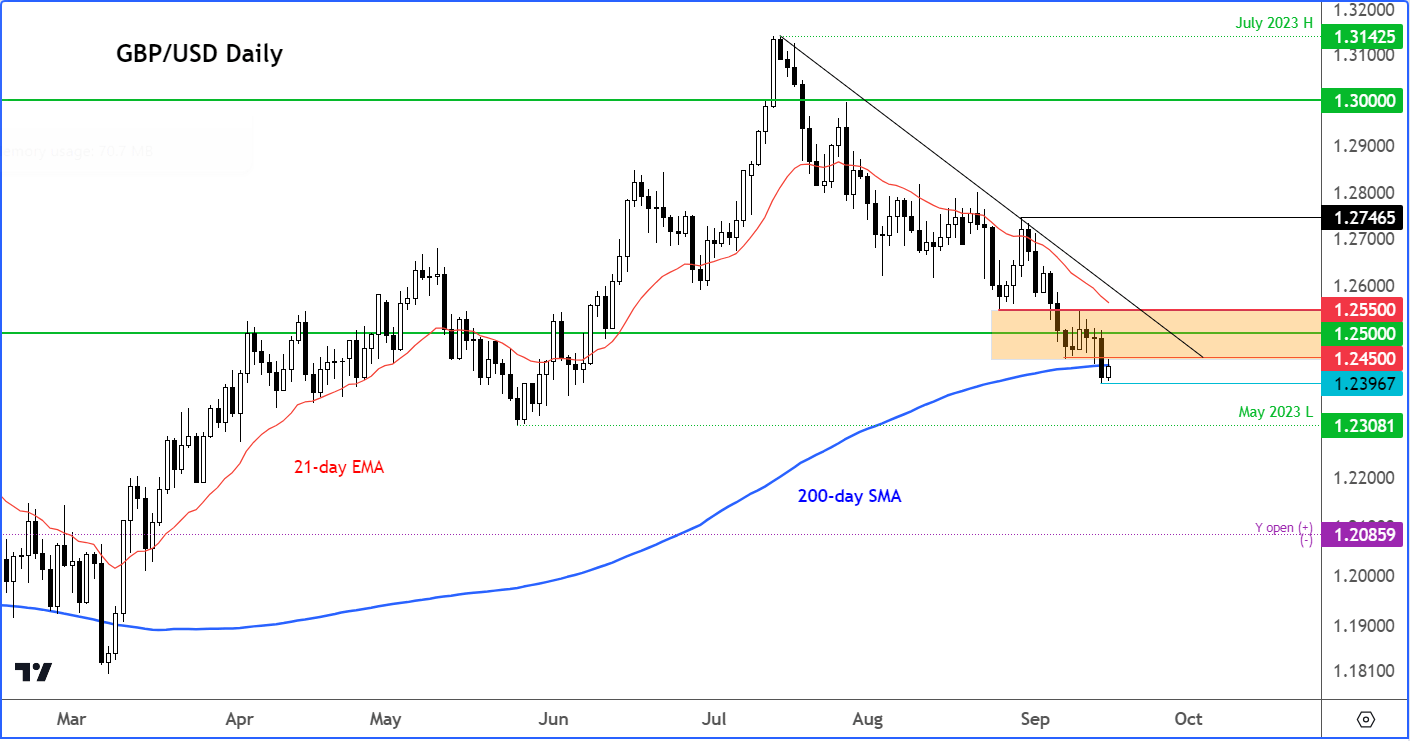

- GBP/USD could be heading towards 1.23 ahead of FOMC and BoE meetings

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week’s report, we will focus the US dollar, EUR/USD and GBP/USD ahead of next week’s key events: FOMC and BoE rate decisions.

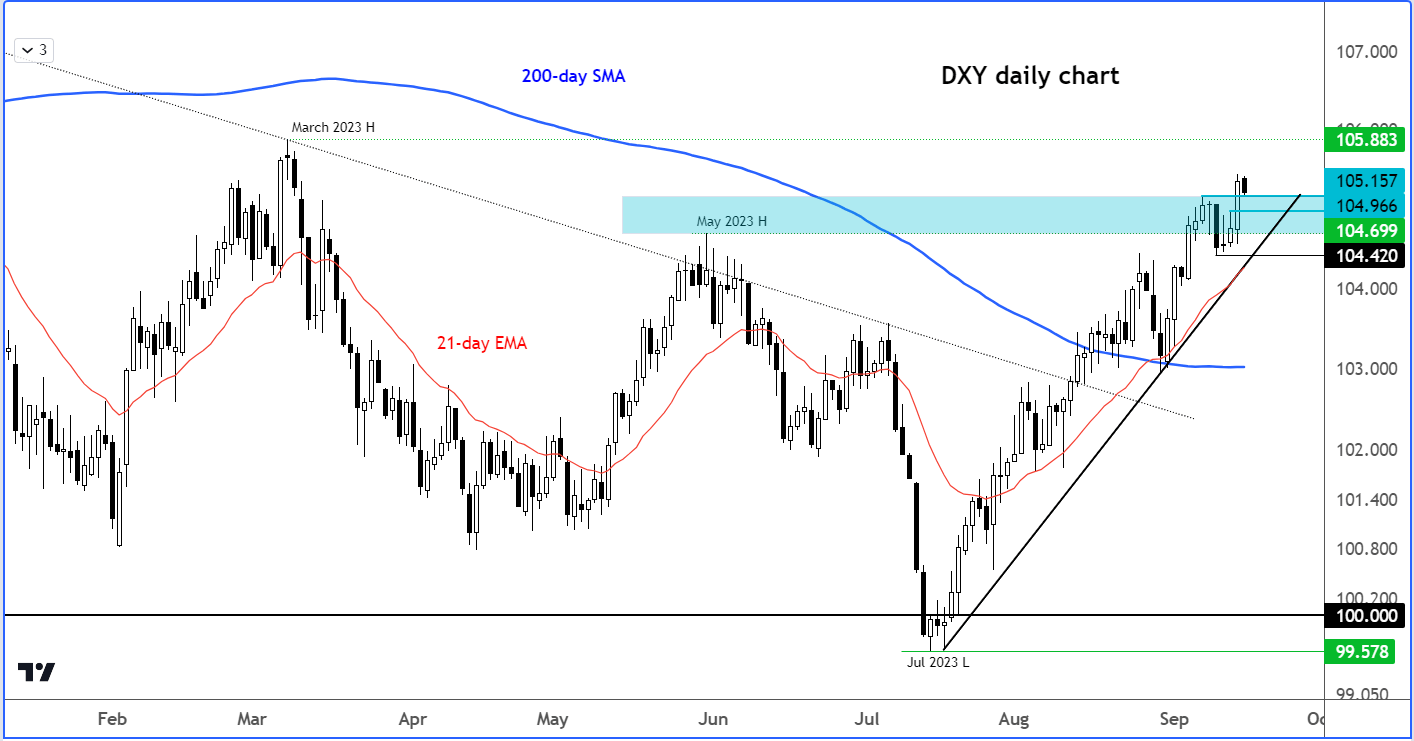

Dollar Analysis: Can Dollar Index extend rally to 8 weeks?

The US dollar took its time this week, but a dovish ECB hike meant the EUR/USD would slump and this would push the Dollar Index (DXY) in the positive territory on the week on Thursday. While the start of Friday saw the DXY pare some of its gains, as the likes of the EUR/USD and GBP/USD bounced back on profit-taking and on the back of surprisingly strong Chinese data overnight, the greenback was still clinging onto its weekly gains.

Will it be able to rise for the 9th consecutive week on a closing basis? I certainly wouldn’t bet against it. For one thing, US data continues to surprise to the upside, which should keep the Fed in a hawkish mode. For another, a growing number of major central banks are either ending or about to end their tightening cycles, owing to weakness in foreign data and clear signs of disinflation around the world.

Focus turns to the Fed

The market will turn its attention towards the FOMC meeting on Wednesday. No interest rate hikes are expected, but the dot plots may indicate one more hike before the year is out – thanks to a slower disinflation process that has undoubtedly been boosted by a stronger US consumer and higher inflation expectations. The FOMC may upwardly revise the 2024 median plot to point to fewer rate cuts than the 100 bps it had projected previously. If so, this would further discourage bearish bets on the dollar, keeping the pressure on the likes of the EUR/USD and GBP/USD.

There are not many key US data pointers to significantly impact the Fed’s thinking until its meeting next week. Today will see the release of UoM’s sentiment indicators, as well as the Empire State Manufacturing Index and industrial production. On Thursday, we saw August retail sales come in better than expected (+0.6% month-on-month), albeit it was boosted largely by fuel sales. PPI was also higher than anticipated and jobless claims fell slightly following last week’s big drop, adding to optimism that a hard landing will be avoided.

Dollar Index technical analysis: DXY prints new higher high

The Dollar Index is now above 105.00 level on a daily closing basis, clearing a key resistance zone that had kept the gains in check for much of this week. The slight weakness for the DXY may well fade as dip buyers potentially now defend the broken resistance circa 105.00 – i.e., the shaded blue area on the chart around 104.70 to 105.15. For as long as support holds here, the path of least resistance would remain to the upside. The March high at 105.88 is now in sight for the bulls.

EUR/USD rebounds after dovish ECB hike but more losses could follow

The EUR/USD outlook remains bearish after the ECB said interest rates are now at ‘sufficiently restrictive levels’ to imply the hiking is now done. Today’s slight recovery in the EUR/USD may well fade, as there are no changes observed in the current data flow. The ECB is clearly worried about the path of growth more than the inflation outlook. While rising oil prices may well keep global inflation elevated, the ECB’s aggressive tightening is clearly impacting demand, as we have witnessed in recent data releases in Germany and the Eurozone. A weakening economy should ensure to bring inflation back down to the target in the medium term, especially when interest rates are now “at sufficiently restrictive levels.”

For weeks, I have been eying a break below the May low of 1.0635 on the EUR/USD. This finally happened after the ECB’s dovish rate hike on Thursday. If the sellers are to remain in control, then they must continue to defend broken support levels. One such area is around 1.0700, which was being tested at the time of writing. Once support, this area could turn into resistance and lead to renewed weakness for the EUR/USD. The EUR/USD bulls meanwhile will need to see a higher high above 1.0770 to signal a possible bullish reversal.

GBP/USD could be heading towards 1.23 ahead of BoE meeting

Not to be left out, the GBP/USD also broke down on Thursday, taking direction from the EUR/USD, before staging a small bounce in this first half of Friday’s session. Weaker data from the UK has also seen investors re-price their Bank of England rate hike expectations lower. Around 75 bps worth of hikes was priced in about a month ago. Now, the markets are expecting around 35 bps until the peak. This means that the BoE could also deliver a final 25bp hike on Thursday of next week, a day after the Fed’s meeting. Ahead of these central bank meetings, the dollar’s ongoing strength is likely to keep the cable under pressure – unless UK CPI comes in significantly stronger on Wednesday morning. So, watch out for renewed weakness in the cable as it tests key resistance here around 1.2450 (give or take a few pips), which was previously support. Like the EUR/USD, the GBP/USD could take out its correspondingly low made in May at 1.2308 next.

Next week’s macro highlights include central bank decisions and global PMIs

The economic calendar is full of key market-moving data next week, so expect lots of volatility in the EUR/USD and other forex pairs. Here are the main ones to keep an eye:

- Canadian CPI (Tuesday)

- US Building Permits and housing starts (Tuesday)

- New Zealand GDP (Thursday)

- UK CPI (Wednesday)

- FOMC policy decision (Wednesday)

- SNB rate decision (Thursday)

- BOE rate decision (Thursday)

- US jobless claims, Philly Fed and existing home sales (Thursday)

- BOJ policy decision (Friday)

- Global PMIs (Friday)

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade