DAX rises as stagnation appears to be ending

- German industrial production rose to a 13-month high

- Eurozone consumer sentiment rose to the highest level in 2-years

- DAX recovers from 20 SMA

The DAX is leading European stocks higher on Monday after upbeat data from the region and ahead of the European Central Bank's rate decision later in the week.

Data from Germany showed that industrial production rose to a 13-month high in February, signaling an end of stagnation in the first quarter.

Industrial output rose by 2.1%, marking its second straight significant monthly rise, confirming that the sector started the year on a firmer note. Following the data, cyclical sectors such as basic resources and industrial goods and services have performed well.

Meanwhile, investor morale in the eurozone also improved for a sixth straight month in April, rising to its highest level in two years. The Sentix index for the eurozone rose to -5.9 in April, up from -10.5 in March, a level that was last seen in February 2022.

The data comes ahead of the ECB's interest rate decision on Thursday and against a backdrop of nervousness surrounding the potential timing of interest rate cuts. The ECB is expected to start cutting interest rates in June; however, robust data in the US has seen investors play down the chances of a June Fed rate cut to just 49%.

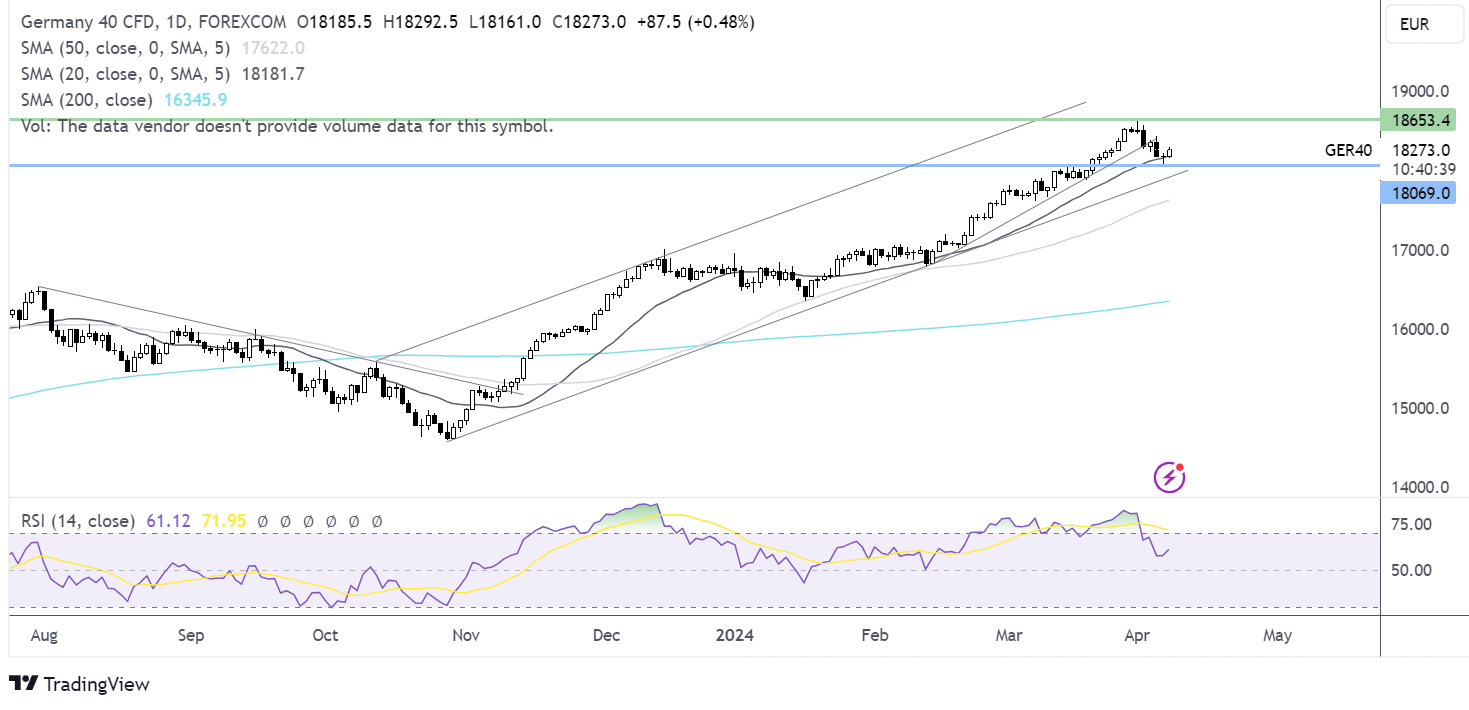

DAX forecast – technical analysis

Despite falling below the 6-week rising trendline and falling to a low of 18085 on Friday, the DAX price managed a close above the 20 SMA at the end of last week. The price remains above the dynamic support as it rises towards 18300. Buyers will look to extend gains towards the 18500 round number ahead of 18650 and fresh all-time highs.

Sellers will look to take out 18085, the April low, to extend losses towards 17900, the lower band of the rising channel dating back to November last year.

GBP/USD struggles amid signs of wage growth easing

- Industry data shows starting salaries grew at the slowest pace in 3 years

- US looks to US inflation data & FOMC minutes

- The GBP/USD trades below multi-month falling trendline

The pound is inching lower against the US dollar after weak pay data from recruiters adds to signs that the UK jobs market is starting to cool.

According to data from the Recruitment and Employment Confederation, starting salaries for permanent staff rose at the slowest pace in three years in March, while spending on temporary workers dropped to its lowest level since July 2020.

The data supports the view that underlying inflationary pressures in the UK economy are easing, which could help inflation reach the Bank of England's 2% target.

Meanwhile, the US dollar is starting the week on the front foot, adding to Friday's gains as treasury yields rise to a four-month high.

A stronger-than-expected US non-farm payroll report, in addition to comments from several Federal Reserve officials who warned of patience when cutting interest rates, has seen the market call into question the chances of a June rate cut.

According to the CME Fed watch, the market is now pricing in a 49% probability of a June rate cut, down from 59% a week ago.

This week's attention will be on US inflation data, which is expected to show that consumer prices ticked higher in March as sticky inflation appears to be a key theme of this cross at the start of the year. Inflation data and the FOMC meeting minutes could provide further clarification on when the Fed could start to cut interest.

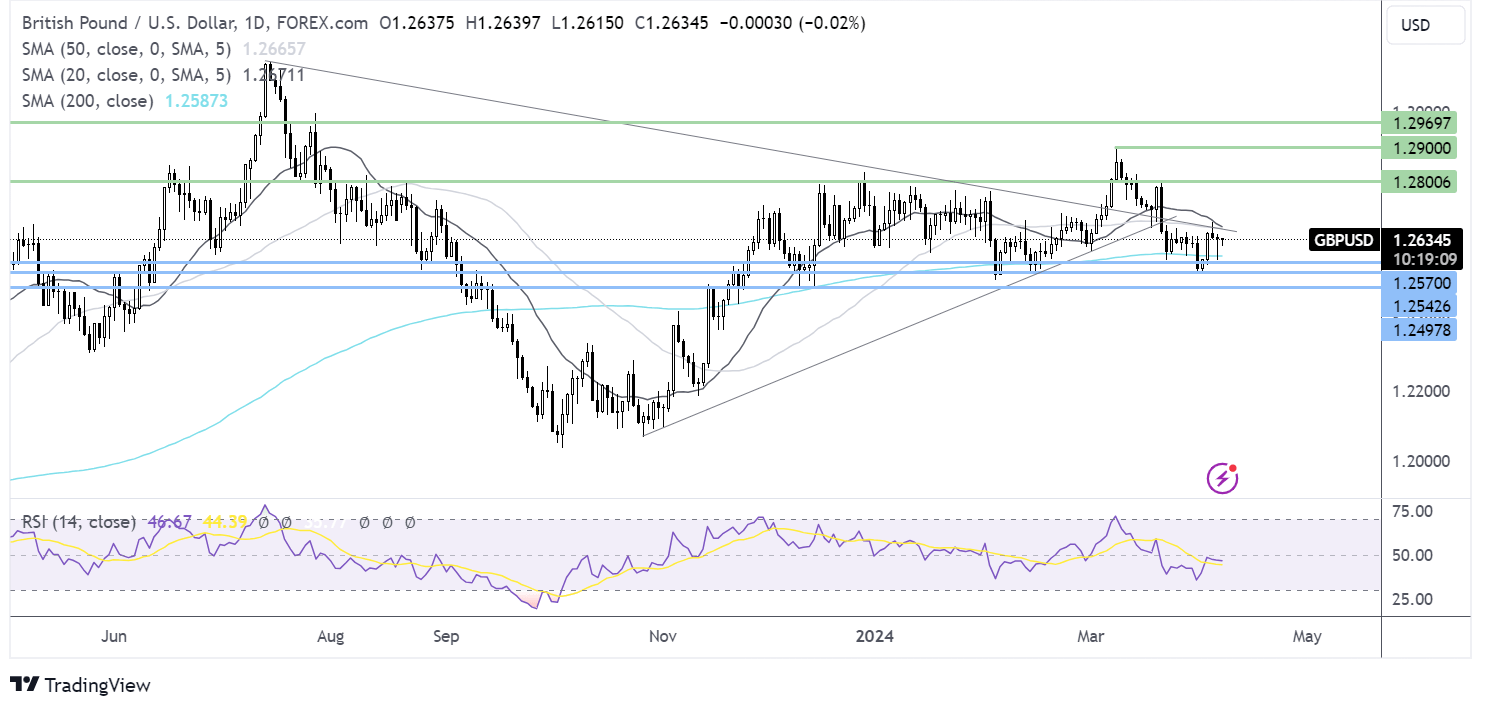

GBP/USD forecast – technical analysis

After spiking higher to 1.2680, GBP/USD hit resistance on the 20 SMA and rebounded lower, remaining below the falling trendline from July last year. However, the long lower wick on Friday’s candle suggests that selling demand at the lower levels was weak.

Sellers would need to take out 1.2590, the 200 SMA at 1.2540, last week’s low, to extend losses towards 1.25.

Meanwhile, buyers will look for a rise above the confluence of the falling trendline and 20 SMA at 1.2670. A surge above here brings 1.28 into play.