GBP/USD Key Points

- Today’s Fed comments reflect an ongoing commitment to patience at the central bank, providing a dollop of support to the US dollar.

- GBP/USD remains rangebound between 1.2500 and 1.2800.

- Short-tern rangebound traders may want to consider sell trades with prices showing signs of rolling over.

GBP/USD Fundamental Analysis

With only the revision to US GDP data from 60-150 days ago on the economic calendar (down a tick to 3.2% annualized), traders shifted their focus to Fedspeak.

Jerome Powell’s cadre of mouthpieces have generally stuck to the proverbial “script” in the wake of the central bank’s late January meeting: The Fed needs to see continued improvement in inflation data before feeling comfortable cutting interest rates to start “normalizing” monetary policy. As the highlighted quotes from the central bank show, that remains the case:

- FED'S COLLINS: MORE TIME IS NEEDED TO DISCERN IF THE ECONOMY IS SUSTAINABLY ON A PATH TO PRICE STABILITY

- FED'S COLLINS: I WANT TO SEE CONTINUED EVIDENCE THAT WAGE GROWTH IS NOT CONTRIBUTING TO INFLATION

- FED'S BOSTIC: THERE IS STILL WORK TO DO ON INFLATION, HAVEN'T DECLARED VICTORY.

- FED'S BOSTIC: I AM COMFORTABLE BEING PATIENT ON POLICY.

- FED’S WILLIAMS: THERE'S STILL SOME WAYS TO GO BEFORE HITTING THE 2% INFLATION TARGET.

- FED’S WILLIAMS: RISKS TO THE OUTLOOK EXIST ON THE UP AND DOWN SIDES.

These comments reflect an ongoing commitment to patience at the central bank, providing a dollop of support to the US dollar, which remains the strongest major currency on the day.

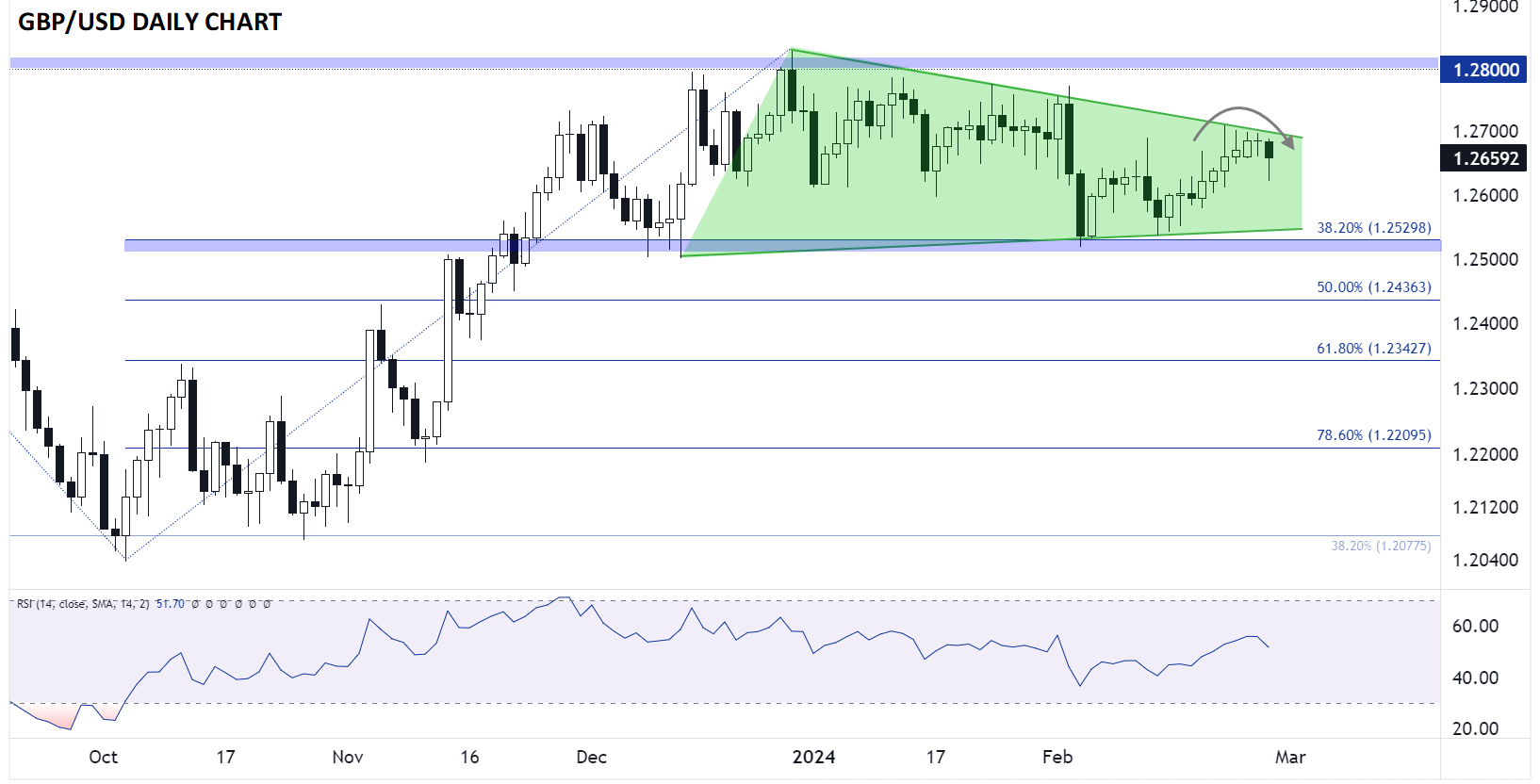

British Pound Technical Analysis: GBP/USD Daily Chart

Source: TradingView, StoneX

Looking at the daily chart above, GBP/USD continues to consolidate in choppy trade. The pair has been contained to the 300-pip range between 1.25 and 1.28 since Thanksgiving, and with rates near the middle of that range as we go to press, no imminent breakout looks likely.

Zooming in, GBP/USD may be rolling over after losing its near-term bullish momentum last week. Traders interested in capitalizing on short-term moves may want to consider sell trades with a stop above last week’s highs targeting a potential drop toward the February lows in the mid-1.2500s. Alternatively, a confirmed break above 1.2710 resistance could lead to a quick continuation toward the year-to-date highs in the 1.2800 range.

Any trading strategy has periods in which it thrives and periods in which it underperforms. As it stands, rangebound trading strategy remain the best way to approach GBP/USD unless/until we see a meaningful breakout from the 3+ month range.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX