US futures

Dow futures -0.08% at 32900

S&P futures -0.11% at 4113

Nasdaq futures -0.23% at 12600

In Europe

FTSE -0.76% at 7531

Dax -1.2% at 14277

Euro Stoxx -1.3% at 3740

Learn more about trading indices

Initial jobless claims rise

After steep losses in the previous session, stocks are pointing to a mildly weaker start on Thursday after worse than expected jobless claims and ahead of tomorrow’s key inflation data.

Inflation fears and concerns over what tighter monetary policy will mean for growth have been hurting risk sentiment over recent sessions. After a surprise outsized hike from the RBA earlier in the week and even the ECB hinting at a 50 basis point rate hike, conditions are set to become much more challenging in the coming months.

US inflation data tomorrow has been the market’s central focus this week, and few are prepared to take a big position ahead of the print. The market needs to see peak inflation has passed to mount a meaningful recovery.

US jobless claims rose by more than expected to 229k, up from 200k and ahead of the 210k forecast. The slight tick higher in claims could be early signs of weakness entering the jobs market, which has so far proved to be resilient.

In corporate news:

Tesla is rising pre-market after UBS upgraded its stance on the EV maker to buy from hold. The bank cited the recent 30% drop in the share price as creating an attractive entry point.

Alibaba falls pre-market after China’s security regulator said it had not conducted an assessment regarding the revival of the ANT group IPO.

Read more about stocks to watch

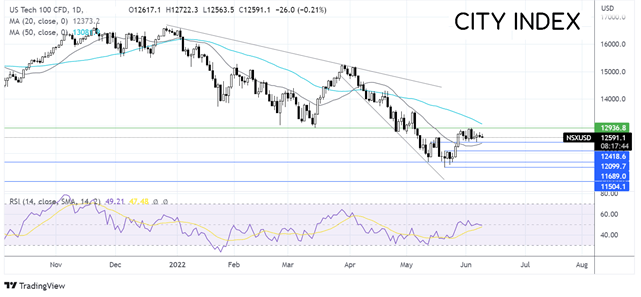

Where next for the Nasdaq?

The Nasdaq is consolidating after rising from the 2022 low of 11490. The price is capped on the upside by 12940, the June high, and on the lower side by 12400, the 20 sma, and the June low. The RSI is neutral, so it provides few clues. Buyers will look for a move over 12940 to approach 13570, the May high. Sellers will look for a move below 12400 to head towards 12060, the May 23 high.

FX markets – USD lowers, EUR

USD is edging lower after strong gains in the previous session, lifted by safe-haven flows amid concerns of slowing global growth. Trade is relatively quiet as investors look ahead to tomorrow’s key inflation data.

EUR/USD is on the rise after the ECB interest rate announcement. As expected, the ECB kept interest rates on hold. However, the central bank signaled that it would hike rates by 25 basis points in July and has kept a 50-basis point rate hike on the table for September.

The 25-basis point hike for June was already priced in. It is the fact that the ECB is willing to consider a 50-basis point hike in September which is pushing the euro higher. A new dove hawk battle has broken out at the ECB. For now, the doves are winning with a 25-basis point hike. However, with oil prices on the rise and peak inflation not expected until Q3, a 50-basis point hike could well gain more support across the summer months.

GBP/USD is falling, extending losses from yesterday after the OECD warned that the UK is set to experience the slowest growth of the G7 nations. The British Chamber of Commerce added to the downbeat outlook saying they forecast a 0.2% contraction in Q4 and 10% inflation.

GBP/USD -0.64% at 1.2560

EUR/USD +0.27% at 1.0733

Oil prices steady after solid gains

Oil prices are holding steady after strong gains overnight. Oil prices found support from encouraging Chins trade data, which showed a jump in both imports and exports. The easing of COVID restrictions has meant that Chinese factories can reopen.

However, a renewed COVID restrictions in Minhang district of Shanghai is reviving the lockdown fears and hurting the demand outlook, capping gains in oil.

Over in the US, peak driving season is keeping the oil prices supported after EIA data showed an unexpected draw in gasoline stocks. The data shows that despite the surge in prices to fill a tank, Americans are still keen to drive.

WTI crude trades +0.03% at $120.34

Brent trades +0.07% at $120.34

Learn more about trading oil here.

Looking ahead

13:30 US initial jobless claims