The USD is on the cusp of flipping to net-long exposure among G10 currencies according to data compiled by IMM (International Monetary Market). And despite the resurgence of US dollar strength, oil continues to perform well and market positioning is looking increasingly bullish for the weeks or even months ahead.

Positioning on the British pound continued to slide on renewed bets that the Bank of England (BOE) are at or near the end of their tightening cycle. EUR/USD bulls continued to scale back their bets and dragged net-long exposure down to a 46-week low. We also saw a large increase on short bets against the Canadian dollar, yet prices have since moved higher and bears may want to reconsider their exposure if Canada’s inflation report comes in hot.

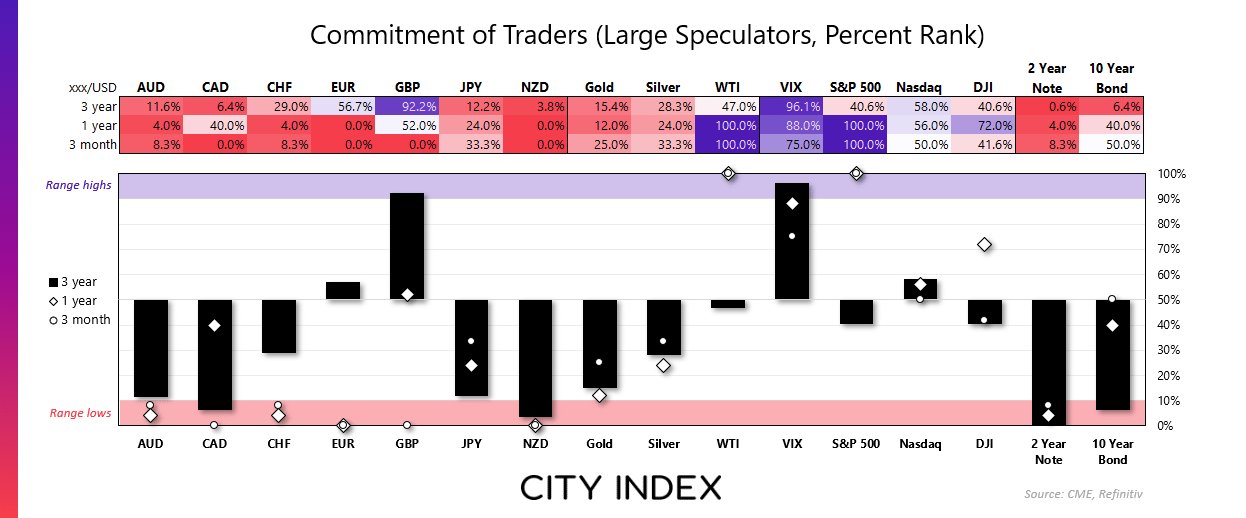

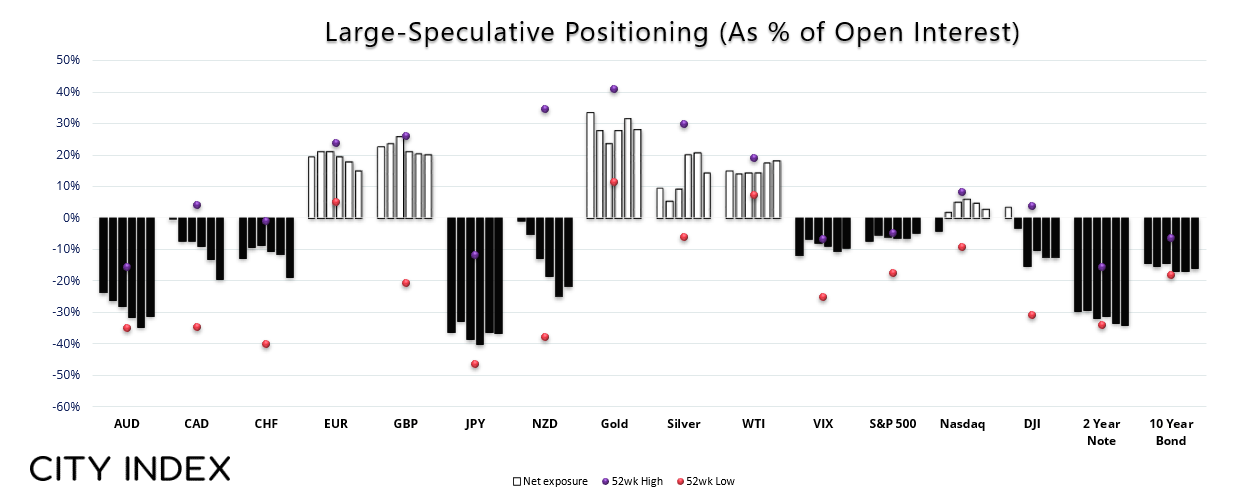

Commitment of traders – as of Tuesday 2023:

- Traders were the least bearish on the US dollar against G10 currencies since November, according to data complied by IMM

- Net-long exposure to EUR/USD futures fell to a 46-week low

- Large speculators increased their gross-long exposure to S&P 500 futures by 13.9%

- Gross-short exposure to gold futures rose 14.4% among large speculators

- Net-short exposure to Canadian dollar futures rose to a 16-week high, and asset managers increased net-short exposure by 20%

- Net-short exposure to AUD/USD futures declined for the first week in five (and exposure remains near a potential sentiment extreme)

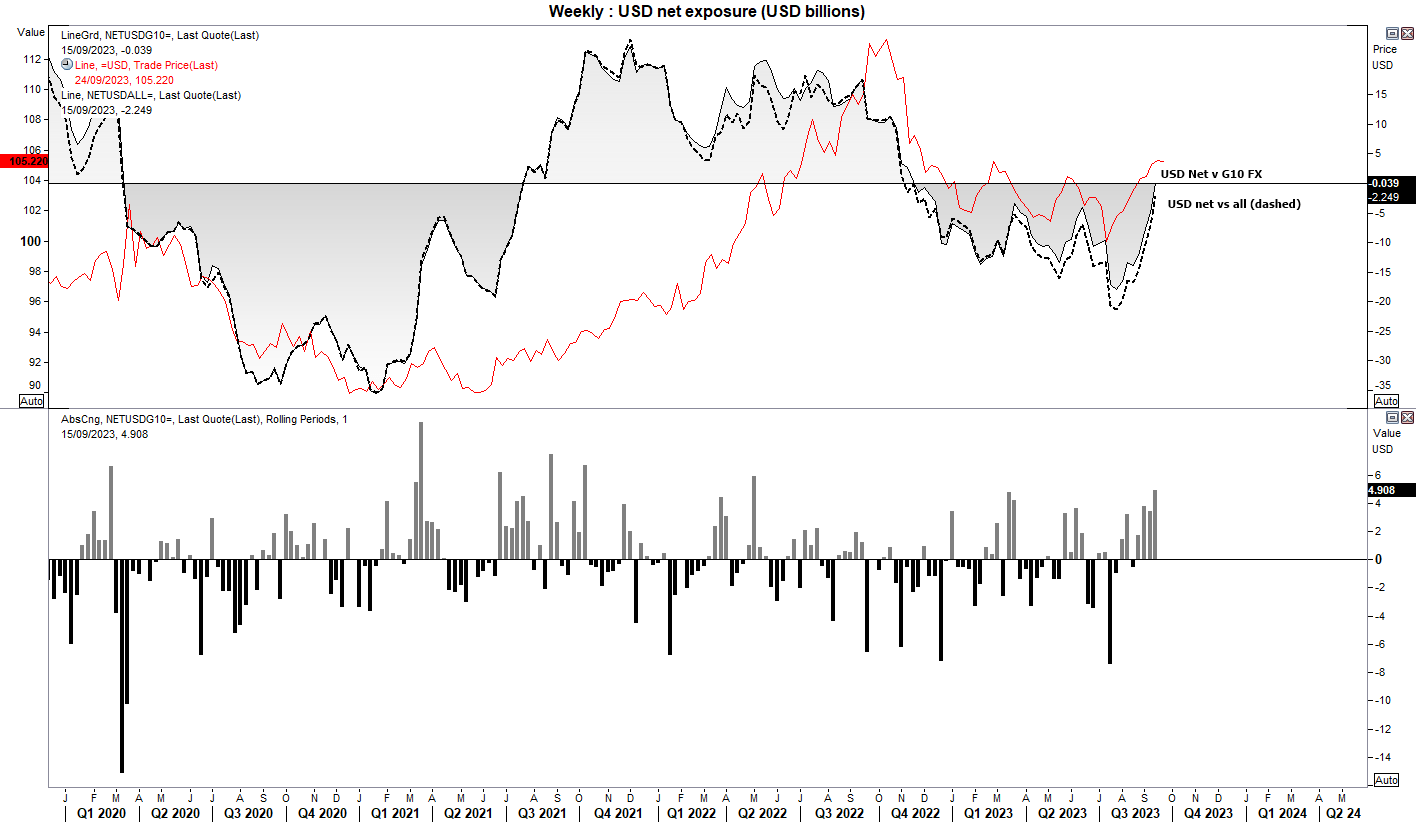

US dollar index futures (DXY) - Commitment of traders (COT):

The chart below shows net-USD exposure against currency baskets. The data is compiled by IMM (International Monetary Market), which I assume shows how the US dollar is positioned among all traders via the CME exchange. We can see that the USD flipped to net-short exposure in November, although short exposure has diminished in recent weeks whilst the US dollar index (red) has rallied from its July low. As of last week, IMM estimate that traders were on the cup of flipping to net-short exposure against G10 currencies, at just -$0.039 billion. If anything, I am surprised it has not flipped to net-long exposure already.

And assuming the US dollar retains or extends its strength, it could make for a challenging environment for risk assets as we head into the new year. With that said, the US dollar index has rallied for nine consecutive weeks, which is its most bullish sequence since September 2014. And with its rally pausing for breath less than 1% from its YTD high, I wonder if it is at least due a pullback over the near-term before its next leg higher. But with an FOMC meeting on the horizon and the potential for another hawkish hold, I see no immediate case to be overly short the US dollar – even4 if caution may be required for longs at these highs.

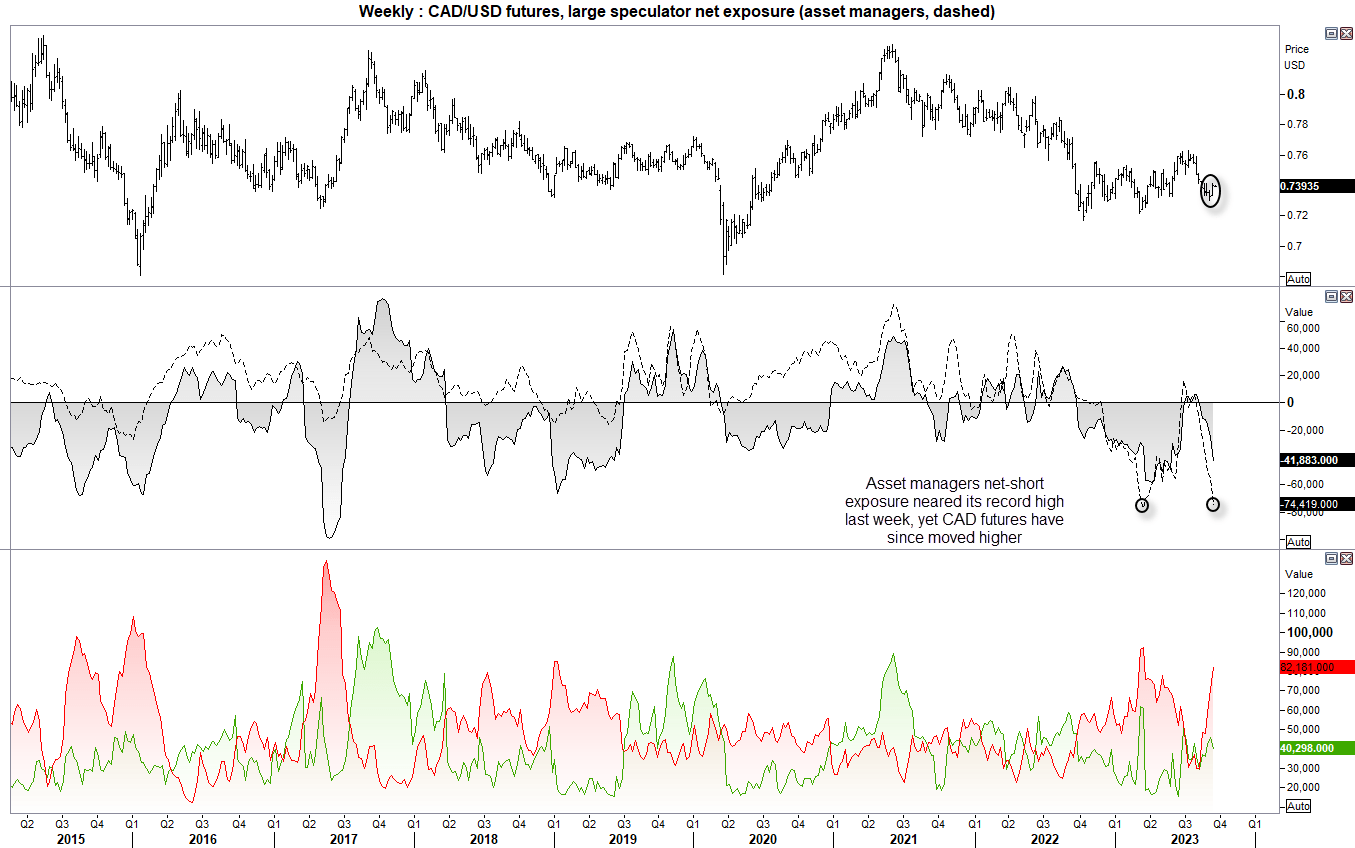

Canadian dollar futures (CAD/USD) - Commitment of traders (COT):

Positioning on CAD futures may have reached a sentiment extreme among asset managers, with net-short exposure nearing a record high by last Tuesday. Bets that the Bank of Canada (BOC) had reached their terminal rate has weighed on the Canadian dollar, yet the strong performance of oil prices and potential for an inflation surprise this week might see some of those bears reconsider their short exposure. IN fact, we can see that CAD futures rose into the back of last week, which suggests some of them may have already been shaken out of their short bets. And if inflation data comes in hot, bets may be bac on for another BOC hike and weigh on USD/CAD.

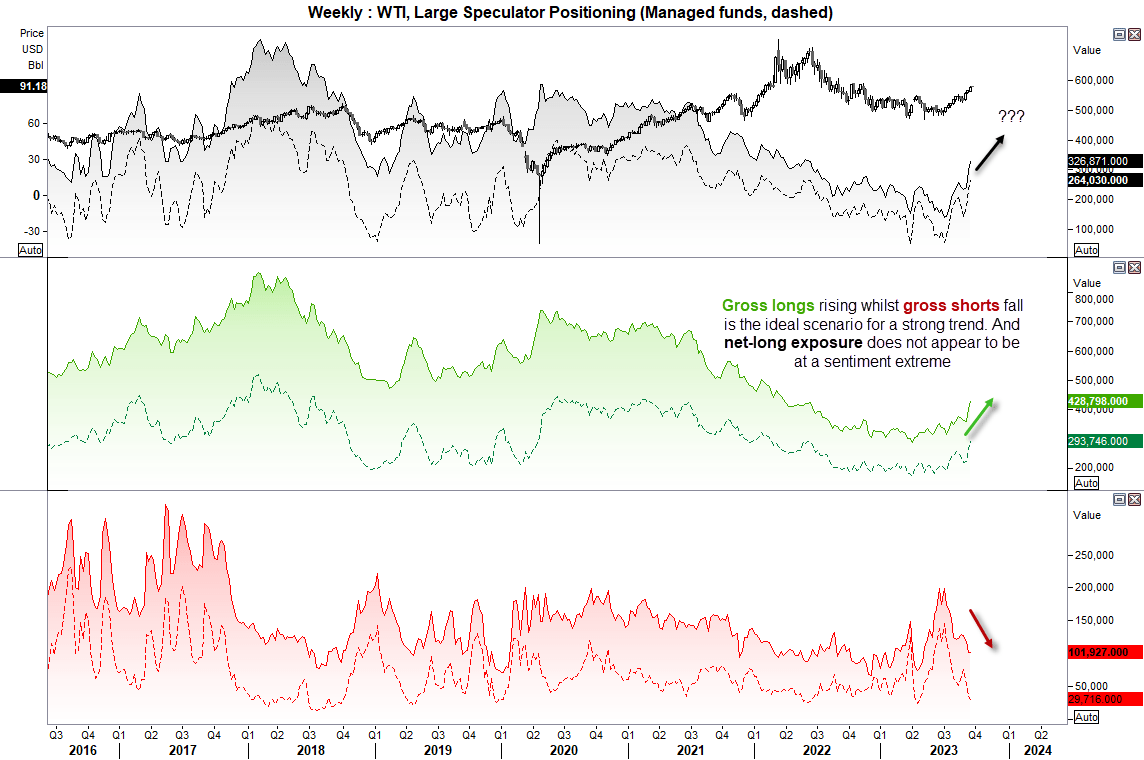

WTI Crude oil future (CL) - Commitment of traders (COT):

Oil prices continue to go from strength to strength, with OPEC+ more than happy to support prices and help WTI crude oil close above $90 last week for the first time this year. Large speculators and asset managers have been decreasing their short exposure and adding to their longs in recent weeks, which is the ideal scenario for a strong trend to develop. And neither set of traders appear to be at sentiment extreme looking at net-long exposure or gross longs. And WTI could even be above $100 were it not for the stronger US dollar, but it seems to be a matter of time looking at the increasingly bullish positioning on this chart.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade