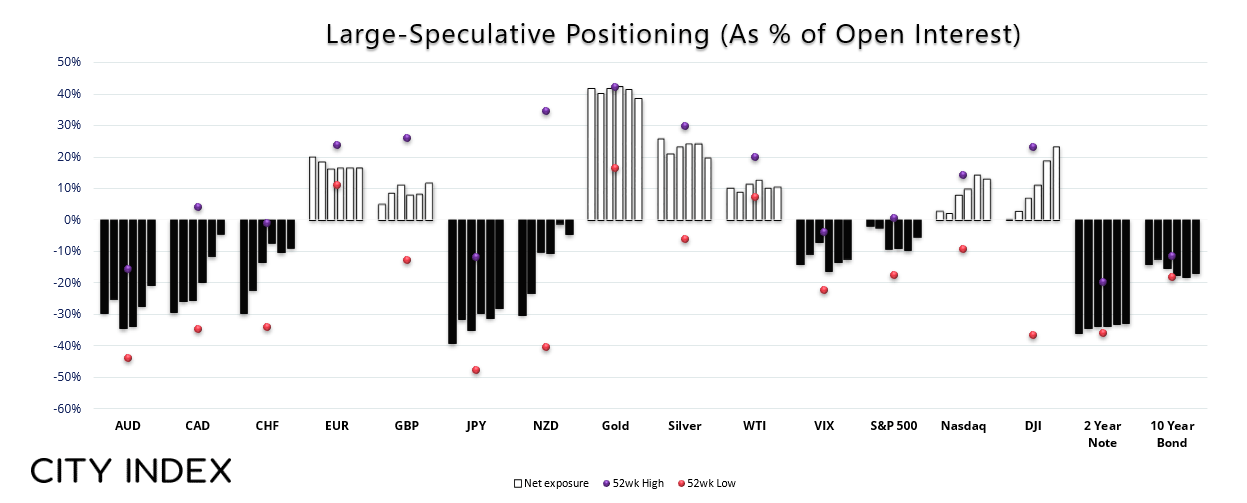

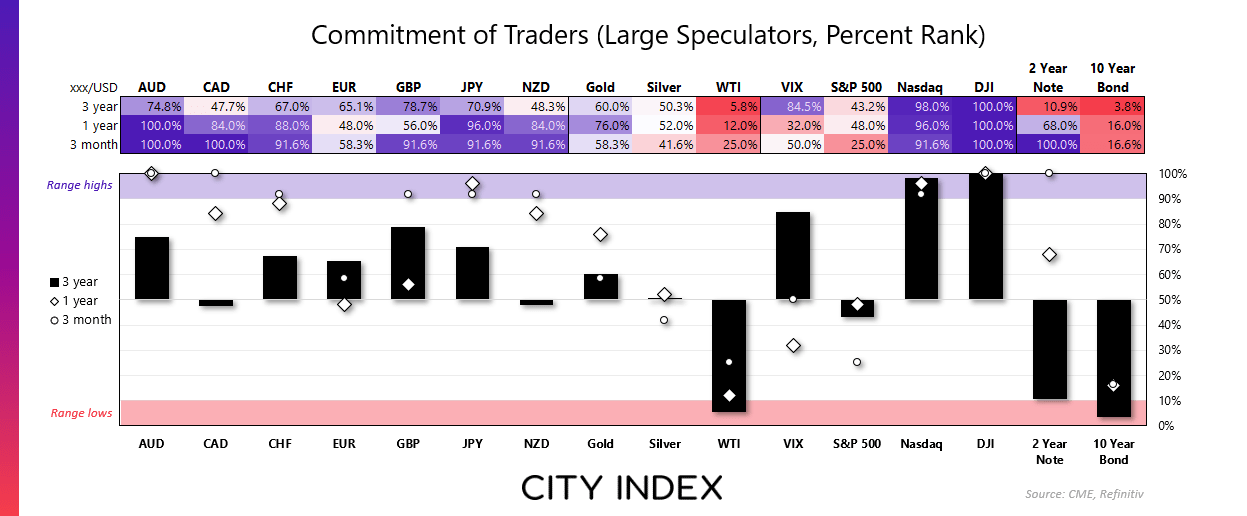

Market positioning from the COT report - as of Tuesday 2023:

- Traders were net-short the US dollar against all currencies by the most bearish amount since August, according to IMM

- Large speculators are their least bearish on AUD/USD futures since April

- Net-short exposure to the 2-year bond bill fell to a 15-week low

- Gross-short exposure to GBP/USD futures fell to a 20-week low

- Large speculators were their least bearish on JPY/USD futures in nine months

- Net-short exposure to CAD/USD futures fell for a third week and large specs are their least bearish in 22 weeks

- Large speculators flipped to net-short exposure to copper futures

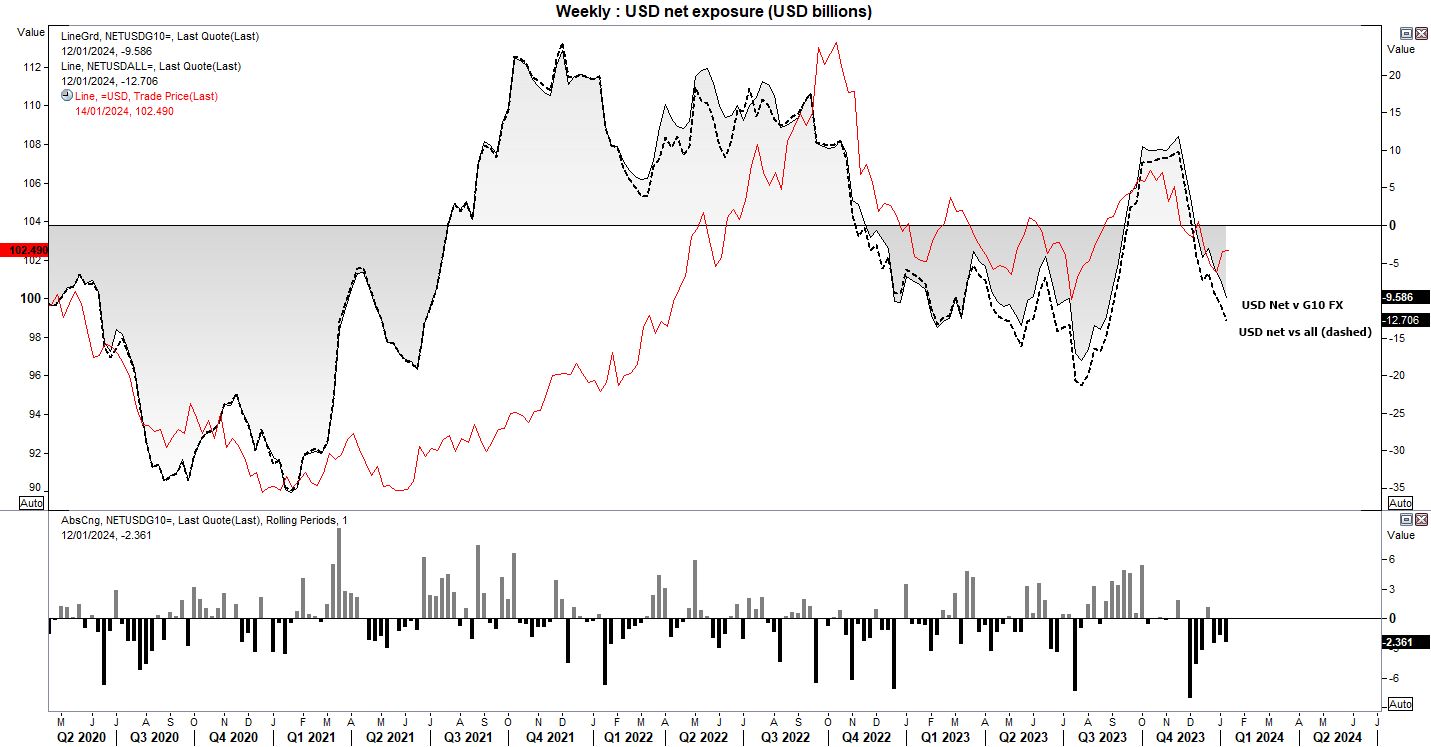

US dollar positioning – COT report:

Traders continue to express a bearish view on the US dollar despite the Fed’s attempt to push back against multiple rate cut expectations this year. According to data compiled by IMM, traders were net-short the US dollar against all currencies by their most bearish amount since August, and the most bearish against G10 currencies since September. For now, the US dollar index continues to trade in a very tight range and above its December low. Yet I continue to suspect there is some upside potential for the dollar when market reprice Fed cut expectations lower.

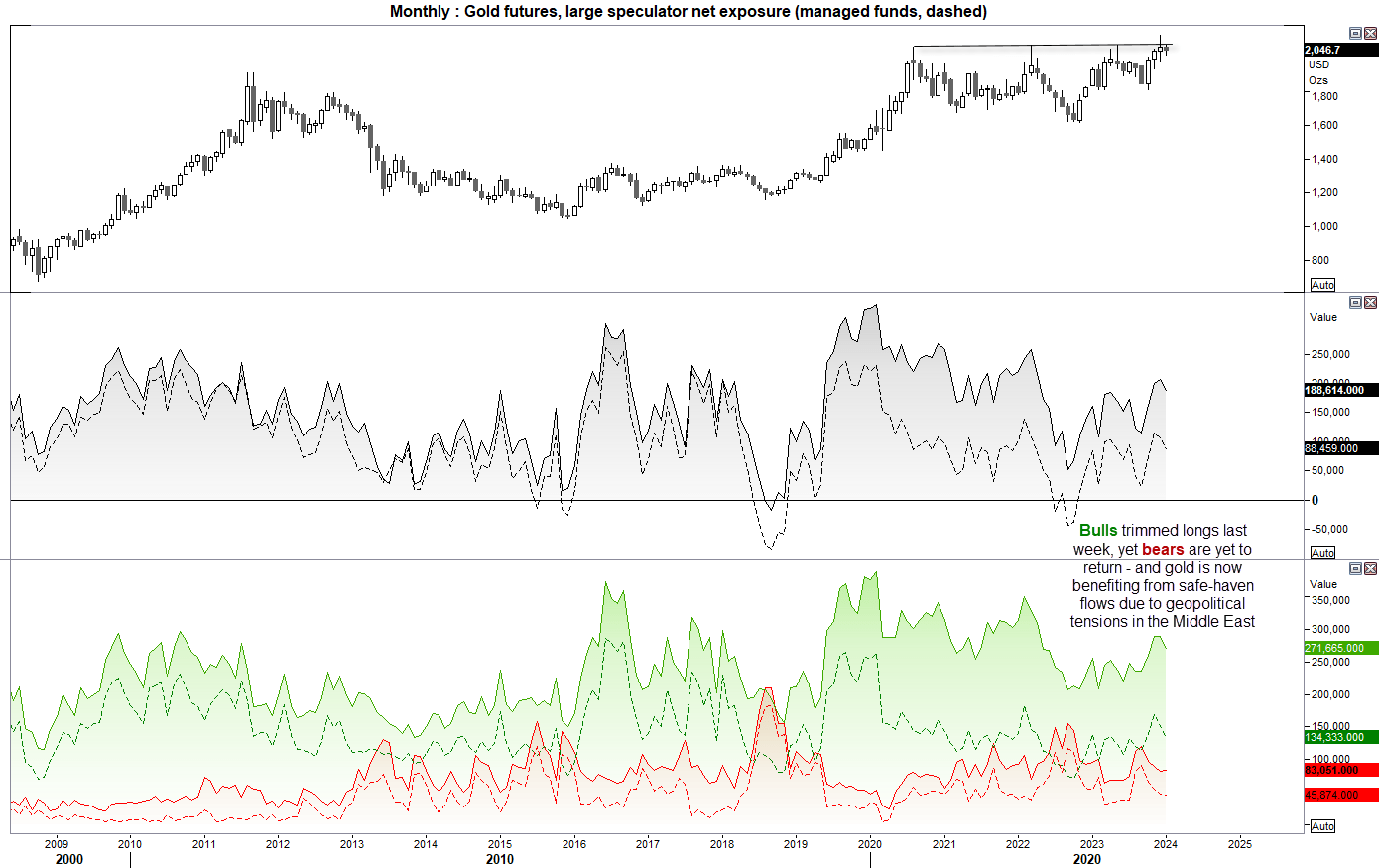

Gold futures (GC) positioning – COT report:

Managed funds and large speculators reduced their long exposure to gold futures last week, at the fastest pace since February. Short exposure also ticked higher slightly higher, which should serve as a cautionary tale for bulls following gold’s false break to a record high. With that said, gold is back in demand due to safe-haven flows due to the rising geopolitical tensions in the Middle East. And with bears seemingly not taking new bets on gold, perhaps it can make another dash for $2100 after all.

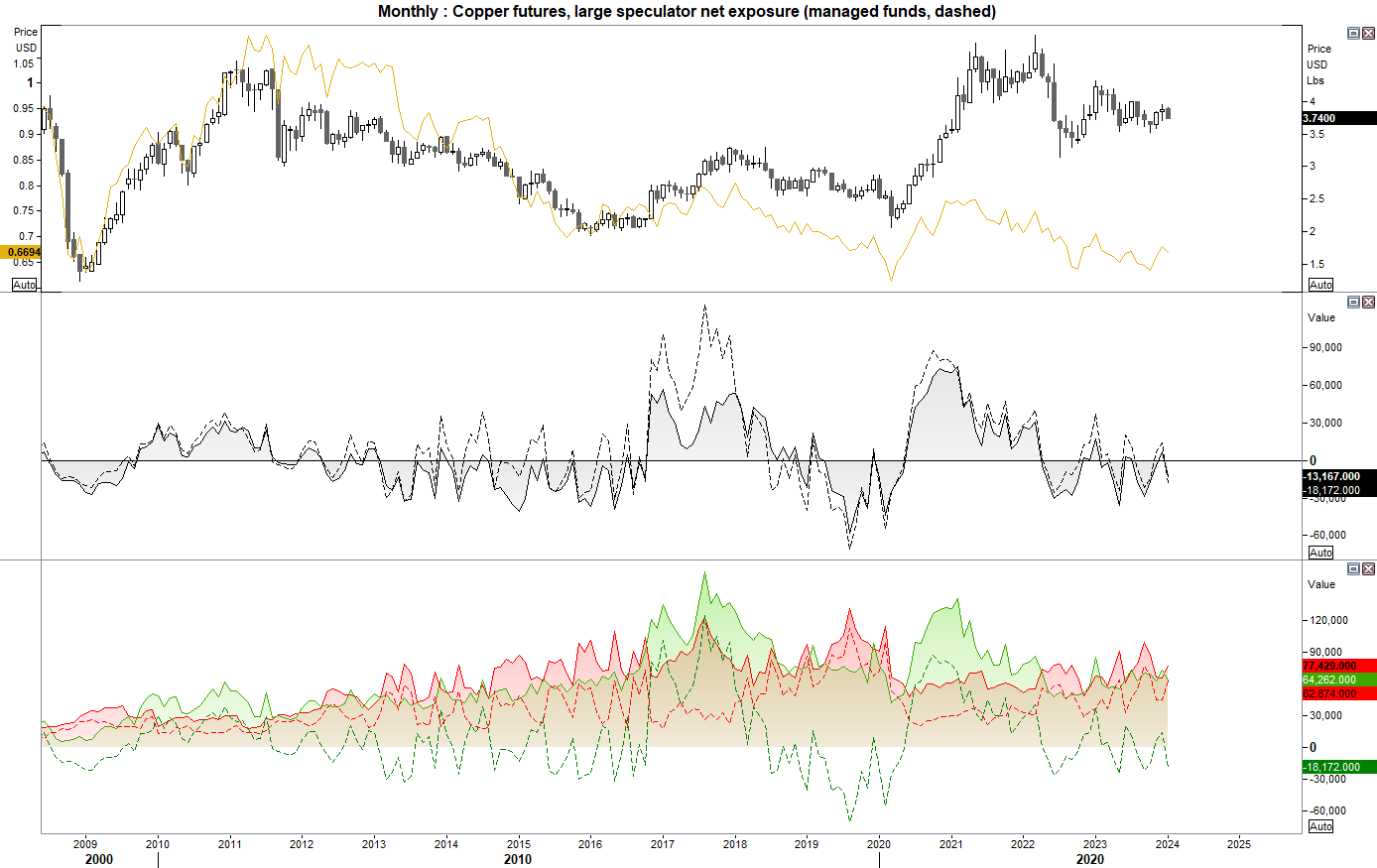

Copper futures (HG) positioning – COT report:

Large speculators and managed funds flipped back to net-short exposure to copper futures after a brief spell at being net long. Longs were trimmed at their fastest pace since August and shorts were increased at their fastest pace since October. Futures traders do not seem to have a rosy outlook for the global economy, and that is one of the key reasons I suspect that the Australian dollar’s upside could be capped.

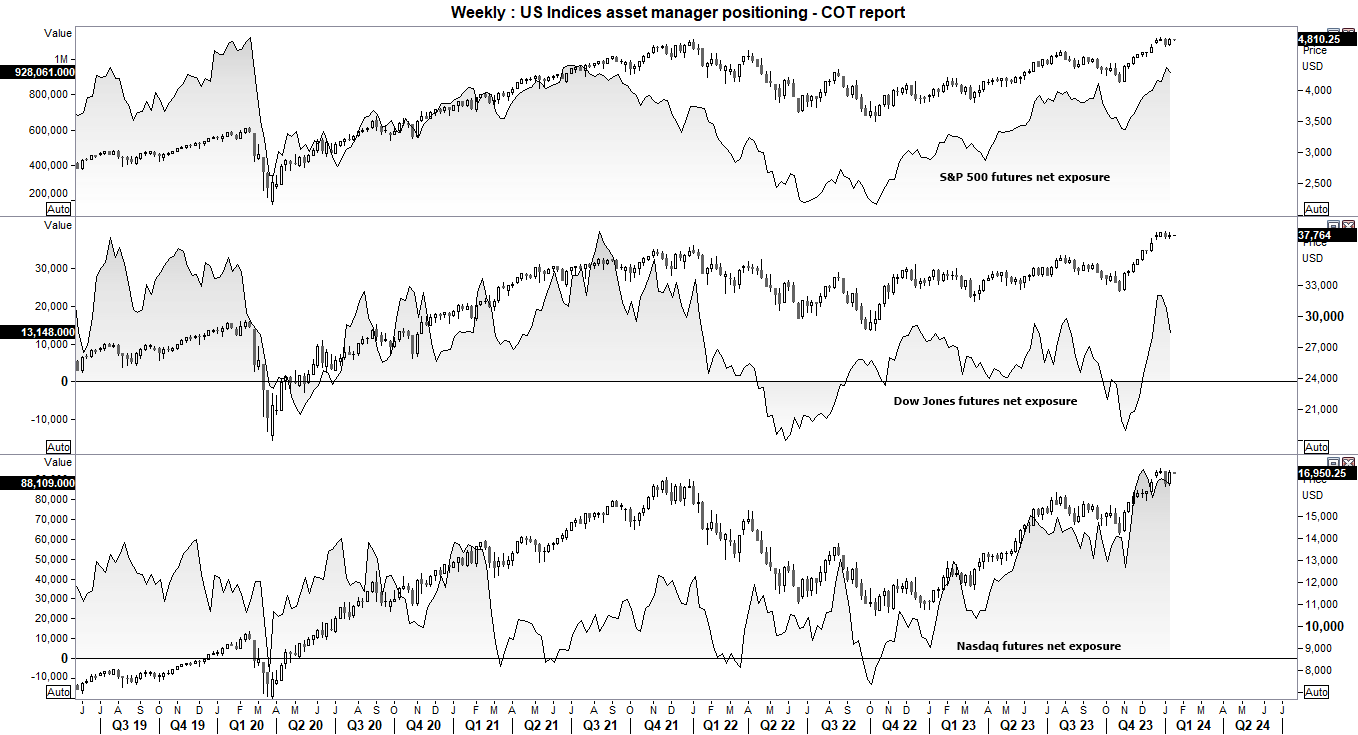

S&P 500, Nasdaq 100, Dow Jones futures positioning – COT report:

Equity traders remain defiantly bullish on US indices, although managed funds appear to have changed their tune in respect to the Dow Jones. Shorts were added and longs were closed last week, to bring net-long exposure to its least bullish level in four weeks. Yet prices are yet to follow the change in sentiment, and all three US indices trade within tight consolidations just off of their cycle highs. If yields continue to fall and bets remain in place of five or more Fed cuts, perhaps we’ll see indices break higher. Yet I remain sceptical that the Fed will cut so aggressively, and if or when markets realise this then it leaves indices vulnerable to a pullback.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade