Sticky wages growth is one of the few positives for the British pound right now, keeping the Bank of England (BOE) sufficiently concerned enough to contemplate continuing hiking rates given the strong linkages with services inflation.

UK wages data key for near-term GBP/USD moves.

With an update on the wages front arriving later Tuesday with employment data for July, it’s an opportune time to look at recent wage trends, especially with GBP/USD sitting at an interesting juncture on the charts.

A month ago in June, the UK Office for National Statistics (ONS) reported wages ex bonuses soared 7.8% from a year earlier, the highest level ever reported dating back to when the series was first published in 2001. The increase exceeded the 7.4% increase expected and came despite a surprise rise in the UK unemployment rate to 4.2% as the employed labour force shrunk by 109,000 in the preceding three-month period.

Looking ahead to later today, momentum in wages is tipped to moderate with economists forecasting an increase of 7.6% over the year with unemployment ticking up by a further tenth to 4.3%. Adding to the importance of the data, markets will also receive speeches from BOE monetary policy committee (MPC) members Catherine Mann and Chief Economist Huw Pill, providing a real-time assessment that may alter the view from economists and markets that the BoE will hike its bank rate later this month to 5.5%.

Data weakness may prompt accelerated GBP/USD selloff

With financial markets putting the odds of another increase at around 80%, any new information that suggests wages growth and labour demand is cooling faster than anticipated could place the British pound under renewed selling pressure.

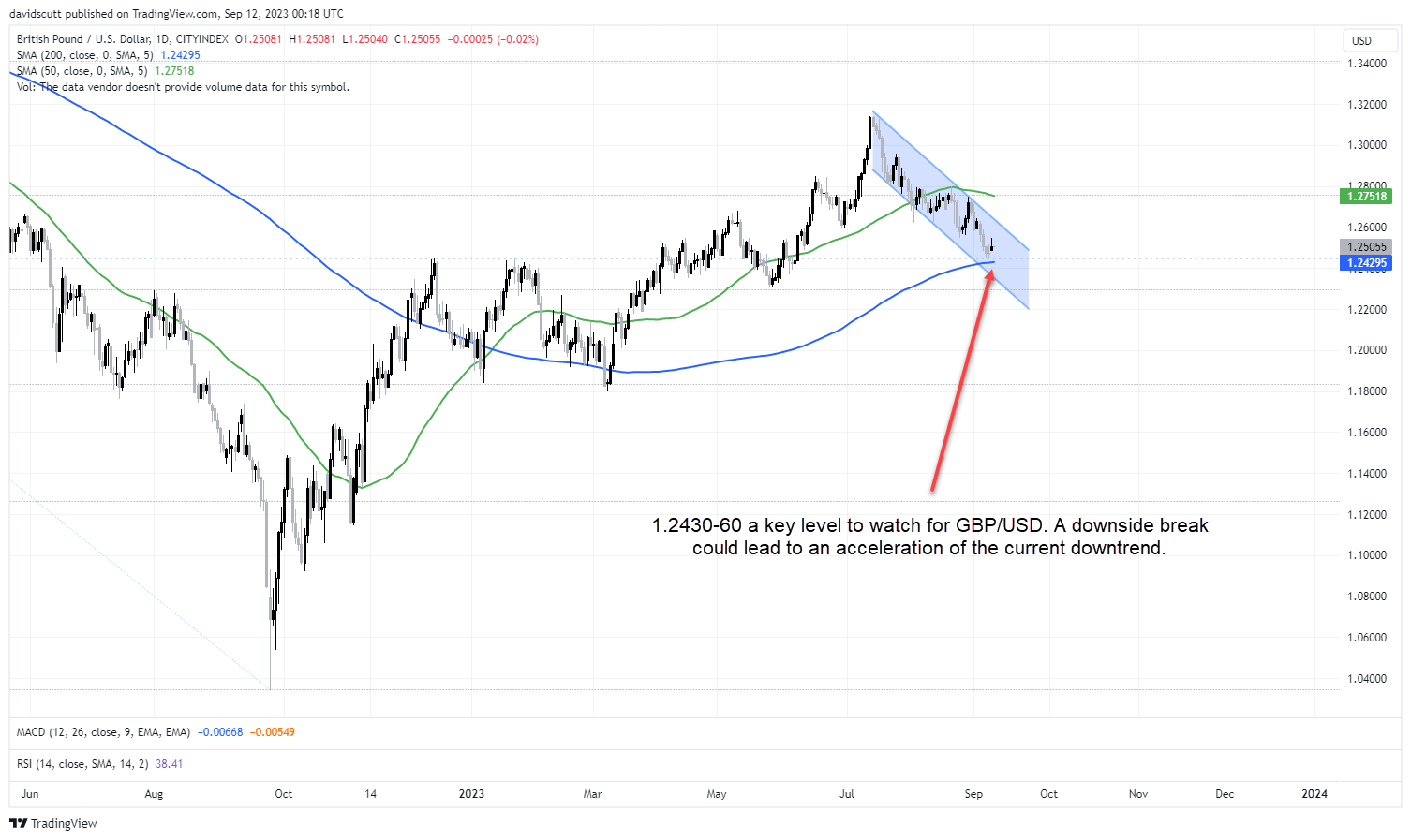

On the daily, GBP/USD remains comfortably in the downtrend it’s been in since July. However, sitting just above its 200-day simple moving average at 1.2430, and having bounced off a long-running support and resistance line at 1.2460, a downside break of this zone could lead to an acceleration of the current downtrend, paving the way for an eventual push back to 1.2300, the 50% retracement of the June 2021 to October 2022 high-low. RSI and MACD are also no impediment to the possibility of further downside.

If the UK data comes out stronger it could bring the top of the trend channel into play, especially if US dollar weakness seen on Monday extends into another session. If that eventuates, it may provide an opportunity to position for a trend change but let’s not get ahead of ourselves.

Source: Trading View

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade