EUR/USD Key Points

- EUR/USD traders have keyed in on the speeches from ECB policymakers and US data.

- traders are now pricing in nearly four 25bps interest rate cuts from the ECB (92bps) this year, versus closer to three (82bps) for the US Fed in the wake of yesterday’s hotter CPI report.

- EUR/USD has carved out a near-term range between 1.0900 and 1.1000. US data will continue to play a major role in the pair, with PPI and Retail Sales on tap tomorrow.

EUR/USD Fundamental Analysis

There hasn’t been much in the way of news that impacts the world’s most widely-traded currency pair directly today, leaving it at the whim of risk appetite and technical factors.

One tidbit to note is that the European Central Bank (ECB) is adjusting its strategy to encourage banks to lend money to each other, aiming to improve financial stability as inflation and interest rates rise. This includes safety measures and lower costs for banks needing emergency funds, with a focus on supporting the economy while considering environmental impacts. This new framework is unlikely to have an immediate impact on markets, but sits in the broader “macroprudential” component of central bank actions seeking to ensure that the financial system functions as intended.

With the economic calendar bereft of European economic data, EUR/USD traders have keyed in on the speeches from ECB policymakers and US data. On the former front, Francois Villeroy noted that “a spring rate cut remains probable” though it seems that he stretched the definition of spring when he went on to clarify that it was “more likely a rate cut will happen in June than in April.”

In any event, traders are now pricing in nearly four 25bps interest rate cuts from the ECB (92bps) this year, versus closer to three (82bps) for the US Fed in the wake of yesterday’s hotter CPI report.

This relative difference in expected interest rates has been the big driver supporting EUR/USD this week.

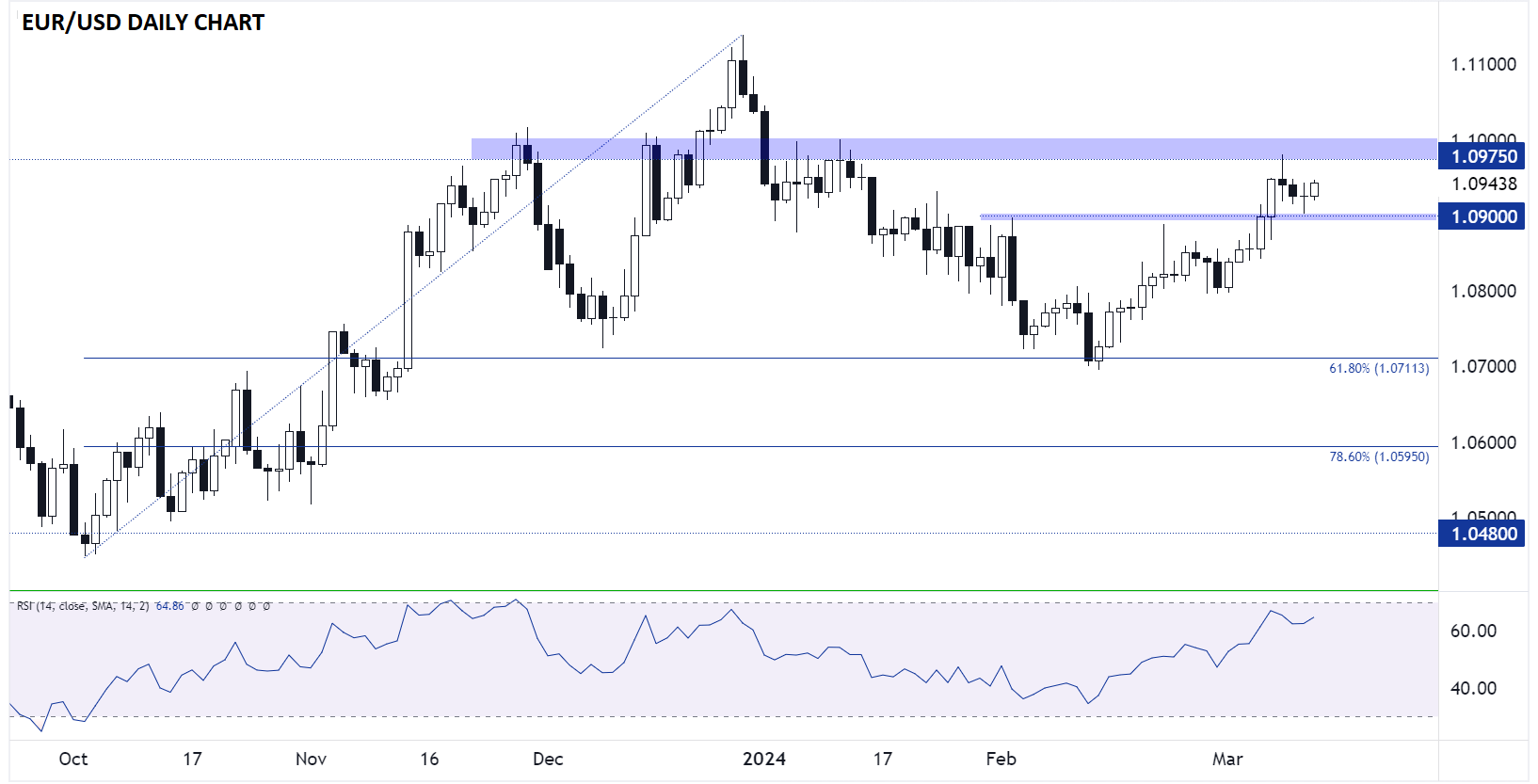

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Looking at the chart, EUR/USD pulled back from key resistance at the 1.0975 level to start the week, gradually ticking down to a low near previous-resistance-turned-support at 1.0900 yesterday. Today, the pair is seeing a slight recovery back toward the mid-1.0900s, marking a key short-term range between 1.0900 and 1.0975-1.1100.

Looking ahead, US data will continue to play a major role in the pair, with PPI and Retail Sales on tap tomorrow. If those reports confirm the ongoing strength of the US economy, traders may continue to price out additional Fed rate cuts this year and take EUR/USD back down to, or potentially through, support in the 1.0900 area. Meanwhile, softer-than-expected readings from tomorrow’s US data could provide a catalyst for EUR/USD to break definitively above 1.10 and open the door for a retest of the XX-month highs near 1.1100.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX