The Bank of England edged closer to a rate cut, although stopped short of announcing any such moved for June as I suspected. Seven of the nine MPC members voted to hold (down from eight) and two to cut (up from one), with a “range of views” among MPC members voting to hold suggesting that a June cut is not yet a slam dunk. The 3-year CPI forecast was lowered to 1.6% from 1.9% previously, and 2.6% for one year, down from 2.8% prior. Incoming data will be closely monitored to see if it shows a “receding risk of inflation persistence”.

The BOE next meet on June 20th and August 1st. Key data points to watch to decipher the likelihood of a June cut include claimant and earnings data next Tuesday and of course the inflation report on Wednesday 22nd May.

GBP was lower against AUD (-0.4%), NZD (-0.25%) and CAD (-0.12%) although made gains against the weaker yen (+0.2% and the US dollar, sending GBP/USD 0.23% higher and forming a bullish engulfing / outside day.

Yet it was the US dollar which took the crown as the weakest forex major on Thursday as traders rejoiced weaker employment data, on hopes it will bring forward Fed rate cuts. US jobless claims rose to an 8-month high of 231k, continuous claims rose 17k to 1.785 million. These figures hardly scram Armageddon, but we’re in the phase where traders will take any scrap of weakness of a sign the Fed might cut rates at some time this year, to send the US dollar lower and Wall Street higher accordingly.

I outlined my bearish bias for the US dollar a couple of time this week, and the US employment figures (rightly or wrongly) were the required catalyst. The US dollar index perfectly tested the 61.8% Fibonacci ratio before rolling over and forming a bearish outside week, which now brings the move down to at least 104.50, or the 104 / 200-day EMA / Q3 open zone into view for bears.

The 1-hour chart shows that losses materialised in one straight move, although bearish volatility is waning around the cycle lows. Take note of the monthly and weekly pivot points between 105.25 – 105.37 which could appeal to bears if prices retrace towards this zone and allow for a fresh short entry.

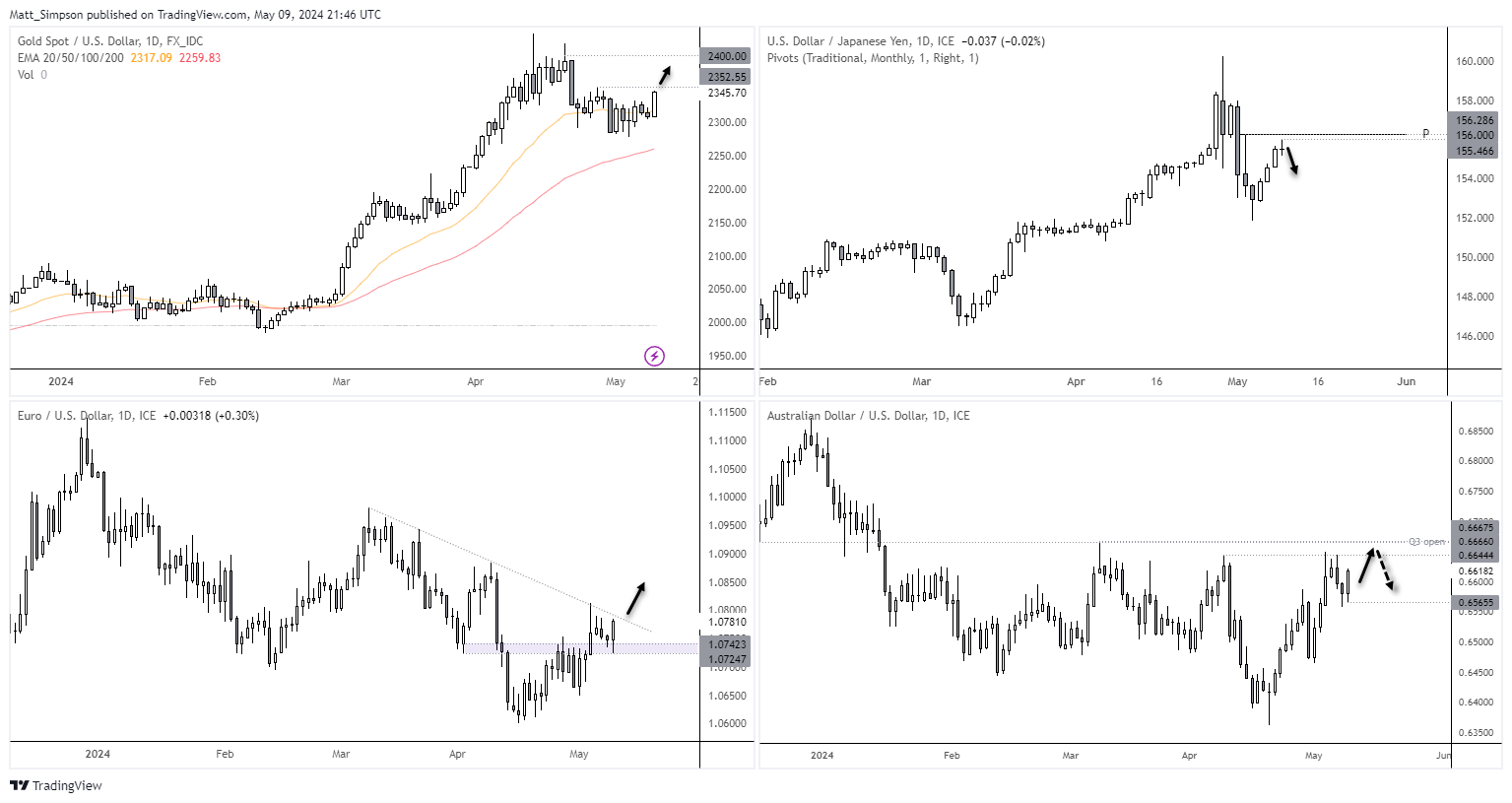

- USD/JPY closed flat with a Rikshaw man doji after reversing just beneath the 156 handle, and with the US dollar losing ground and the BOJ potentially looking to take advantage, the bias is for a move lower for the pair

- A bullish engulfing candle formed on AUD/USD which brings the potential for further gains today, although bulls may want to err on the side of caution as we approach the 0.6666 resistance level as the Aussie has failed to gain any real traction around these highs this year so far

- EUR/USD formed a bullish outside day to show demand above the 1.07 handle, with eyes now on trend resistance for a potential break above the 1.08 handle

- Wall Street extended its gains led by the Dow Jones (0.85%), S&P 500 (0.51%) and Nasdaq (0.16%)

- The DAX reached a record high, seemingly because Dortmund reached the UEFA cup final

- Gold rallied 1.6% and reached my target around $2345-$2350 outlined earlier this week. Should US dollar weakness persist then an upside break of $2352 is likely on the cards.

- Silver also broke higher in line with yesterday’s bias and now trades just above the $28.30 target

- Crude oil prices rose in line with my bias, although only just. There is plenty of resistance nearby including the $80 and the 200-day MA, but with traders remain net long and prices having already fallen -12% from the April high, I suspect a break above $80 is no the cards

Economic events (times in AEST)

- 09:30 – Japan household spending

- 09:50 – Japan foreigner bond/stock purchases, FX reserves

- 15:00 – Japan economy watchers current index

- 16:00 – UK business investment, manufacturing production, construction output, monthly GDP, index of services, trade balance

- 21:45 – BOE member Dhingra speaks

- 22:30 – Canada employment report

- 23:00 – FOMC bowman speaks

- 00:00 – US consumer sentiment, inflation expectations (Michigan University)

- 02:45 – Fed Goolsbee speaks

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade