EUR/USD Key Points

- Unlike the Fed, the ECB keeps pushing back against expectations that it will cut interest rates in Q1 2024…

- …But markets aren’t buying it, with traders pricing in similar odds of a March rate cut and 150bps of easing across 2024.

- EUR/USD could rally back to retest key resistance at 1.10 after pulling back on Friday.

EUR/USD Fundamental Analysis

At the start of the final “real” trading week of the year, traders are still digesting last week’s central bank meetings, specifically the contrast between the Federal Reserve and the European Central Bank.

Despite an ostensibly stronger economy and near-target inflation, Fed Chairman Jerome Powell and Company clearly endorsed multiple interest rate cuts next year, starting as soon as March, whereas ECB President Christine Lagarde pushed back against the market’s expectations for easing policy.

This morning, ECB members Vasle (“Market pricing for rate cuts is excessive”) and Kazimir (“Policy mistake of easing too early would be more significant than tightening for too long”) both tried to reemphasize that the ECB isn’t planning to cut interest rates any time soon, but traders are not buying it; traders are still pricing about ~60% odds of an ECB rate cut in March and 150bps of interest rate cuts across all of 2024, nearly identical to the market’s expectations for the Fed.

Time will tell if the ECB is forced to cut interest rates sooner and more aggressively than it hopes to, but clearly markets are content betting against central banks’ “higher for longer” mantra.

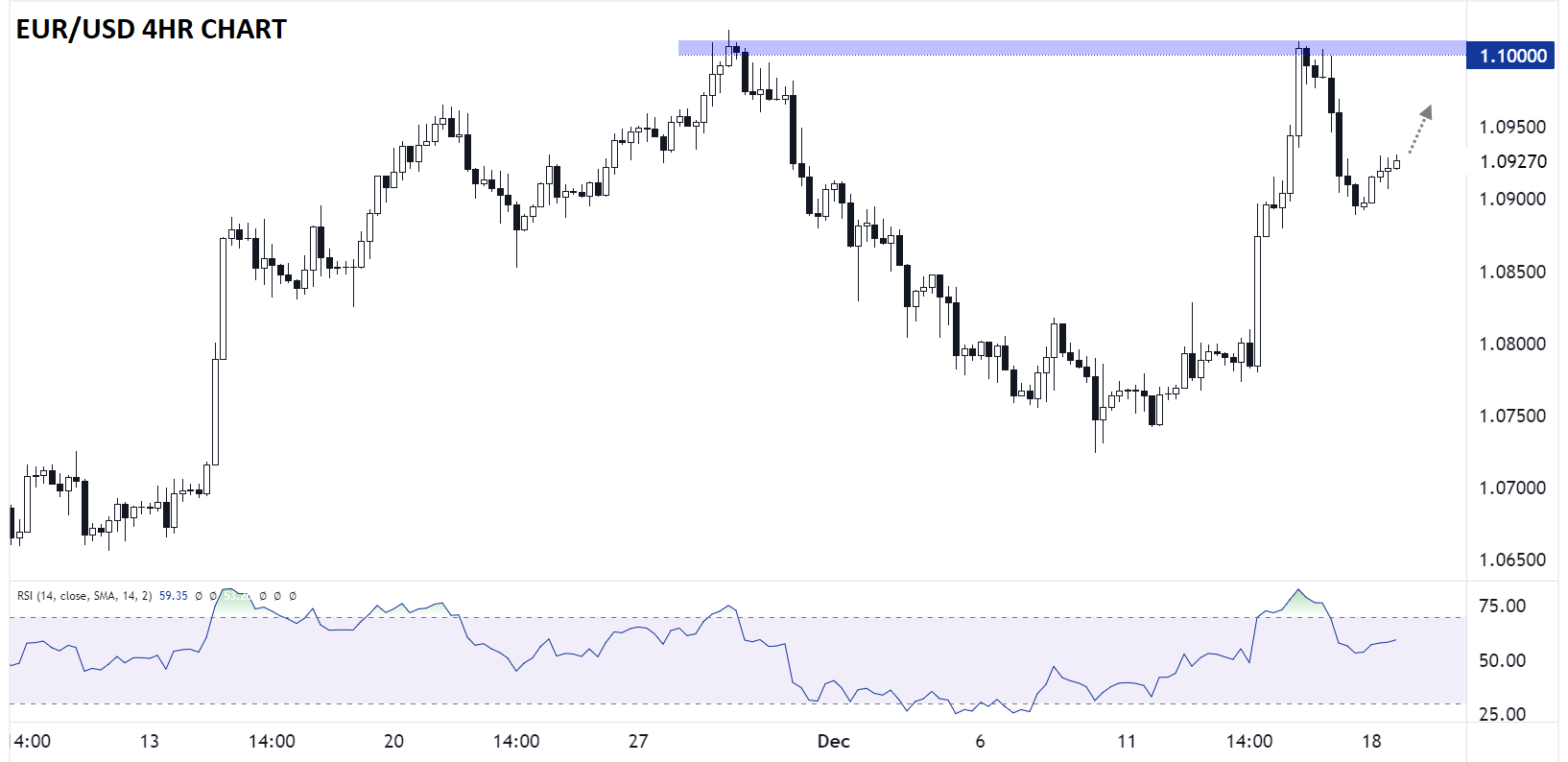

Euro Technical Analysis – EUR/USD 4-Hour Chart

Source: TradingView, StoneX

Keying in on the 4-hour chart of EUR/USD, the world’s most widely-traded currency pair pulled back from key previous / psychological resistance at 1.10 on Friday as traders took profits after a massive 200+ rally through the first four days of the week.

As we begin this week’s trade, EUR/USD appears to have found support near 1.0900, setting the stage for a higher low and a potential recovery rally back toward 1.10 resistance through the middle of the week.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX