This is an excerpt from our full EUR/USD 2024 Outlook report, one of nine detailed reports about what to expect in the coming year. Click the banner at the bottom to download the full report.

EUR/USD Key Points

- After a quiet 2023, EUR/USD is likely to see more volatility in 2024.

- Stronger US growth and similar inflation on both sides of the Atlantic could lead to more aggressive interest rate cuts from the ECB, boosting EUR/USD.

- Technically speaking, the 2023 range between 1.0500 and 1.1250 will be key.

EUR/USD 2023 in Review

Despite some volatility throughout the year, you could say that 2023 was a relatively forgettable year for the world’s most widely-traded currency pair.

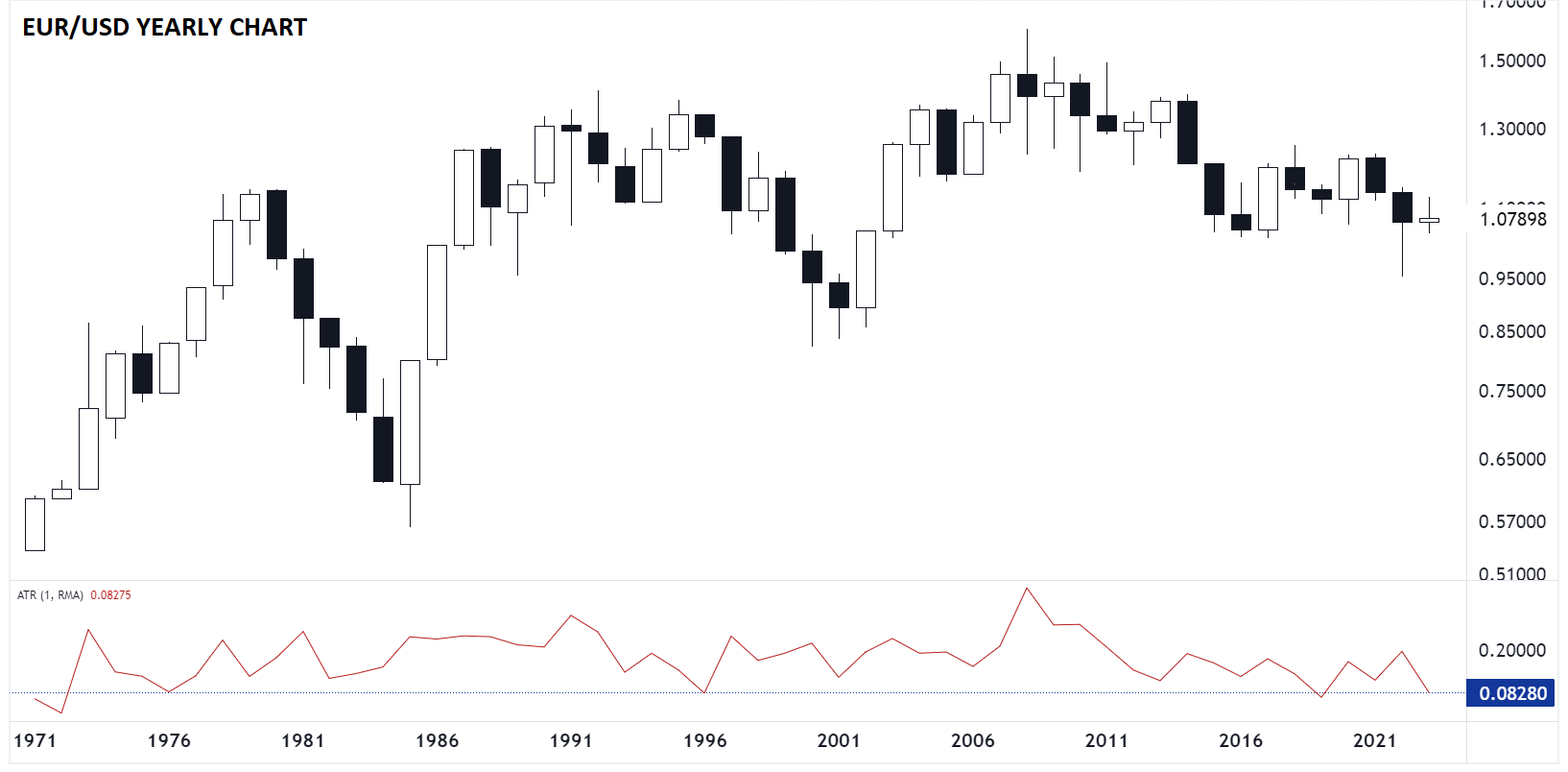

As of writing in mid-December, EUR/USD is trading up just a couple hundred pips, or about 2%, from the 1.0699 level where it started the year. More to the point, the pair saw a range of just 828 pips across the entire year, the second-lowest range since the inception of the euro in 1999; Using interpolated prices based on the national currencies before that, 2023’s range is the 3rd lowest in the last 50 years!

Source: TradingView, StoneX

The clearest trend in EUR/USD during 2023 was the big Q3 drop from above 1.12 to below 1.05 on the back of the “US Economic Exceptionalism” narrative, or the theme that the world’s largest economy was handily outperforming and decoupling from other developed market rivals. Not surprisingly in retrospect, that theme reversed in Q4 as US economic data slowed down and began to “catch down” to the rest of the world, including the European Continent.

EUR/USD Fundamental Analysis

When it comes to the fundamental outlook for EUR/USD in 2024, the most important theme will be central bank interest rate cuts.

As of writing in the wake of the final central bank meetings of 2023, traders believe that both the US Federal Reserve and European Central Bank have reached peaked interest rates and will be cutting interest rates in the first half of 2024. Of course, forex is a relative game, so the key question for EUR/USD traders will be which central bank cuts interest rates the most, or specifically which cuts interest rates the most relative to expectations.

Conveniently, expectations for both central banks are relatively similar as we flip our calendars to 2024: Traders are pricing in roughly five or six interest rate cuts from both the Fed and the ECB, with the easing cycles projected to begin as soon as March. While much will ultimately depend on how economic data evolves and the temperament of the central bankers in question, basic economic analysis suggests that the odds are skewed toward the more interest rate cuts from the ECB than the Fed, and therefore elevated odds that EUR/USD could fall in 2024.

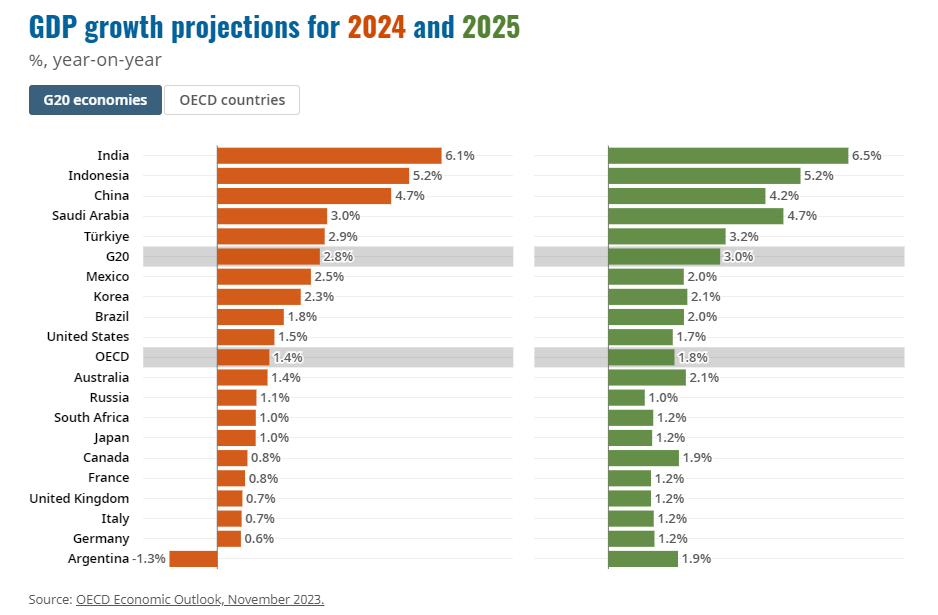

To keep it as simple as possible, economic growth is likely to be higher and more resilient in the US than in the Eurozone, and inflation, the bogey that both central banks are trying to defeat, should be similar on both sides of the Atlantic over the next year. Starting with economic growth, the Organization for Economic Cooperation and Development (OECD) projects that the US economy will grow by 1.5% and 1.7% over 2023 and 2024 respectively, roughly in-line with the OECD average. In contrast, Germany, France and Italy, the 3 largest economies in the Eurozone, are all expected to grow by less than 1% in 2024 and by 1.2% in 2025, leaving the entire Eurozone at risk of slipping into a recession if any negative shocks emerge:

Source: OECD

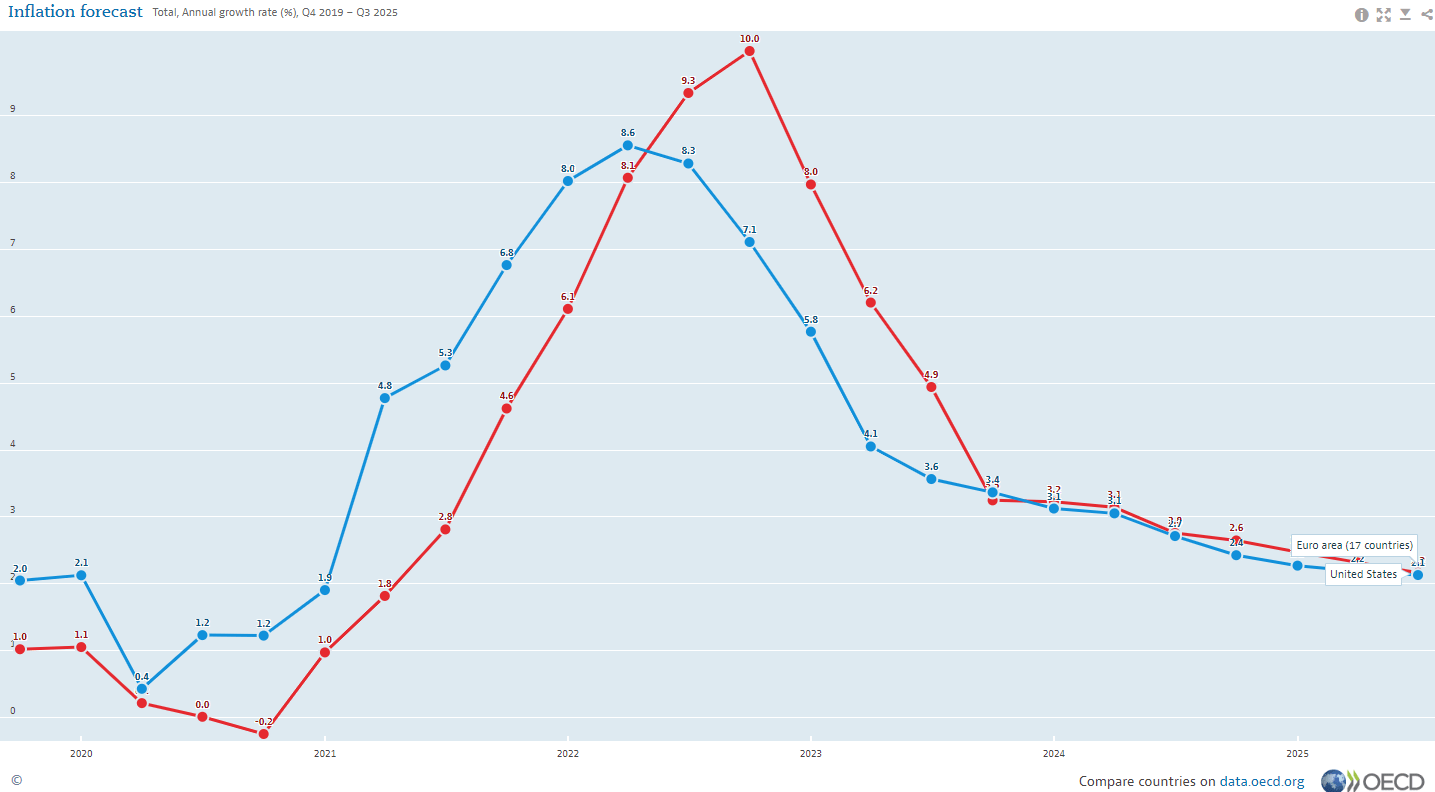

Tackling inflation next, the OECD forecasts that after seeing a later and higher peak in 2022, price pressures in the Eurozone will move in lockstep with those in the US in a gradual decline toward the central banks’ 2% target:

Source: OECD

Throw in the more Eurozone-proximate risks from ongoing conflicts in the Middle East and Ukraine, and it’s clear that the balance of the risks is tilted toward more potential downside in EUR/USD in 2024, especially in the latter half of the year.

How will a US election and Eurozone fiscal reforms impact the pair? What are the key levels to watch in 2024? See our full guide to explore these themes and more!