The recent escalation of the conflict between Israel and Hamas has sparked concerns about its potential ramifications for both regional and global markets. In this comprehensive analysis, we will examine the various dimensions of the conflict and its probable effects on the GCC (Gulf Cooperation Council) and Middle East equities markets, oil prices, inflation, and interest rate outlook in major economies like the US, Europe, the UK, and Japan. We will also explore how the conflict has influenced the price of gold, which often serves as a safe haven during times of geopolitical uncertainty.

Effect on GCC and Middle East Equities Markets

The Israel-Hamas conflict has already left its mark on the stock markets in the Middle East. Israel's benchmark stock index experienced its most significant drop since March 2020, with share prices in Riyadh, Cairo, Doha, and Kuwait also seeing declines.

The Tel Aviv Stock Exchange witnessed a significant downturn, with key indices reflecting substantial losses. The TA-35 index, representing blue-chip firms, experienced a sharp decline of 6.4%, while the benchmark TA-125 index dropped by 6.2%. Similarly, the TA-90 index, which monitors stocks with the highest capitalization but not part of the TA-35 index, also recorded a decline exceeding 6%. In addition, the TA-Bank index, encompassing the five largest banks, registered a substantial decrease of 7.8%. Furthermore, sectors like construction, building, and insurance saw their stocks plummet by percentages ranging from 8% to 9%.

Notably, GCC stock markets have not seen the significant declines witnessed on the Tel Aviv Stock Exchange. This divergence in performance can be attributed to the crisis's positive effect on oil prices. Consequently, any adverse impact arising from the geopolitical uncertainty stemming from the conflict may be offset by the augmented revenue stemming from elevated oil prices. As of 2:25 PM Abu Dhabi Time the Abu Dhabi Securities Exchange was down about 1.28% with about 30 minutes to close. On the other hand the Dubai Financial Market was down about 2.79% and Saudi Tadawul TASI Index is flat at 0.02%.

The outbreak of the unprecedented violence has introduced a new layer of volatility and increased borrowing cost into the markets, causing investors to adopt a more risk-averse approach in the short term. The situation remains fluid, and further declines in regional stock markets could be on the horizon.

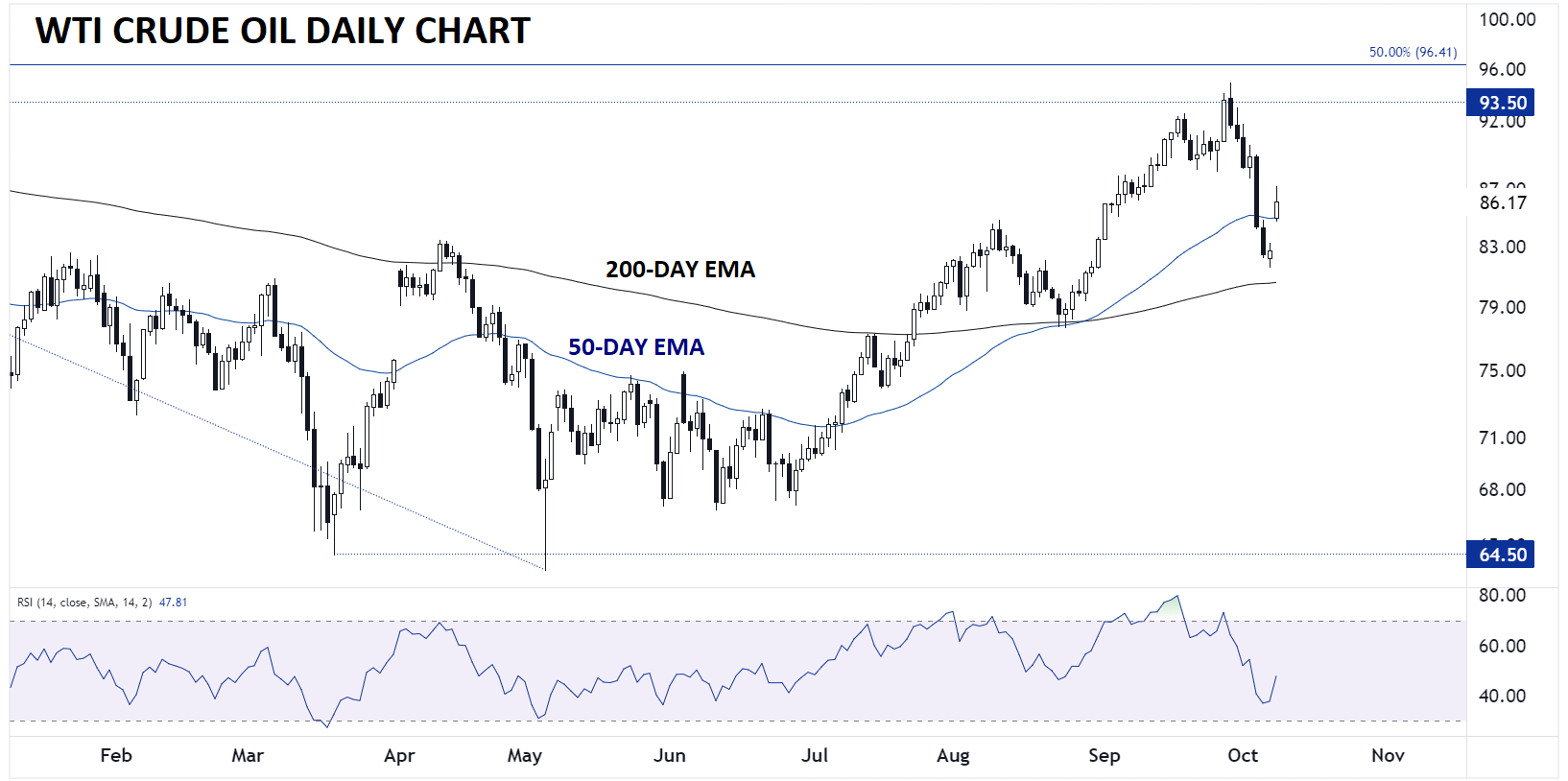

Effect on Oil Prices

While Israel and Palestine are not major oil producers, the conflict's geographical location in the Middle East, a key oil-producing region, has raised concerns about potential disruptions to oil markets. Oil prices surged by more than 5% in response to increased tensions following Hamas's attack on Israel. Energy experts suggest that the overall impact on oil markets should remain limited, provided the conflict does not escalate into a regional war.

Nonetheless, if the conflict were to swiftly escalate, it could have significant and wide-ranging implications for oil prices. This potential impact is primarily driven by two key factors. Firstly, the region collectively accounts for approximately 30% of global oil production, making it a critical player in the world's oil supply.

Secondly, it is home to three of the most vital maritime bottlenecks globally, namely the Strait of Hormuz, the Strait of Mandab, and the Suez Canal, which serve as essential choke points for the global transportation of oil. These strategic passages facilitate the transit of a substantial portion of the world's oil and other energy products, estimated at approximately 59% of the global energy supply.

Moreover, the OPEC+ coalition has actively worked to constrain oil supplies throughout the year's end. In an attempt to alleviate these supply constraints, the United States has been negotiating with Iran to reintroduce its oil into the market. However, with the eruption of the conflict between Israel and Hamas and Iran's open support for Hamas, the United States may find itself compelled to impose sanctions on Iran, including restrictions on its oil exports. In the event of such sanctions, an additional reduction of 0.5-1% in global oil supply would exacerbate the existing supply constraints even further.

Source: TradingView, StoneX

Effect on Inflation and Rates Outlook in Major Economies

The Israel-Hamas conflict has the potential to affect the inflation and interest rate outlook in major economies such as the United States, Europe, the United Kingdom, and Japan.

Higher oil prices contribute to inflation directly by increasing the cost of inputs, such as transportation and production costs for consumer goods. Energy accounted for about 7.3% of the Consumer Price Index (CPI) as of December 20211. Federal Reserve Chair Jerome Powell has stated that, as a rule of thumb, every $10 per barrel increase in the price of crude oil raises inflation by 0.2%

The heightened geopolitical tensions and uncertainty in the Middle East could lead to increased volatility in global financial markets. This, in turn, may influence inflation expectations and the interest rate decisions made by central banks in these key economies.

Strengthening of the US Dollar

The US dollar gained 0.45% at the outset of Monday's trading session even before US market opens and with Japan market closed for the day, indicating its potential for further strengthening in light of the ongoing conflict. This prospect is underpinned by several key factors. As the world's foremost reserve currency, the US dollar enjoys a distinctive position, rendering it a safe haven in times of global turbulence. Consequently, emerging markets may experience mounting pressure as investors seek avenues for exit.

In parallel, the shekel initially depreciated by over 2% against the dollar, marking its weakest performance since 2016. However, it subsequently exhibited a partial recovery, ultimately trading 1.8% lower at Shk3.9155 following the central bank's announcement.

Moreover, the interest rate differential between the US dollar and other major currencies, such as the euro and the British pound, is likely to widen as a result of the divergence in economic activity and interest rate outlook in favor a stronger dollar. The Federal Reserve's hawkish stance on monetary policy has attracted global capital in search of higher returns, further bolstering the dollar's value.

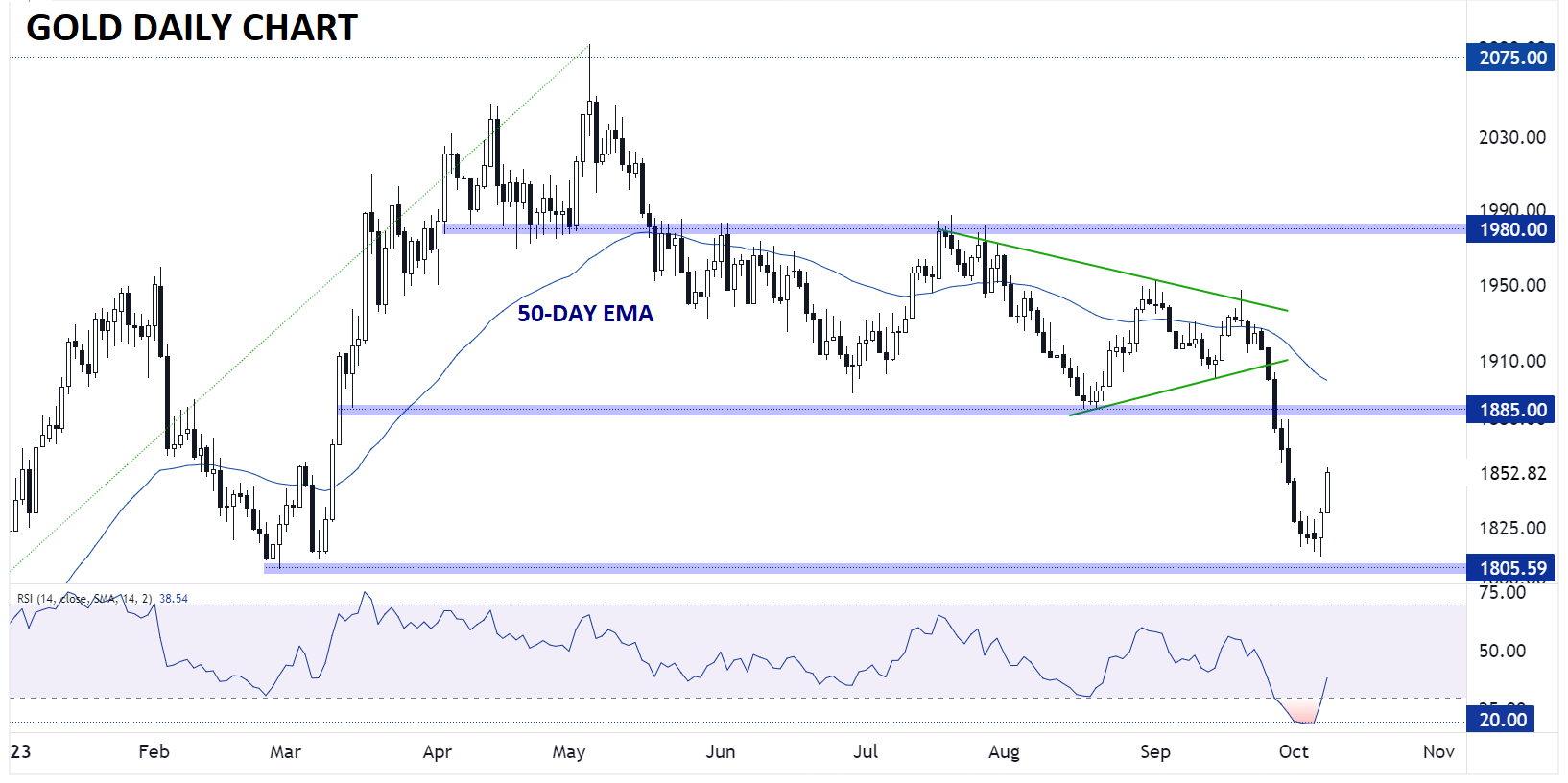

Positive Impact on Gold

Gold, often considered a safe-haven asset during times of geopolitical turmoil, has already experienced a surge in price as a result of the Israel-Hamas conflict having gained as much as 19 US Dollars today or about 1%.

Investors are seeking refuge in this precious metal as a hedge against uncertainty. If the conflict continues to escalate, we can anticipate continued upward pressure on the price of gold, as investors seek safe havens to protect their portfolios.

Furthermore, mirroring the trends observed in 2022, there is a potential for increased demand for gold as certain countries, whose political and military stances may not align with those of the United States and Western nations, follow the example set by Russia and Iran.

These countries have actively diversified their reserves by acquiring gold in response to concerns about potential economic sanctions imposed by the US. This pattern has been a global phenomenon, culminating in central banks worldwide purchasing gold at a rate not witnessed in 55 years during 2022.

Russia and China have emerged as frontrunners in this surge, with even smaller nations bolstering their gold holdings. Notably, the Russian central bank has expressed a desire for gold to constitute up to 25% of its overall reserves.

Source: TradingView, StoneX

Conclusion

The Israel-Hamas conflict is not confined to regional borders; it possesses intricate geopolitical, economic, and market-related facets that have global implications. As we have expressed, its impact extends beyond the Middle East, affecting aspects such as oil prices, regional equities markets, currency dynamics, and the precious metals market. For investors, policymakers, and market analysts, staying attuned to the evolving situation in the region and its economic repercussions will be crucial. As the conflict unfolds, it will continue to shape the trajectory of global markets, warranting vigilance and strategic planning and risk management to navigate the ever-changing landscape.