US futures

Dow futures -1% at 33620

S&P futures -1.3% at 3940

Nasdaq futures -1.4% at 11555

In Europe

FTSE -0.73% at 7440

Dax -2% at 14160

Learn more about trading indices

The terminal Fed rate rose to 5.1%

US stocks are heading lower on Thursday, extending losses from the previous session after the Federal Reserve failed to give the market the dovish tilt it was hoping for and instead flagged higher interest rates for longer. Meanwhile, the ECB also indicated that significant rate hikes were still needed in order to tame inflation.

The rally in stocks which had been sparked by cooler-than-expected US inflation, has come to an abrupt halt after Federal Reserve policymakers signaled that the terminal interest rate was now forecast at 5.1%, well above the market expectations and up from 4.6% in September. Policymakers also pushed back on expectations of a rate cut next year, suggesting that inflation is going to be much stickier the previously expected and will take longer to bring back down to the 2% level.

The Fed ECB was more hawkish than the market had been expecting, meaning they consider that more tightening is needed, which is hurting equity prices and boosting the USD.

Adding to the downbeat mood US retail sales fell by more than expected to -0.6% MoM in November after rising 1.3% in October. Jobless claims were stronger than forecast, falling to 211k.

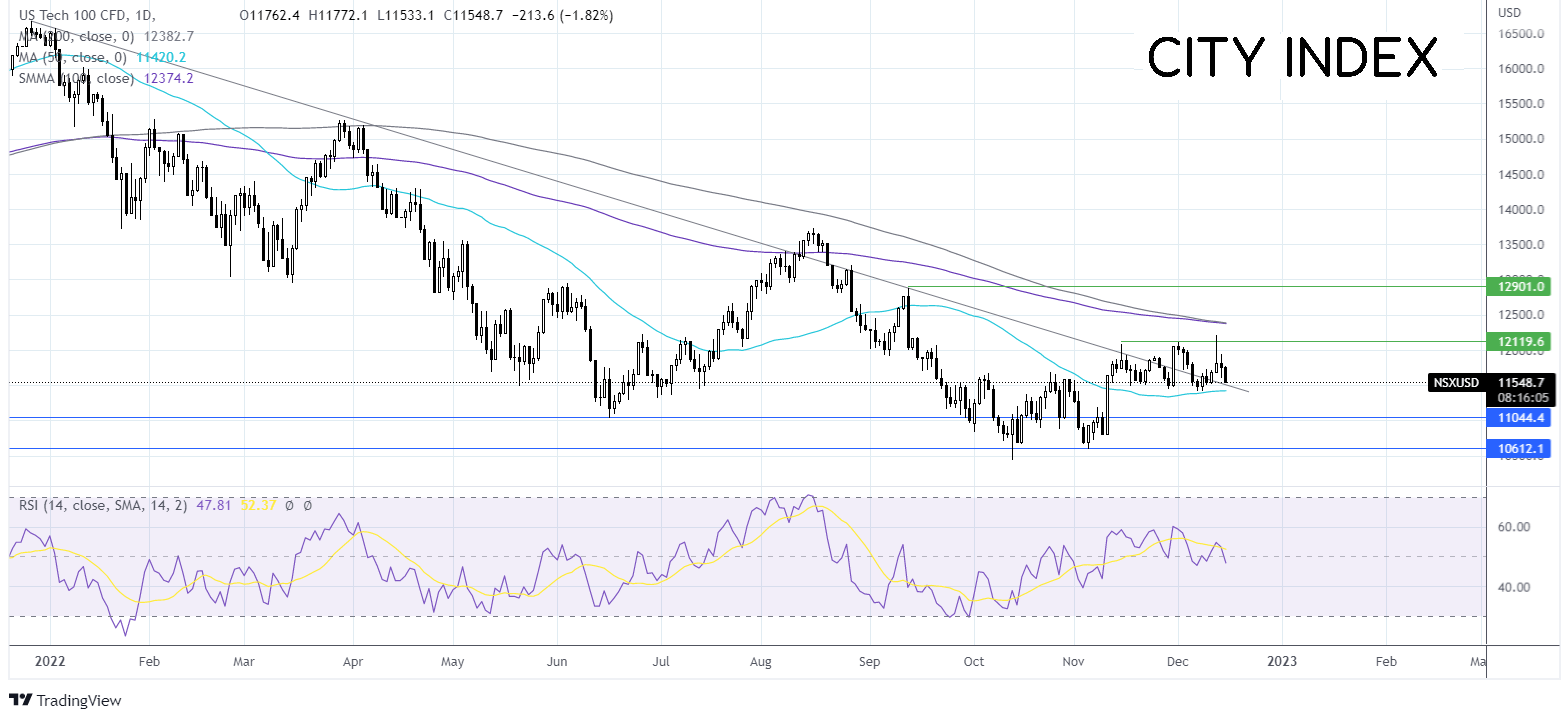

Where next for the Nasdaq?

The Nasdaq continues to trade in a holding pattern limited on the upside by 12,120 and on the lower side by the 50 sma at 11,400. The RSI has slipped below 50, keeping sellers optimistic about further downside. Sellers could look for a full below 11,400 to open the door to 11,000 and 20 June low, ahead of 10600 the November low. Meanwhile, buyers could look for a rise over 12120 is needed to expose the 100 and 200 sma at 12400, and a rise above here opens the door to 12,900, the September high.

Corporate news

Tesla is set to open lower again on the news that Elon Musk has sold a further $3.6 billion of stock.

Lennar falls after the house builder forecast a slow down in new orders in early 2023 as a result of higher mortgage rates.

FX markets – USD rises, GBP falls

The USD is rising following the more hawkish than-expected Federal Reserve stance. The US dollar has fallen over 7% in the past three months, so a small rebound is perhaps not that surprising.

EUR/USD it's falling owing USD strength, and after the ECB hiked interest rates by 50 basis points in line with forecasts. This takes the benchmark lending rate two 2%. The guidance was hawkish, saying that interest rates still need to rise significantly to reach levels that are sufficiently restrictive to bring inflation back to 2%

GBP/USD is trading under pressure after the Bank of England raised interest rates by 50 basis points as expected, taking the benchmark index to 3.5%, its highest level since 2008. However, the vote split was more dovish than expected, with two policymakers voting to keep interest rates on hold and one voting for a larger 75 basis point hike. The divergence between policymakers highlights the complex task that the BoE is facing to bring double-digit inflation back towards a 2% target as the UK economy falls into a potentially long recession.

GBP/USD -0.83% at 1.2310

EUR/USD -0.23% at 1.0650

Oil steadies after 4 days of gains

Oil prices are holding steady after four straight days of gains, recovering from earlier declines as the possibility of further interest rate hikes raises concerns of slowing economic growth and boosted the dollar.

A stronger dollar can weaken oil demand as it makes it more expensive for buyers with foreign currencies.

Weak economic data from China has also dampened the demand outlook sending oil prices lower in early trade. Factory output slowed, and retail sales fell, both missing forecasts.

Meanwhile, projections from the International Energy Agency for a recovery in Chinese oil demand next year helped to lift the price.

WTI crude trades +0.05% at $75.85

Brent trades at +0.05% at $81.20

Learn more about trading oil here.

Looking ahead

N/A