US futures

Dow futures +0.3% at 30598

S&P futures +0.5% at 3776

Nasdaq futures +0.7% at 11606

In Europe

FTSE -0.5% at 7057

Dax -1.3% at 13000

Euro Stoxx -0.5% at 3427

Learn more about trading indices

Jobless claims around a 5-month high

US stocks are set to rise after moderate losses in the previous session, as investors digest the last jobless claims and look ahead to another testimony from Powell.

Yesterday in his testimony before Congress Powell came across as slightly less hawkish than in the previous week and also explicitly acknowledged that a recession was possible. In response Treasury yields fell, pulling the USD lower whilst lifting stocks from the session lows.

The markets have been fretting that aggressive Fed hikes could tip the economy into recession. The Fed is expected to raise rates by 75 basis points in July and 50 basis points in September.

On the data front jobless claims came in at 229k, and last weeks were upwardly revised to 231k. The numbers were little changed and sit near a five-month high, which could be indicating that tightness in the labour market is starting to ease.

The jobs market remains strong but several firms are starting to announce redundancies in recent weeks again pointing to an easing in a historically tight market.

In corporate news:

read here for the latest stock news

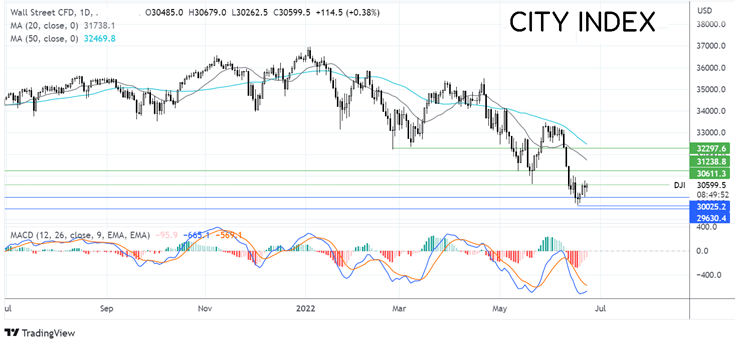

Where next for the dow jones?

The Dow Jones has been forming a series of lower lows, running into support at 29650 last week’s low, before clawing higher. The price is testing resistance at 30600 the May 20 low, a move above here and the receding bearish bias on the MACD keep buyers hopeful of further upside. Resistance can be seen at 31000 the June 15 high and round number. A break above exposes the 20 sma. On the flip slide, the sellers could look for a break below support at 30050 to bring 29650 back into play and to create a lower low.

FX markets – USD rises, GBP falls

USD is rising, recouping losses from the previous session as it awaits PMI data and another appearance from the Fed Chair. Whilst recession concerns pulled the USD lower yesterday, today the greenback is capitalizing on the weaker PMI data in Europe, even as stocks move higher.

EURUSD is falling after dismal business activity data across the board. The composite PMI showed that the economy is losing momentum. The sharp drop in the composite PMI to 51.9 from 54.8 indicates that the economy has already started cooling rapidly, even before the ECB has started hiking.

GBP/USD is falling on the back of USD strength and despite UK services PMI coming in ahead of forecasts and in line with May’s reading of 53.4 meanwhile the composite reading held steady at 53.1. Delving deeper into the data, the numbers show that rising inflation is hitting new orders and business confidence slips to a level that is associated with a recession. The report will be a concern for the BoE as firms pay higher wages and pass on the higher costs to customers heading towards spiraling inflation.

GBP/USD -0.58% at 1.2267

EUR/USD -0.47% at 1.0557

Oil extends losses

Oil prices fell sharply yesterday and are edging lower again today, although they have picked up off the daily low.

Fears of a recession and what that will mean for oil demand is weighing on the price of oil, pulling WTI to a low of $102.32. However, the price has picked up from the lows helped by improving demand for risk assets across the financial markets. But gains are likely to be capped, it seems unlikely that oil prices will rise back to the levels seen earlier in the month while recession fears and demand destruction concerns linger.

Separately President Biden has requested a 3-month suspension on the federal gasoline tax, in order to help eases prices at the pump.

WTI crude trades +0.8% at $109.56

Brent trades +0.8% at $113.22

Learn more about trading oil here.

Looking ahead

14:45 US Composite PMI

15:00 Fed Chair Powell testifies

21:30 banks stress test