US Open Stocks rise as banking fears calm

US futures

Dow futures +0.7% at 32480

S&P futures +0.55% at 4000

Nasdaq futures +0.3% at 12820

In Europe

FTSE 1.4% at 7480

Dax +1.5% at 14858

- Bank worries ease as US authorities consider further support

- First Citizens Bank to buy most of SVB’s loan book

- EUR/USD rises after upbeat German IFO business climate data

- Oil rises despite weak China factory profits

Learn more about trading indices

More bank volatility expected

US futures are tracking European markets higher, boosted by hope of further support from US authorities towards the regional banking sector.

Reports that US authorities are considering expanding a lending facility to boost balance sheets sent regional banks sharply higher. First Republic Bank jumped 34% pre-market on the news after falling 90% so far this month.

News that First Citizens Bank would buy most of the loan book of collapsed SVB also helped boost the mood.

Volatility is expected to be elevated again this week as investors continue watching and weighing up developments in the banking sector.

Fed speakers will also be under the spotlight after the Fed hiked rates by 25 bps last week, but the market is questioning the Fed’s ability to hike further amid the stresses in the financial sector. Over the weekend, Fed Minneapolis President Neel Kashkari said that the bank turmoil had increased the risk of a recession in the US.

Fed speakers will shed more light on how policy makers are balancing the banking sector crisis against high inflation and the need to hike rates.

Looking towards the end of the week US core PCE, the Fed’s preferred inflation gage will also be in focus. The gauge unexpectedly rose on a monthly basis in January, the Fed will be keen to see this resume a downward trajectory.

Corporate news

Regional banks are rebounding after losses last week as investors cheered hopes of additional support from authorities. Western Alliance Bancorp rises 6% pre-market. Major banks such as JPM, Citigroup, Wells Fargo and Bof A rise pre-market.

Alibaba ADR’s rise pre-market after the return of founder and former CEO Jack Ma to China for the first time in a year, signalling an easing of tensions between the government and internet giants.

Tesla rises 1.7% after Barclays said that it expects a modest beat from deliveries in Q1 of 2023, forecasting 425,000 deliveries against 420,000.

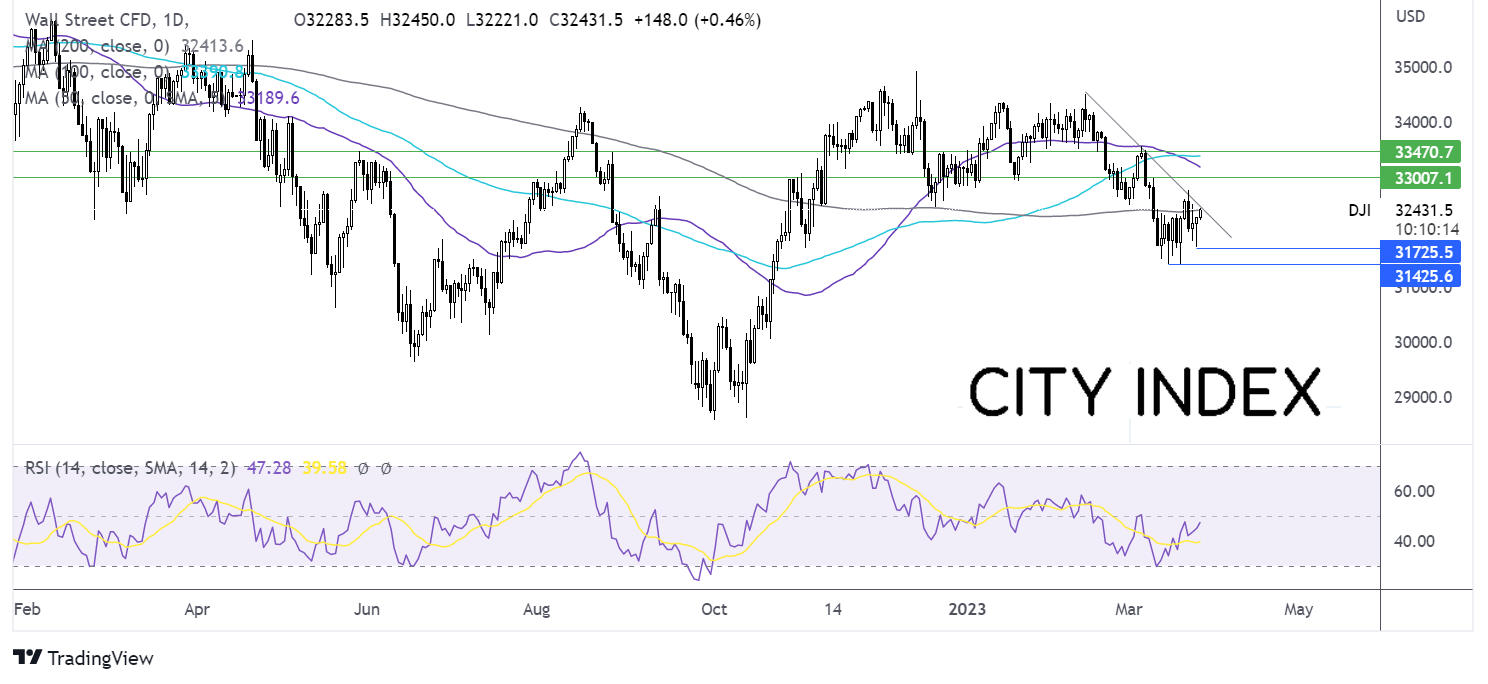

Where next for the Dow Jones?

After finding support at 31450 the Dow Jones has rebounded higher and is testing resistance at the 200 sma at 32400, which is also the 6-week falling trendline resistance. A rise over this level could see buyers gain momentum towards 32775 last week’s high and 33000 the round number. On the flipside, sellers could be encouraged by the 50 sma crossing below the 100 sma. Should sellers successfully defend the 200 sma, support can be seen at 31730, Friday’s low ahead of 31450 the March low.

FX markets – USD steadies, GBP rises

The USD is subdued in early trade edging quietly higher after losses in the previous week. The US dollar fell last week despite the Fed hiking interest rates by 25 basis points, as investors were increasingly convinced that the Fed would keep rates on hold at the next meeting owing to the fallout from the banking crisis.

EUR/USD is ticking a few points higher boosted by stronger than expected German IFO business climate data, which rose to 93.3 in March up from 91.1 and defying expectations of a fall to 91. This marks the fifth straight month that business morale has improved, as Germany continues to benefit from falling energy prices. ECB official Isabel Schnabel will speak later.

GBP/USD is rising as the market mood improves and as investors look ahead to a speech by BoE Governor Andrew Bailey. His appearance comes after the BoE voted to raise interest rates by 25 basis points last week and kept the door open for further hikes in the fight against persistently high

EUR/USD +0.06% at 1.0765

GBP/USD +0.19% at 1.2257

Oil rises as risk sentiment improves

Oil prices are edging higher extending gains from the previous week as investors weighed up efforts by the authorities to calm concerns regarding the global banking system. optimism that they could be more support coming has boosted the market mood and has seen investors rein in recession fears.

Oil is also finding support from Putin's plans to put nuclear weapons in Belarus for the first time since the 1990s. The move has ramped up geopolitical tensions in the region. At the same time Moscow is close to achieving its cut of crude oil output by 500,000 barrels per day to around 9.5 million bps.

WTI crude trades +0.6% at $69.75

Brent trades at +0.6% at $75.13

Learn more about trading oil here.

Looking ahead

16:00 BoE’s Andrew Bailey speech

22:00 Fed Jefferson speech