US futures

Dow futures -1.0% at 33370

S&P futures -1.17% at 4178

Nasdaq futures -1.47% at 13050

In Europe

FTSE -0.33% at 7515

Dax -2% at 13250

Euro Stoxx -1.7% at 3660

Learn more about trading indices

Jackson Hole Symposium moves into focus

US stocks point to a sharply lower open, extending losses from the previous week. Fears that the Federal Reserve could continue to act aggressively hiking interest rates are dragging stocks lower.

The Fed has already hiked interest rates by 225 basis points, and the market fears that the US central bank could continue front-loading rate hikes to tame inflation after comments from Richmond Federal Reserve President Thomas Barkin and other Fed officials.

There is no high-impacting US economic data due to be released today. However, this week is busy with the Jackson Hole Symposium and US PCE due.

Fed Powell’s speech at the annual economic forum could provide further guidance on how high the Fed sees interest rates going.

The Fed’s next meeting is in September, and the market is split as to whether the Fed will hike by 50 or 75 basis points.

In corporate news:

Tesla is falling pre-market after Elon Musk tweeted over the weekend that the price for the full self-driving system will rise by 25% to $15000 in September.

Zoom is expected to report earnings after the closing bell. The pandemic play is expected to report EPS of $0.93, down 31%, while revenue is expected to jump 9.8% to $1.12 billion.

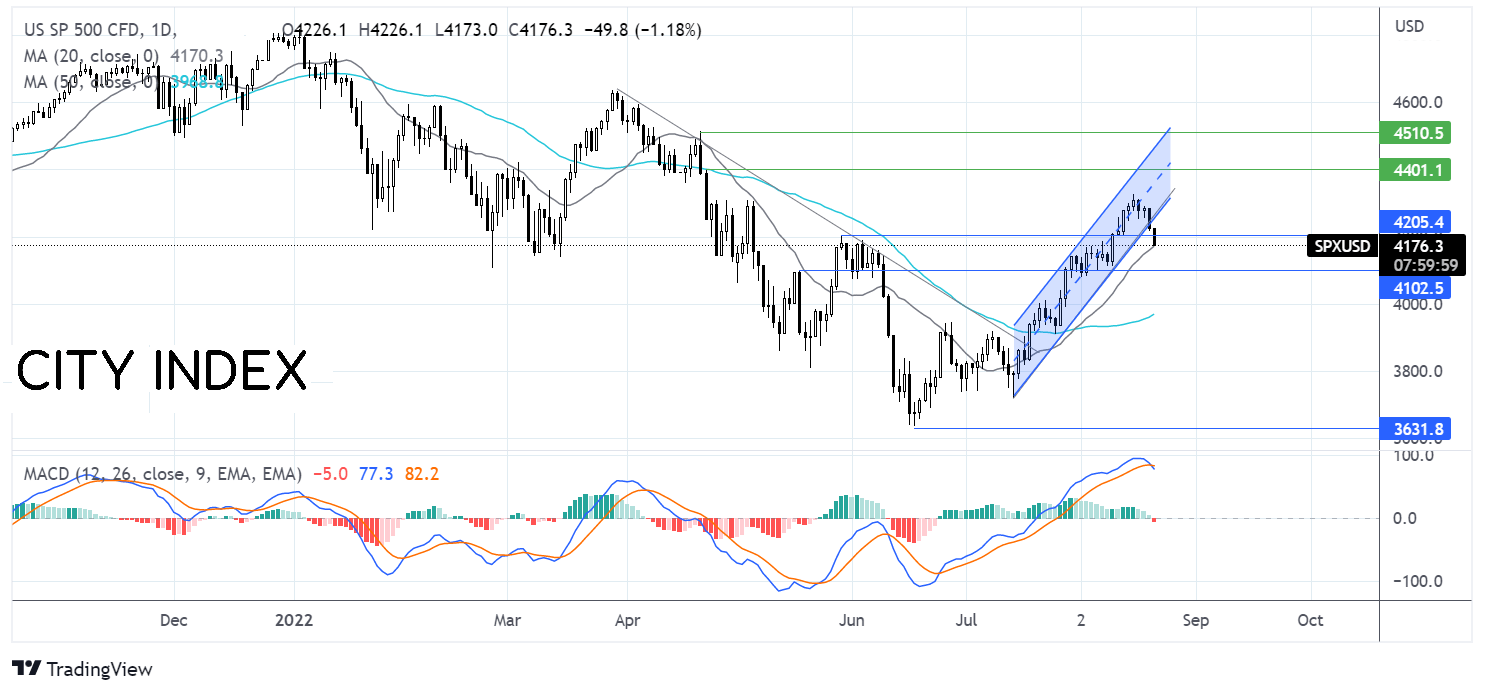

Where next for the S&P500?

The S&P500 has fallen out of the rising channel within which it had been trading since mid-July. The fall below support at 4200 combined with the bearish crossover on the MACD keeps sellers hopeful of further declines. The price is currently finding support at 4180, the 20 sma, a fall below here opens the door to 4100, the round number, and the 50 sma at 3970. Should the 20 sma hold a rise towards 4260, the lower band of the rising channel could be the cards. A move over 4325 creates a higher high.

FX markets – USD rallies, EUR drops

The USD jumped over 2.4% last week in its best weekly performance since April 2020 after the Fed reiterated the need to keep raising interest rates to tame inflation. Today the USD is extending those gains after comments from Richmond Fed Barkin that the inclination is to front-load rate hikes.

EURUSD drops to parity as the energy crisis in Europe deepens. Russia announced a 3-day halt to gas flows to Europe along the Nord Stream 1 pipeline, sending gas prices 11% higher. Inflation is unlikely to start falling anytime soon from its record high.

GBP/USD is falling as the gloomy outlook for the UK economy overshadows the prospect of a 50 basis point rate hike in September. Consumer confidence has fallen to a record low, and inflation is in double digits.

GBP/USD -0.17% at 1.1810

EUR/USD -0.43% at 0.9996

Oil rises from session lows.

Oil prices have pared earlier losses and are edging higher as investors weigh up slowing economic growth and as OPEC+ missed targets again in July.

Worries over aggressive Federal Reserve rate hikes sent oil prices lower in early trade amid fears that slowing global growth could hurt the demand outlook. Meanwhile, a stronger USD makes buying oil more expensive for buyers with foreign currency,

Price also fell amid worries over slowing demand in China amid a power crunch in the southwest as the heatwave continues.

While OPEC+ agreed to increase output by 648,000 barrels per day in July, however, the group reportedly missed its target by 2.892 million barrels per day, resulting in a tighter than expected supply.

WTI crude trades +0.05% at $90.50

Brent trades +0.07% at $97.42

Learn more about trading oil here.

Looking ahead

N/A