US futures

Dow futures +0.28% at 33796

S&P futures +0.3% at 3930

Nasdaq futures +0.27% at 11240

In Europe

FTSE +0.94% at 7762

Dax +1.1% at 14934

Learn more about trading indices

Are slower rate hikes coming?

US stocks are set to open modestly higher on Wednesday, building on gains from the previous session, as the broadly upbeat start 22023 continues.

Stocks have pushed higher so far this year as investors are broadly expecting the Federal Reserve to slow the pace of rate hikes down to 25 basis points in the coming meeting at the start of February, from 50 bps in December.

The Fed’s decision will be largely based on tomorrow's headline inflation figure, which is expected to rise 6.5% YoY in December, down from 7.1% in November, as higher interest rates fight inflation.

Amid a light economic calendar and with US earnings season set to kick off on Friday with the US banks, investors are in wait-and-see mood, biding their time ahead of the coming catalysts.

Corporate news

Tesla is rising 1.7% pre-market after it applied to expand its gigafactory in Texas. An investment of $775.7 million makes it the largest expansion in the company since setting up the $5.5 billion factory in Germany last year.

Airlines such as Delta Airlines, American Airlines and Southwest Airlines are falling after the US FAA grounded all US flights owing to a system outage.

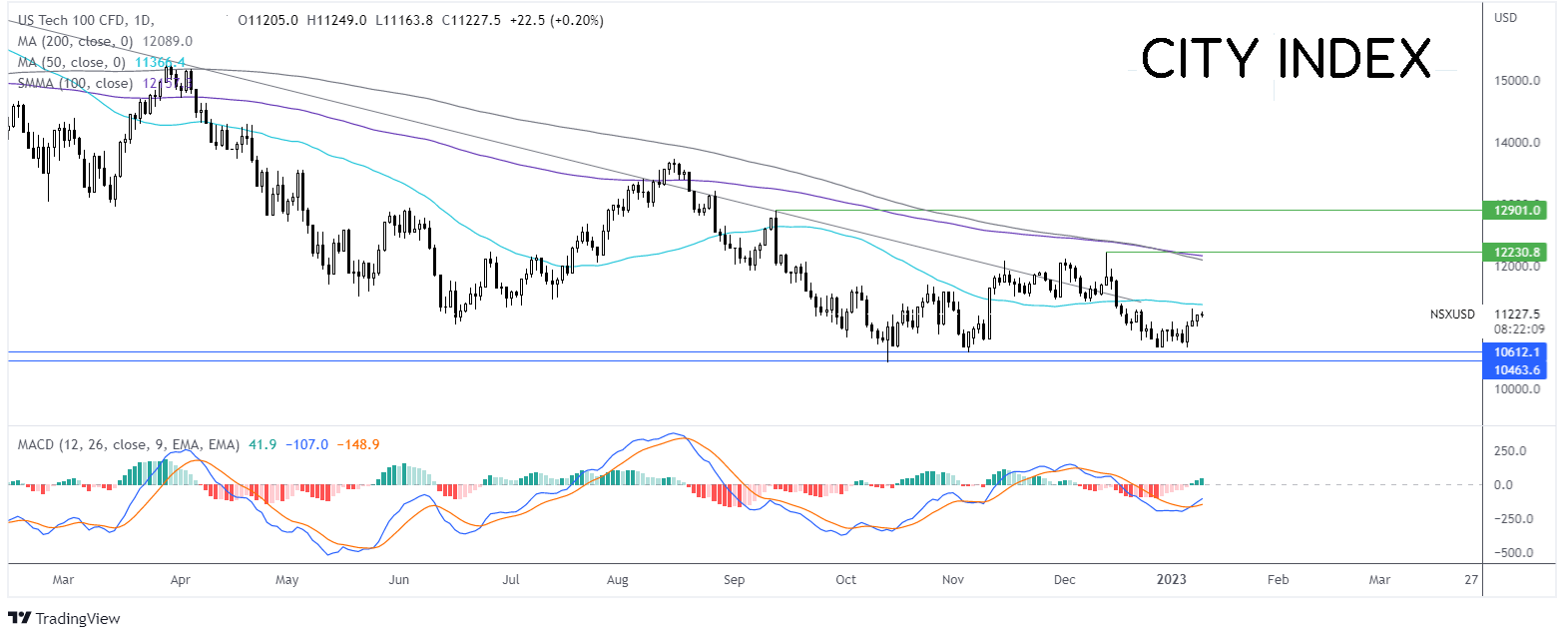

Where next for the Nasdaq?

The Nasdaq has picked up from 2023 low of 10676 and is attempting to grind higher. The price has been bouncing along this lower since October. The bullish crossover on the MACD is keeping buyers hopeful of further upside. Buyers will look to rise above the 50 sma at 11395 before bringing 12200 into focus the December high. A rise above here creates a higher high. On the downside, sellers could look to break below 10676 to open the door to 10430, the 2022 low.

FX markets – USD rises, GBP falls

The USD is rising, adding to yesterday’s gains. The dollar found some support from Fed Chair Powell’s comments that the central bank will need to take unpopular decisions to rein in inflation. With no US data due all eyes are on tomorrow’s inflation report.

EUR/USD is holding onto recent gains despite a lack of fundamental drivers and economic data. The euro is being broadly supported by optimism that the region could avoid a sharp recession and by hawkish comments from ECB Christine Lagarde said at the end of last year that the central bank would likely continue raising rates at 50 basis points for a period of time.

GBP/USD is falling for a second straight session on the back of a stronger U.S. dollar. the UK economic calendar has been quiet in recent sessions leaving investors little else but to mull over the dire economic outlook for the region. GDP data on Friday is the next big catalyst.

GBP/USD -0.4% at 1.2135

EUR/USD -0.1% at 1.0710

Oil holds steady amid mixed drivers

Oil prices are holding steady for a second day on Wednesday as investors digested an unexpected build in US crude oil and fuel inventories, global economic uncertainty, and the reopening of China as it eases zero COVID restrictions.

US crude oil stockpiles surged by 14.9 million barrels in the week ending January the 6th meanwhile, distillate stocks rose by 1.1 million barrels. Expectations were for both crude and distillate stocks to fall.

The oil market is also being weighed down by worries of a global recession. The World Bank forecast that the global economy will grow just 1.7% in 2023, down from a 3% forecast just six months earlier. Slowing growth, particularly in the US, the largest consumer of oil hurts the demand outlook for oil.

EIA crude oil stockpiles are due later today.

WTI crude trades +0.7% at $75.83

Brent trades at +0.8% at $80.80

Learn more about trading oil here.

Looking ahead

N/A