US futures

Dow futures +0.1% at 29250

S&P futures +0.25% at 3596

Nasdaq futures +0.41% at 10835

In Europe

FTSE -0.91% at 6826

Dax -0.24% at 12150

Learn more about trading indices

FOMC minutes due later

US stocks are set to open higher on Wednesday after a mixed close in the previous session but pared gains following PPI inflation data. The rise comes after the Nasdaq has fallen across the past five days, hitting a new 2-year low yesterday.

US PPI inflation rose 8.5% YoY in September, down from 8.7%; expectations had been for PPI to ease to 8.4% YoY. The hot inflation reading boosted bets of more aggressive action from the Federal Reserve. Given that PPI is considered a lead indicator for consumer prices, the data suggests that the lowering in inflation will be a very slow process.

Looking ahead attention turns to the minutes to the September FOMC, which are expected to confirm the Fed’s hawkish outlook. The minutes are from the meeting where the Fed raised interest rates by 75 basis points and raised the likelihood of more aggressive hikes in the coming meetings.

Corporate news:

PepsiCo rises pre-market after it raised its annual revenue and profit forecasts. The beverage and snack form managed to raise its prices on several occasions to impact rising costs. Consumers are eating more at home than in restaurants amid a cutback in discretionary spending.

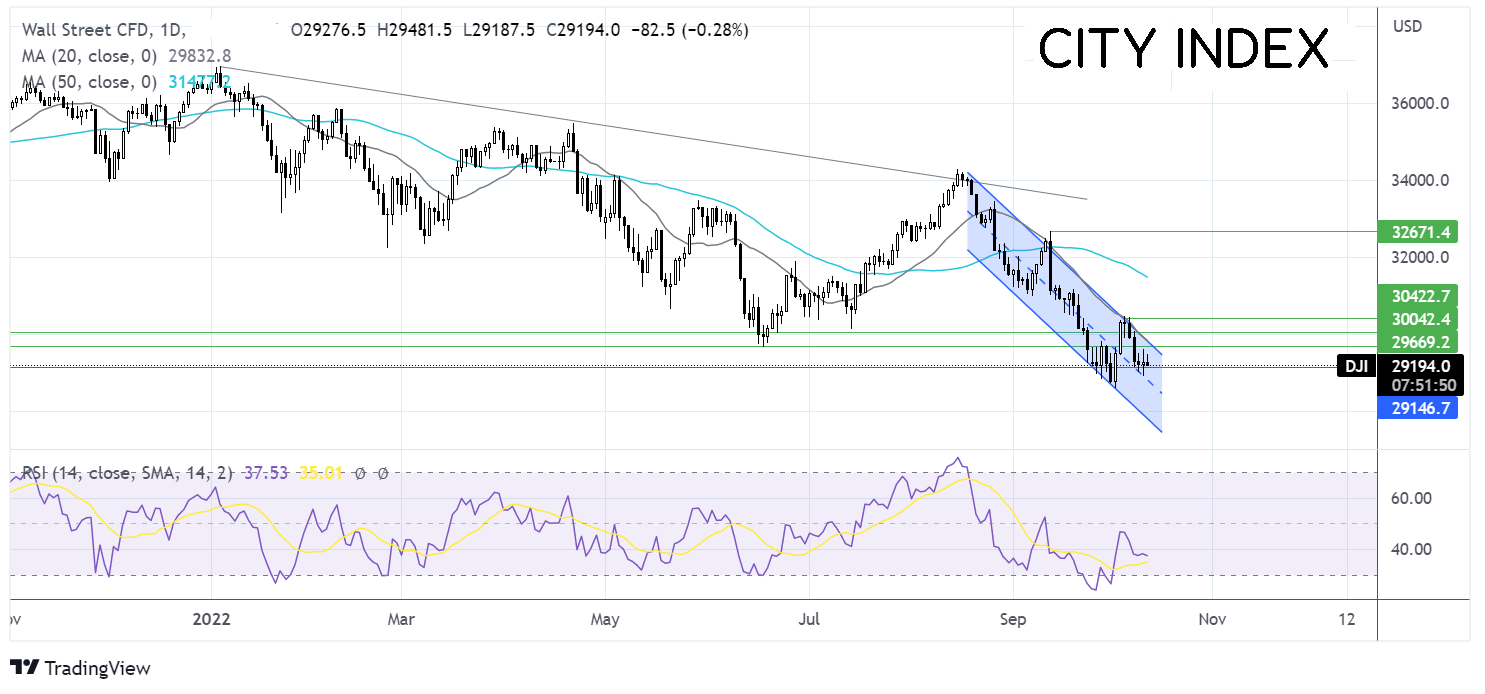

Where next for Dow Jones?

The Dow Jones is trading within a descending trendline since mid-August. It trades below its 20 & 50 sma, and the RSI remains in bearish territory, suggesting that there is more downside to come. Sellers will look for a break below 28900, opening the door to 28500, the 2022 low. A break below here brings 28000 the round number, and lower band of the falling trendline into focus. On the flipside, buyers will look for a move over 29720, the June low, and 30,000, the round number. A move over 30450 creates a higher high.

FX markets – USD slips, GBP rises

The USD is edging lower after five straight days of gains. Hawkish comments from Federal Reserve speakers boosted the USD in the previous session. Attention is now shifting to the FOMC minutes later today.

EUR/USD is holding steady after stronger-than-expected industrial production, which rose 1.5% MoM in August after falling -2.3% in July. Attention now shifts to ECB President Lagarde who is due to speak later.

GBPUSD is rising, paring losses from the previous session. The pound is rising despite dismal data, which showed that GDP unexpectedly fell -0.3% MoM in August after rising 0.2% in July. Expectations had been for 0%. The BoE also confirmed that it would be ending its bond-buying programme on Friday after some confusion over whether it would be prolonged to offer additional support.

GBP/USD +0.18% at 1.1070

EUR/USD +0.18% at 0.9726

Oil falls for a third day

Oil prices are heading lower for a third straight session, as investors fret over declining demand as recession worries rise. The IMF cut its global growth outlook yesterday and warned of the increasing risk of a global recession. The IMF encouraged central bankers to keep up the fight against inflation, even if this meant slowing growth or a recession.

OPEC cut oil demand growth for 2022 and 2023. This is the fourth such cut in demand since April

Rising COVID cases in China are also a concern. Testing is being ramped up in Shanghai and Shenzhen as cases rose to the highest level since August.

On the supply side, crude stocks have risen by 1.8 million barrels after falling for the past two weeks. API stockpile data is due later today.

WTI crude trades -0.6% at $88.70

Brent trades -0.6% at $94.50

Learn more about trading oil here.

Looking ahead

14:30 ECB President Lagarde to speak

19:00 FOMC minutes