US futures

Dow futures -0.02% at 33027

S&P futures +0.2% at 3907

Nasdaq futures +0.67% at 11367

In Europe

FTSE -0.17% at 7760

Dax +0.24% at 14975

Learn more about trading indices

Netflix subscribers smash forecasts

US stocks are set to open mixed on Friday after Netflix impresses, helping the tech sector higher and as the Dow Jones underperforms.

While all three main indices are set to end the week lower, the Dow Jones is set to decline over 3.5% in its worst weekly performance since last September.

Recession fears have dominated across the week as economic data has broadly been disappointing while Federal Reserve speakers, such as NY Fed President John Williams and vice President Lael Brainard, have reiterated their commitment to raising interest rates and taming inflation.

Fed speakers will remain in focus today, with Patrick Harker and Christopher Walker due to speak. Investors will be watching closely for any clues over February’s decision. Currently, the market is almost fully pricing in a 25 basis point cut in February.

In addition to Fed speaker, US existing home sales data is due to be released and is expected to show sales fell 5.4% in December after falling 7.7% in November.

Corporate news

Netflix jumps after queue for subscriber numbers were much higher than expected at 7.66 million, beating forecasts of 4.5 million. The outlook was also strong with revenue expected to rise 4% annually in Q1.

Google parent alphabet was also on the rise pre-market after announcing plans to cut 6% of the workforce, which equates to around 12,000 jobs as growth slows.

Tesla is also rising premarket early signs suggest that price cuts are helping to boost demand amid intensifying competition.

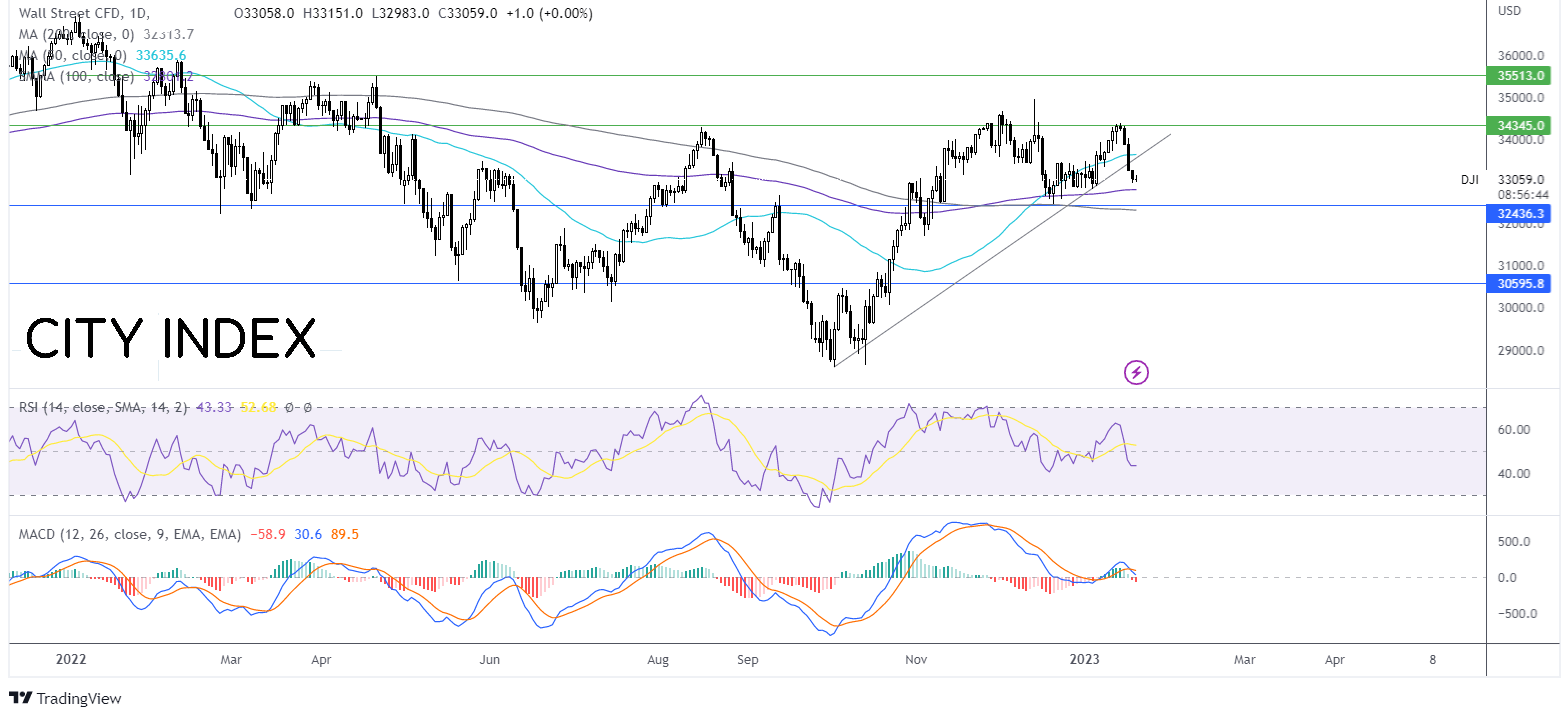

Where next for the Dow Jones?

After running into resistance at 34400 the price rebounded lower, falling below the 50 sma and the multi-month rising trend line. The RSI has dipped below 50, which along with the bearish crossover on the MACD keeps sellers hopeful of further declines. Sellers could test the 100 sma support at 32800, with a break below here opening the door to 32325, the 200 sma, and December low. Should buyers successfully defend the 100 sma, a rise towards 33700 the 50 sma and then 34400 could be on the cards.

FX markets – USD rises, GBP falls

The USD is rising after two days of declines boosted by hawkish Federal Reserve chatter. Federal Reserve vice Chair Lael Brainard reiterated the central bank’s commitment to

GBP/USD is falling after UK consumer confidence slipped back towards a 50-year low and UK retail sales unexpectedly dropped retail sales fell in December by 1%, well below the 0.5% forecast and down from -0.5% in November. Sales fell despite government payments to help households with the rising cost of living. The data highlights the struggles that households are facing as inflation remains in double digits.

EUR/USD is edging lower but trades within a familiar range after ECB president Christine Lagarde reiterated the central bank support terrain and inflation and following German PPI data. German PPI fell to 21.6% YoY in December, down from 28.2% in November. The was slightly above the 20.8% forecast.

GBP/USD -0.3% at 1.2350

EUR/USD -0.1% at 1.0823

Oil falls as stockpiles rise

Oil prices are heading higher and oil is expected to book a weekly gain marking the second straight weekly rise. the oil market has been boosted recently by the improving outlook for the Chinese economy as it reopens after Covid.

Both the IEA and OPEC, in their monthly reports, I lighted the reopening of China as a driving force to push oil demand to a record high in 2023.

Oil is also finding support as bets rise that the US federal reserve will start to slow the pace of rate hikes before pausing hikes for the rest of the year. This could improve the chances of the US avoiding a recession or experiencing a shallower recession.

Looking ahead, Baker Hughes rig count data is due later.

WTI crude trades +0.525% at $79.59

Brent trades at +0.55% at $85.02

Learn more about trading oil here.

Looking ahead

15:00 Existing home sales

18:00 Fed Waller