EUR/USD holds over 0.98 amid an upbeat mood

EURUSD is on the rise, extending gains from the previous session as the upbeat mood continues, despite the eurozone’s weaker-than-expected manufacturing PMI.

A smaller than expected rate hike by the RBA has brought some optimism that global central banks could soon ease back on aggressive hikes.

Weaker than expected US ISM manufacturing data yesterday suggest that the US economy is slowing, raising hopes that the Fed could ease back on hiking rates. Treasury yields fell lower and continue to fall today.

Attention now turns to eurozone PPI, which is expected to rise to 43.2% YoY in August, up from 37.9%. Hot inflation piles pressure on the ECB to hike rates. ECB’s Lagarde is to speak later.

Meanwhile, US JOLTS jobs openings and factory orders are due. Several Federal Reserve speakers will also be in focus.

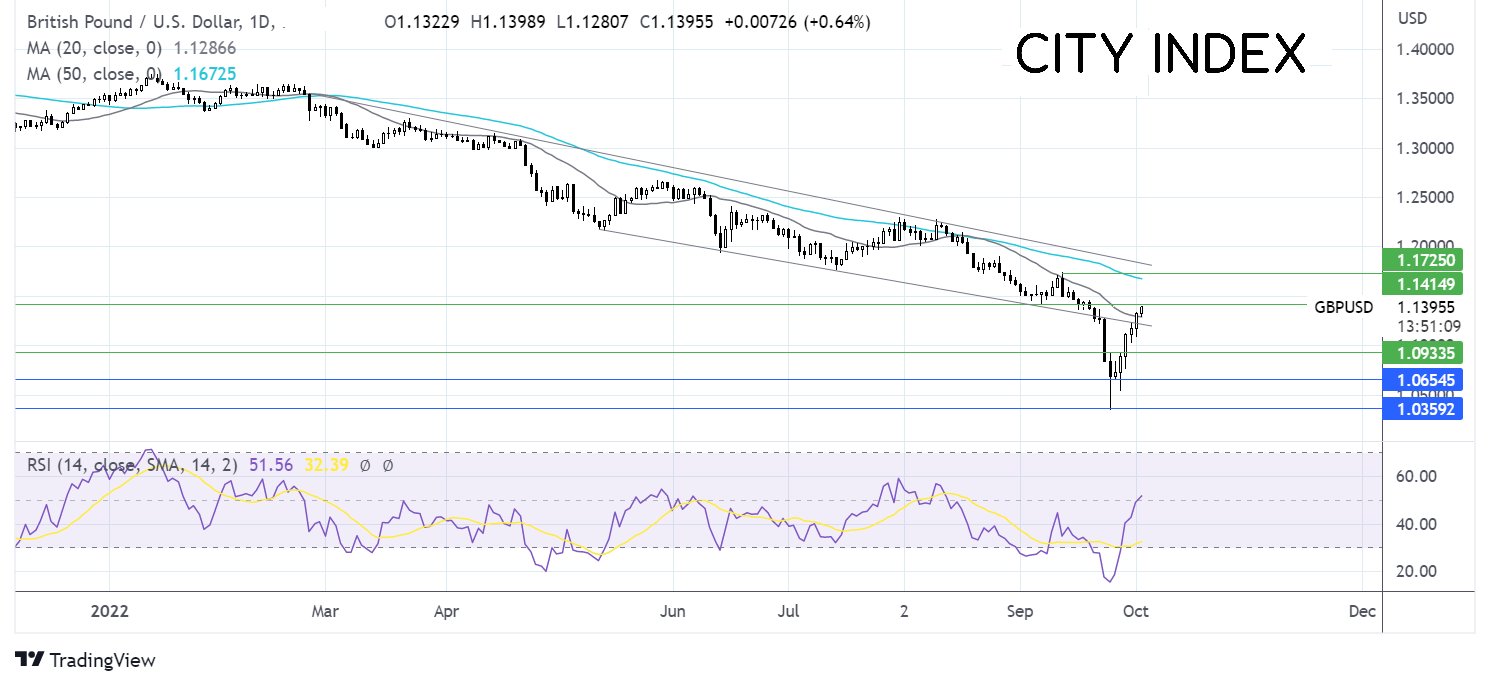

Where next for EUR/USD?

EURUSD has rebounded from the 0.9535 2022 low, rising above the falling trendline resistance, which combined with the bullish crossover on the MACD keeps buyers hopeful of further gains.

Buyers will look to rise above the 0.9890 the 20 sma to bring parity back into target.

Support can be seen at 0.98 the falling trendline support ahead of 0.9750 yesterday’s low.

GBP/USD extends gains after Chancellor’s U-turn

GBP/USD rose 1% yesterday and is extending those gains today, boosted by the Chancellor’s backtracking on the high-rate tax cut. Furthermore, Kwasi Kwarteng said that he would bring forward his plan to bring UK debt under control to this month, from 23rd November.

These moves have helped calm fears over the outlook for the UK economy, at least for now, even if Liz Truss’ position is looking less sure than a few weeks ago.

There is no high impacting UK data due today. Attention will remain on Westminster for further developments.

The US continues to weaken as optimism grows that the Fed could ease rate hikes sooner rather than later.

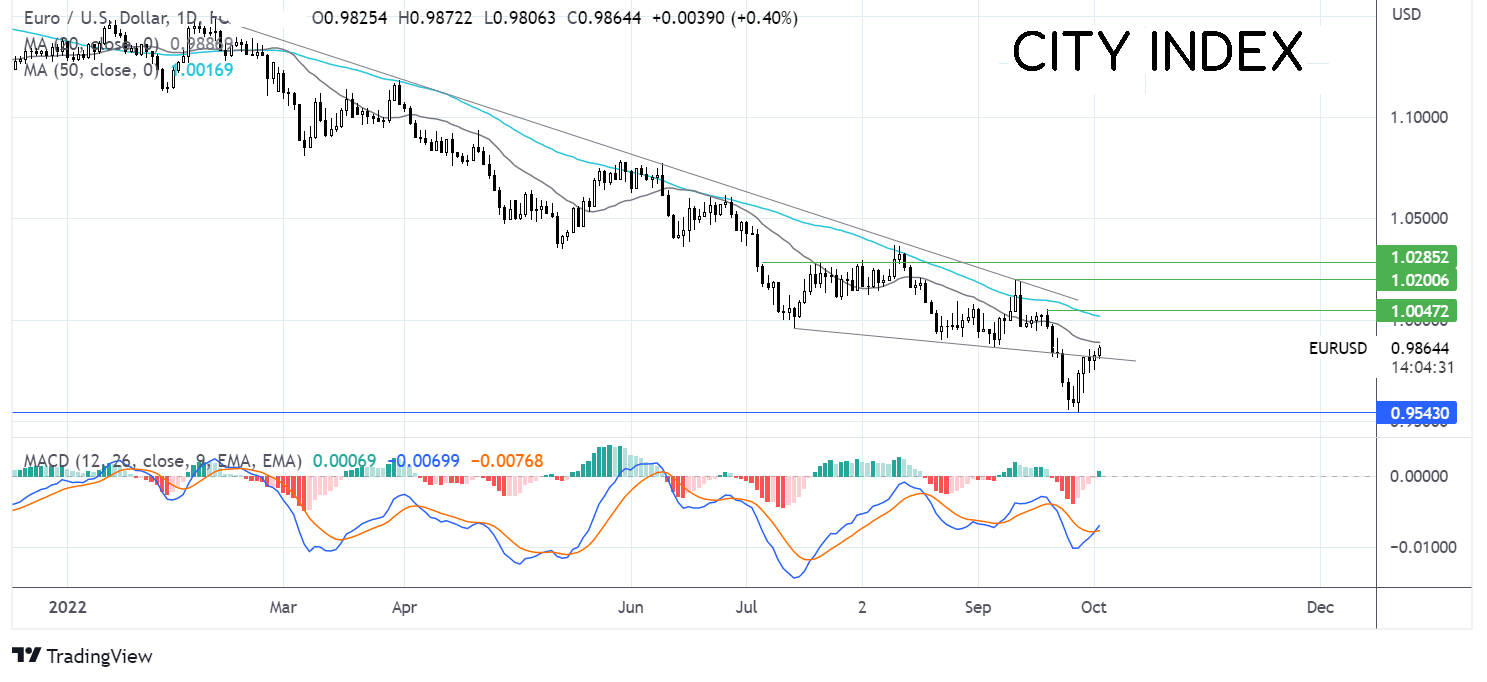

Where next for GBP/USD?

GBP/USD has rebounded from 1.0350, its all-time low, rising back into the multi-month falling channel. A rise over the 20 sma and the bullish RSI keep buyer’s hopeful of further upside.

Immediate resistance can be seen at 1.14 the September 7 low and Brexit low. A move over 1.1725 is needed to create a higher high.

Immediate support can be seen at 1.13 the 20 sma, with a breakthrough here opening the door to 1.1160 trendline support and 1.10 round number.