EUR/USD rises ahead of the ECB rate decision

EURUSD is on the rise, lifted by optimism as gas flow returns to Nord Stream 1 and investors look ahead to the ECB rate decision.

After ten days of maintenance, Russia switched back online Nord Stream 1 gas flow to Germany, calming fears that the gas would remain offline, tipping Germany into recession.

Attention now turns to the ECB, which is expected to hike rates for the first time in 11 years. The central bank had pre-committed to a 25 basis point rate hike. However, the picture has changed since then, with inflation hitting a new record high and EURUSD dropping to parity importing inflation.

The money markets are pricing in a 70% chance of a 50 basis point hike. However, analysts are less confident, with most surveyed by Bloomberg expecting a 25 basis point hike, which could disappoint the market and pull the EURUSD lower.

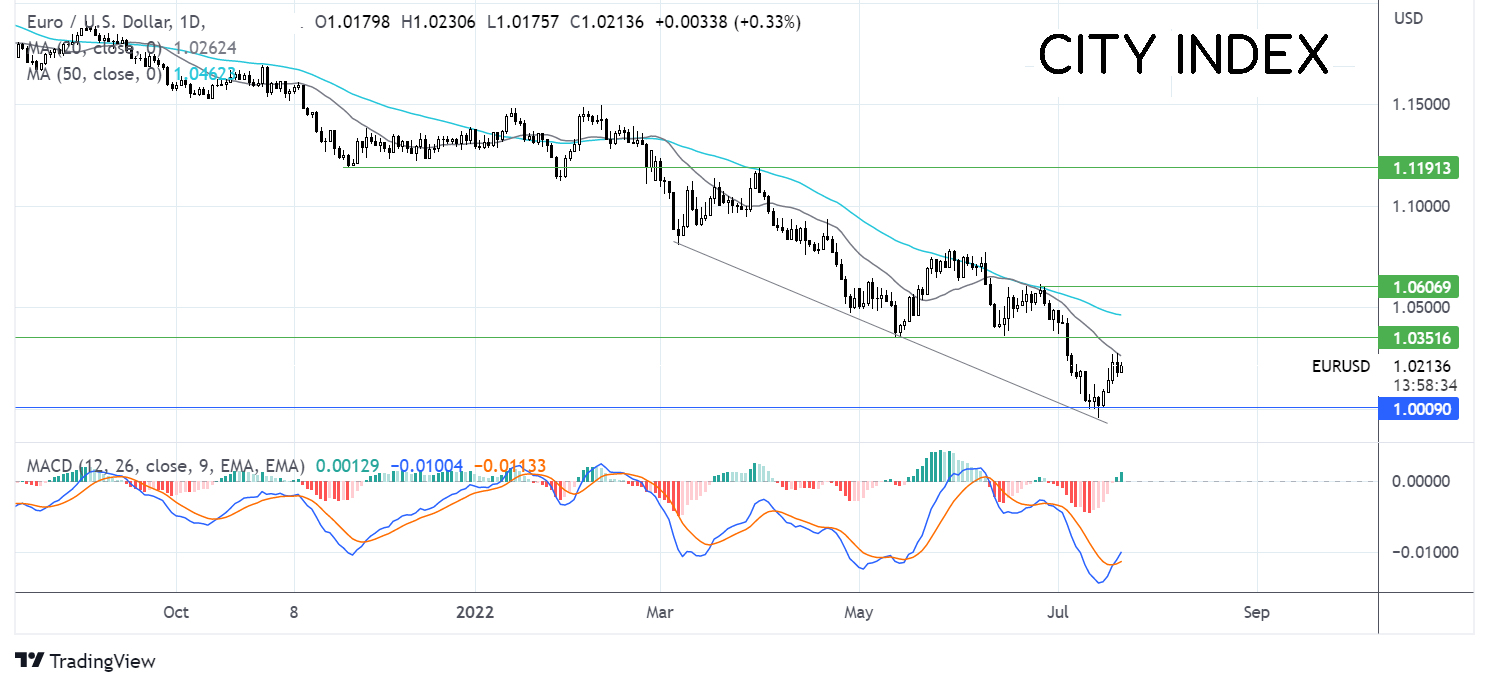

Where next for EUR/USD?

EUR/USD is extending its rebound from the 2022 low of 0.9952 and is running into resistance at the 20 sma at 1.0260. The bullish crossover on the MACD keeps buyers hopeful of further upside.

Buyers need to retake the 1.0260, the 20 sma, and the weekly high in order to rise towards resistance at 1.0350, the May low. A move above here exposes the 50 sma ahead of 1.06, the late June high.

Failure to retake the 20 sma could see the price head back towards parity and the 2022 low.

FTSE MIB falls as Draghi looks set to resign

The FTSE MIB is falling after Prime Minister Mario Draghi is set to resign. The Italian leader won a vote of no confidence. However, the vote was sat out by three coalition parties, setting the stage for his resignation.

The latest events bring to an end a period of relative political stability in Italy, destabilising the eurozone’s third-largest economy. A snap election is now highly likely. The next government could bring together a group of nationalists and center-right, including some that hold Eurosceptic views.

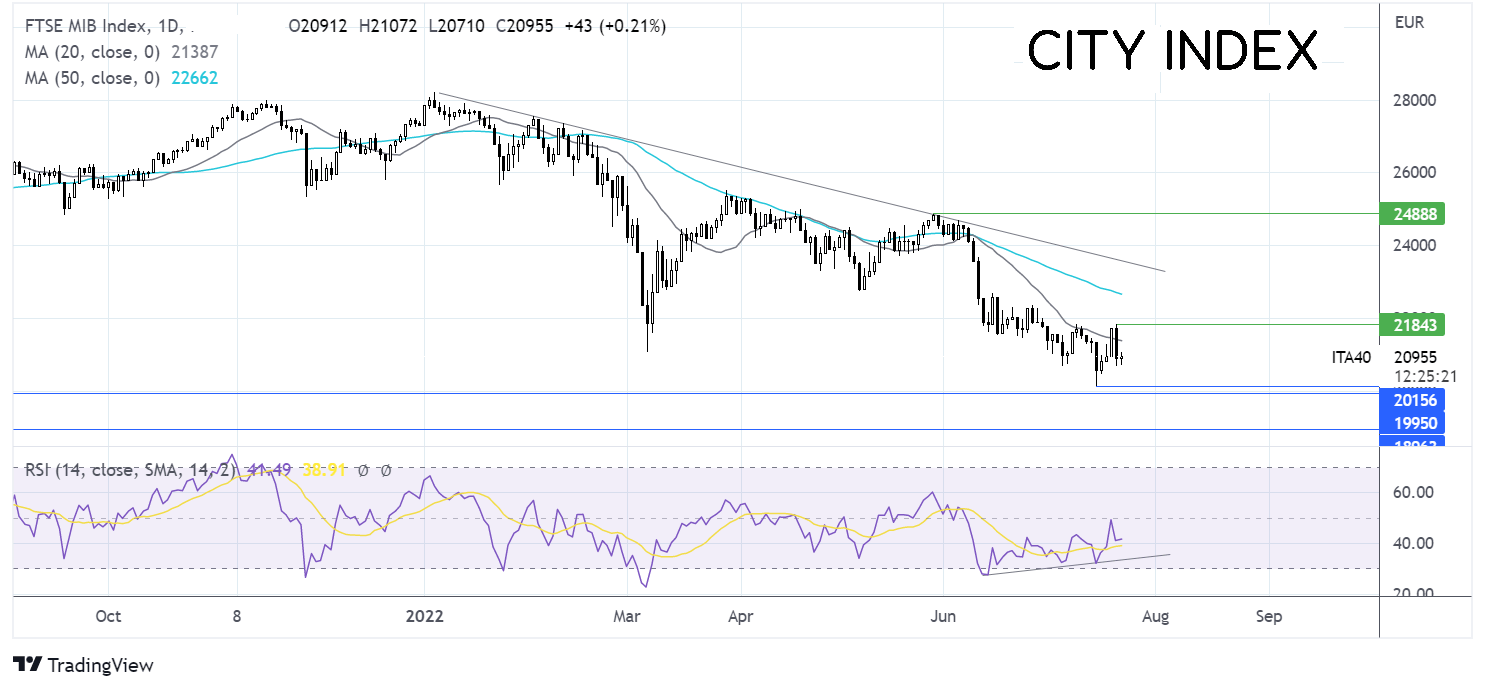

Where next for the FTSE MIB?

The FTSE MIB has been trending lower since the start of the year, falling to a low of 20146.

The price trades below the 50 & 20 sma, after failing to meaningfully capture the later earlier this week. However bullish RSI divergence suggests that the downward move could be running out of steam. Sellers will look for a move below 20146, the 2022 low to open the door to 20000 psychological level and 19000 the August 2020 low.

Buyers will look for a move over 21840 the weekly high to create a higher high and expose the 50 sma at 22665.