US pending homes sales for June released today were -8.6% MoM after an expectation of only -1.5% MoM and a reading of +0.4% MoM in May. The main reason may be due to mortgage rates, which averaged near 5.70% for the month of June. Rates continue to climb into July, with mortgage rates ending the week of July 22nd at 5.74%, down from 5.82% the prior week. Last week, the US reported existing home sales for June at -5.4% MoM vs -1.8% MoM expected and -3.4% MoM in May. Housing starts and building permits also continued to decline during the month of June.

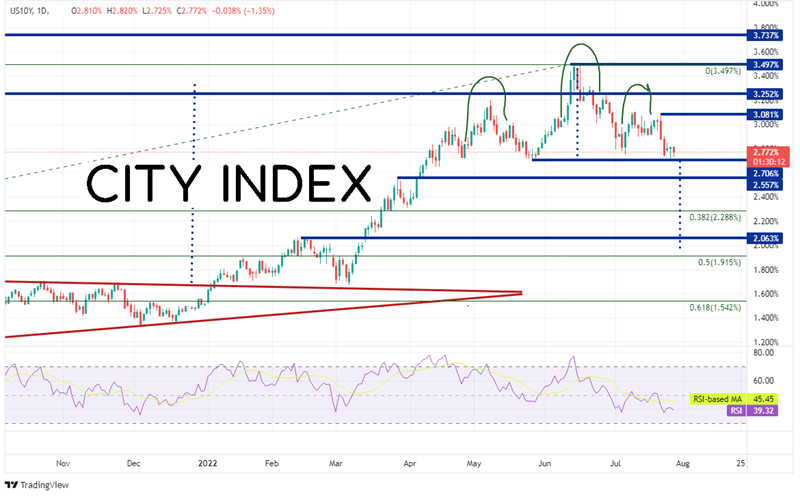

Although the FOMC hiked rates by 75bps to bring the Fed Funds rate to the 2.25%-2.50% range, the 10-year yield is little changed. It is currently is hovering near the 2.74%/2.77% area. After moving higher out of a symmetric triangle in early January with rates near 1.5%, 10-year yields moved as high as 3.497% by June 15th, breaking above 2018 highs. However, yields then moved lower to current levels as the overbought RSI unwound back into neutral territory in a head and shoulders formation. The neckline for the head and shoulders pattern is 2.706%. If yields break below, the target is near the 50% retracement from the low of March 2020 to the highs of June 15th, near 1.915%. However, in order to get there, yields must first pass through horizontal support at 2.557%, the 38.2% Fibonacci retracement from the previously mentioned timeframe near 2.288% and additional horizontal support at 2.063%. If the neckline holds, yields can bounce to the highs from July 21st at 3.081%, the 2018 highs at 3.252% and then the June 15th highs at 3.297%.

Source: Tradingview, Stone X

Trade Interest Rates now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

During the press conference Powell said that it is “likely to be appropriate to slow the pace of hikes as rates get more restrictive”. This briefly sent yields down to test the 2.706% level, however yields have since bounced. If markets see the Fed cutting back the pace of rate hikes, we may see 10-year yields lower, and as a result, housing data may pick up again. However, if data supports the idea that the Fed will continue to raise rates at a clip of 75bps, rates could be back near the June highs in a hurry. This would continue to slow the housing market.

See our complete recap of today’s FOMC meeting here.