US futures

Dow futures +0.57% at 32911

S&P futures +0.57% at 4054

Nasdaq futures +0.5 at 12935

In Europe

FTSE +0.87% at 77550

Dax +1.15% at 15489

- Investors bet peak interest rates are near

- US jobless claims rise to 198k

- Netflix 20% upside?

- Oil extends gains as inventories hit a 2-year low

Learn more about trading indices

Investors bet peak rates are near

US stocks are pushing higher as banking fears ease further and investors bet that the peak in interest rates is near.

Stocks are extending gains from yesterday which saw the NASDAQ move into a bull market for the first time in three years, boosted by mega cap tech stocks such as Apple, Amazon and Microsoft.

Tech stocks have been favoured recently as investors seem increasingly convinced that the Fed will start cutting interest rates this year despite Fed Chair Powell insisting otherwise. Also tech stocks have been an attractive alternative to banking stocks amid the recent turmoil in the banking sector.

Indices have been drifting higher over the past few sessions as banks fears continued to fade and as investors look ahead to Fridays core PCE index for further clears on whether the Fed will pause rate hikes in May.

Today US jobless claims rose very slightly more than expected to 198,000 up from 191,000 in the previous week. Expectations were for a rise to 196k. This is only a very slight softening in the labour market which all in all is still very resilient.

US Q4 GDP was downwardly revised to 2.6% QoQ annualised, down from 2.7% in the earlier reading and down from 3.2% in Q3.

Corporate news

Alibaba ADRs Boo 1.4% pre market consolidating after recent gains. Chinas biggest Internet platform outlined plans to sell off noncore assets and said that it would consider giving up majority control of its 6 soon to be operating companies.

Tesla rises premarket after the EV maker encouraged customers to take delivery now of its model 3 ahead of an expected decline in tax credit for buyers at the end of March.

Netflix could be under the spotlight after Well Fargo says that it sees at least 20% potential upside to the share value and reiterated its $400 per share price target.

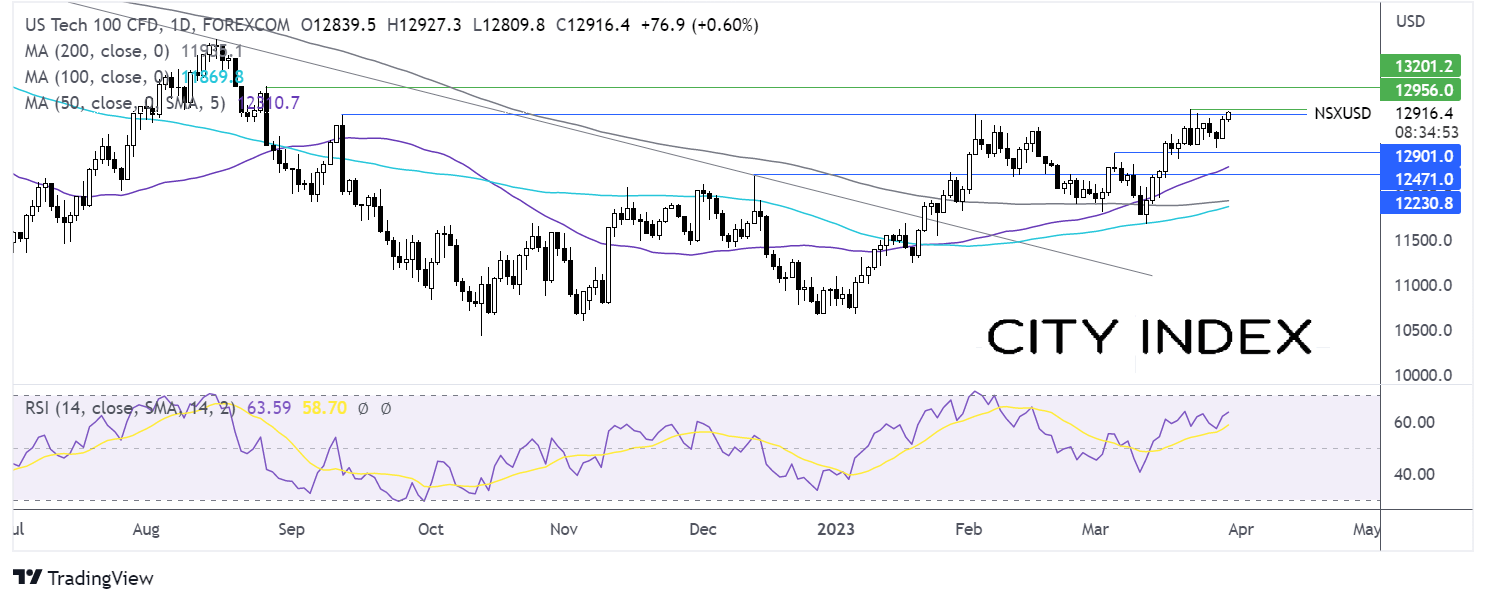

Where next for the Nasdaq?

The NASDAQ rebounded from the 100 sma, pushing above the 200 & 50 sma. The price has also risen above resistance at 12900 the February 2 high. Buyers need a rise over 12950 the March high to extend the uptrend towards 13200 the August high. On the flip side, sellers could be encouraged by the RSI bearish divergence. Sellers could look for a fall below 12515, the weekly low to extend the selloff to 12465 the March 6 high.

FX markets – USD falls, EUR rises

The USD is falling, tracking US treasury yields lower. The market remains convinced that the Fed will cut rates twice by the end of the year, despite Fed chair Powell insisting otherwise.

EUR/USD is rising despite inflation in Germany and Spain falling. Spanish inflation collapsed to 3.3%YoY in March. an German inflation cooled to 7.4% from 8.7%. This was above forecasts of 7.3%. However, inflation is proving to be stickier, as highlighted by ECB policymaker Isabel Schnabel. ECB -Fed divergence keeps the pair supported.

GBP/USD continues to hold above 123 but has failed to bring two fresh two-month highs above the 12360 level. the pound remains supported by expectations that the Bank of England could raise rates given that you can inflation is proving to be stubbornly high. Investors are awaiting the BoE’s quarterly bulletin.

EUR/USD +0.36% at 1.0890

GBP/USD +0.27% at 1.2323

Oil rises after stock piles drop

Oil prices are resuming the uptrend boosted by a weaker U.S. dollars, a steep draw in inventors and a halt in exports from Iraq’s Kurdistan region.

According to the latest EIA U S crude stockpile data, inventories fell unexpectedly to a two year low. inventories dropped by 7.5 million barrels defying expectations of 100,000 barrel rise.

Meanwhile export from iraq's northern region remain on pause. producers have reduced or halted output in several oil fields in the Kurdistan region following holds to the northern export pipeline.

The weaker U S dollar is also boosting oil prices. a weaker dollar makes oil cheaper for those buying with foreign currencies.

WTI crude trades +0.62% at $74.00

Brent trades at +0.56% at $78.80

Learn more about trading oil here.

Looking ahead

17:45 Fed Barkin to speak