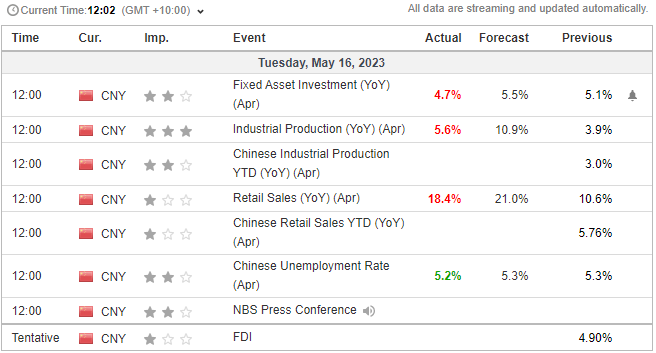

Q2 data is certainly not going as planned for China. PMI’s unexpectedly contracted for services and manufacturing, exports are slowing, imports are contracting, loan growth has stumbled and inflation is barely rising. And that was ahead of today’s data dump, which saw fixed asset investment, industrial production and retail sales all fall below expectations.

Admittedly, industrial production and retail sales were higher than March’s data, but slower than hoped. And that is leading to more calls for aggressive stimulus from China, which could ultimately throw a pillar of support under domestic stock market indices. But for now, sentiment is on the ropes and China’s equity markets are lower just after the open.

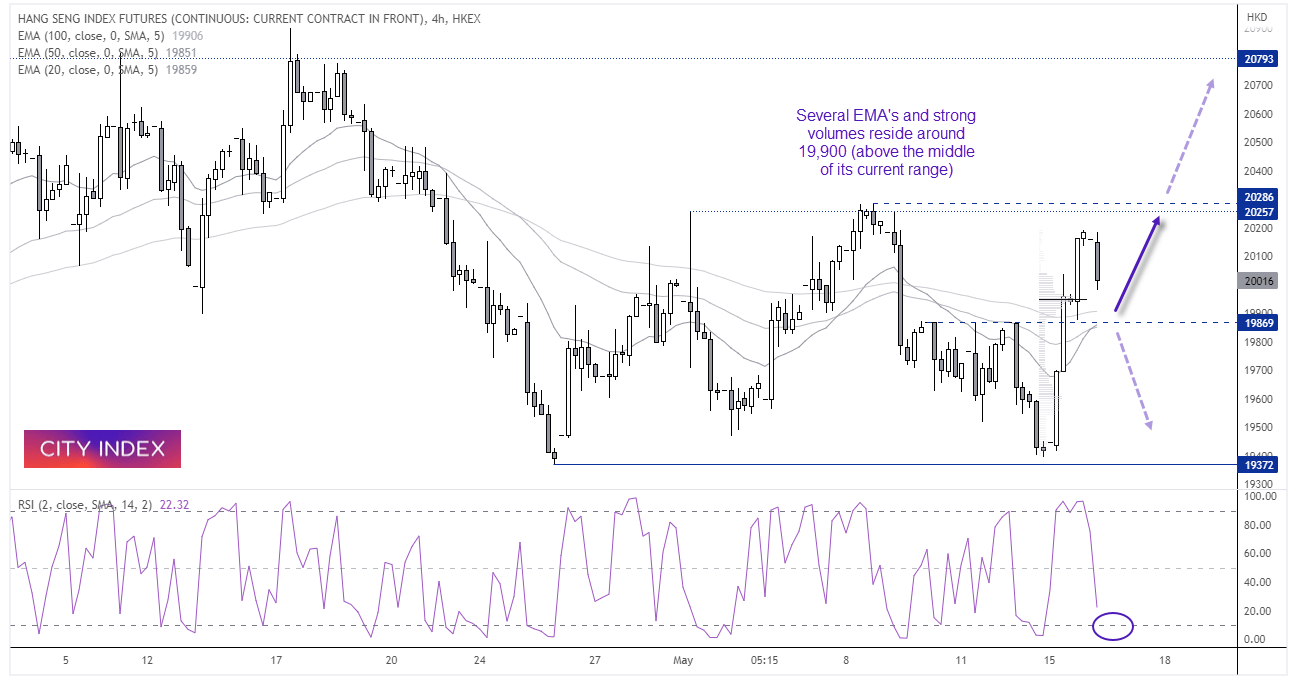

Hang Seng 4-hour chart:

The Hang Seng is another index which has seen progressively lower volatility over the past couple of weeks, with the current week’s range well within last week’s inside week. Weekly trading volumes have also moved lower. The daily chart has carved out two distinct ranges; between the 18,850 and 20,750 area and, over the past four sessions, between 19,400 – 20,300.

The four-hour chart shows a strong rally from recent cycle lows which suggest bullish pressure is building. Whilst today’s data has seen prices pull back from recent highs, we note strong volumes around 19,900 during the rally, with a series of exponential moving averages around the 19,869 high which could also provide support when the pullback completes. If RSI is to move to oversold around support levels it could suggest a near-term inflection point is near.

We therefor favour buying dips around these support areas and for prices to have another crack at the cycle highs, a break above which could be triggered by a fresh round of stimulus from Beijing (and / or news that the US debt ceiling has been raised).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade